Bitcoin Price Pulls Back From $86K As Bloomberg Analyst Predicts $10K BTC, Peter Schiff Warns Of ‘Crash’

The Bitcoin price edged up a fraction of a percent in the past 24 hours to trade at $86,640 as of 2:40 a.m. EST on trading volume that dropped 11% to $44.8 billion.

This comes as BTC permabear Peter Schiff warned of a BTC crash, with money flowing back into traditional safe havens like gold and silver.

“The first casualty of the gold and silver surge will likely be Bitcoin,” Schiff said in an X post. ”Before a U.S. dollar crash, we will likely get a Bitcoin crash,”

Meanwhile, Bloomberg commodity strategist Mike McGlone says Bitcoin’s price could drop to $10,000.

McGlone says positive catalysts like the launch of spot Bitcoin ETFs, US leaders recognizing Bitcoin’s benefits, and broader mainstream adoption have all come to pass, suggesting the market will be short of future uplifting developments.

Meanwhile, US spot BTC ETFs have recorded their second day of outflows this week, with investors selling around 3,210 BTC worth around $277.2 million on Tuesday, according to Coinglass.

Bitcoin Price Faces Bearish Pressure After Losing Key Support

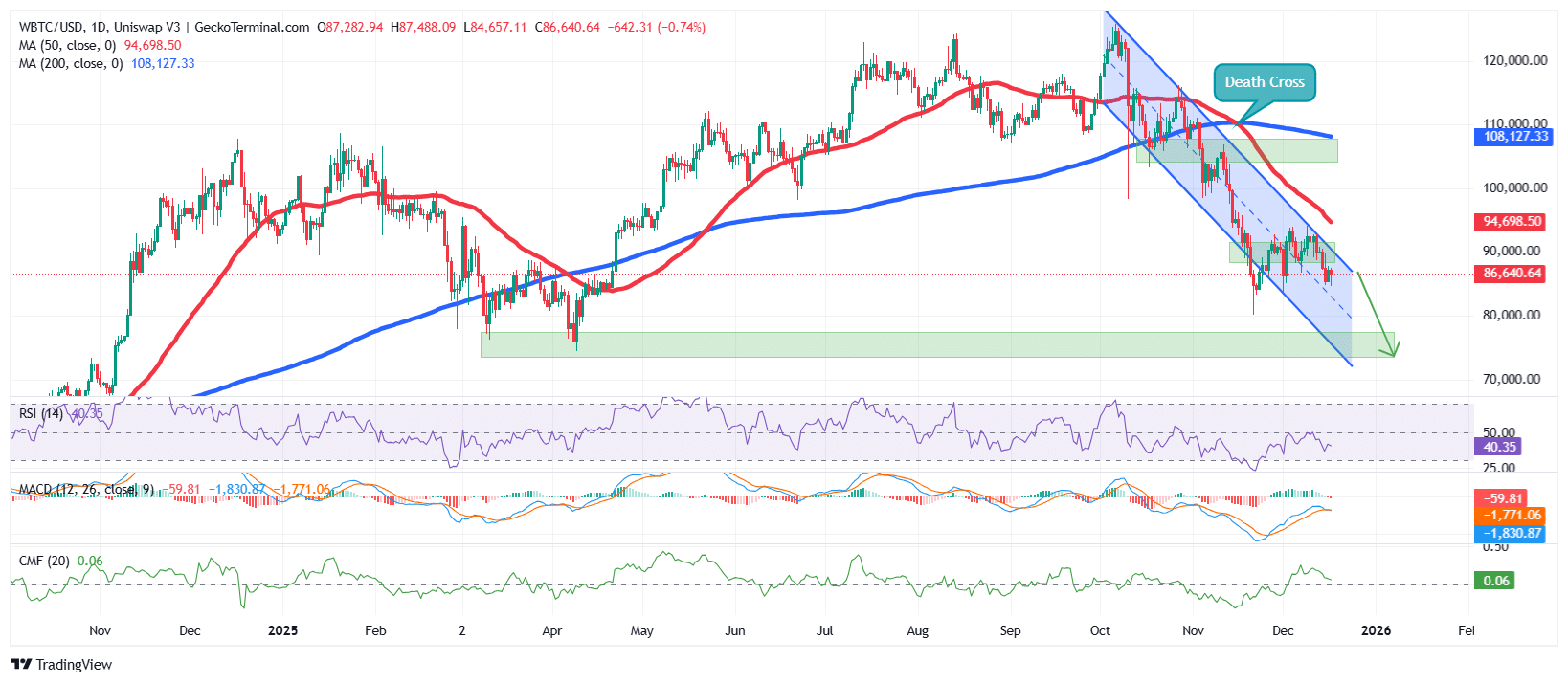

According to the BTC/USD chart analysis on the daily time frame, the BTC price is currently in a bearish falling channel pattern.

After touching an all-time high (ATH) around $126,200 in October, Bitcoin then corrected within the falling channel, as investors booked profits from the bullish surge from $74,000 in April to its ATH.

The sustained bearish pressure was further cemented by a death cross around $110,400, as the 200-day Simple Moving Average (SMA) crossed above the 50-day SMA.

This then pushed BTC’s price below both SMAs, supporting the long-term bearish stance.

BTC has now lost the $88,200 support area, which has been holding the price within a consolidation zone, capped by the $94,000 resistance area.

The Relative Strength Index (RSI) supports the bearish narrative, with the RSI now dropping towards the 30-oversold level, currently at 40, and continuing to decline.

Moreover, the blue Moving Average Convergence Divergence (MACD) line has crossed below the orange signal line, and the red histogram bars are now forming below the neutral line, signaling that Bitcoin’s price has lost momentum.

BTC/USD Chart Analysis Source: GeckoTerminal

BTC/USD Chart Analysis Source: GeckoTerminal

BTC Price Prediction

Based on the BTC price analysis, the asset has turned bearish after losing support at $88,200. With the negative RSI and MACD indicators, BTC could continue to drop, with the next key support around $74,200 in the long term.

Ali Martinez, a prominent crypto analyst on X, says the SuperTrend indicator has flipped to sell, suggesting Bitcoin’s price may slide even further, based on historical data.

Conversely, if bulls defend the $85,000 area, Bitcoin could surge, with the 50-day SMA at $94,698 acting as the immediate target and resistance zone.

The bullish case could be supported by the Chaikin Money Flow (CMF), which is slightly positive, suggesting a mild capital inflow and indicating that buyers are still present but without firm conviction, suggesting weak accumulation rather than a strong bullish push.

Related News:

You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

Microsoft Corp. $MSFT blue box area offers a buying opportunity