Wintermute Warns: Altcoin Season Is Dead as Bitcoin Dominance Soars

Bitcoin dominance continues its relentless climb as markets consolidate into year-end, leaving altcoins trapped under heavy supply pressure and an unforgiving token unlock schedule.

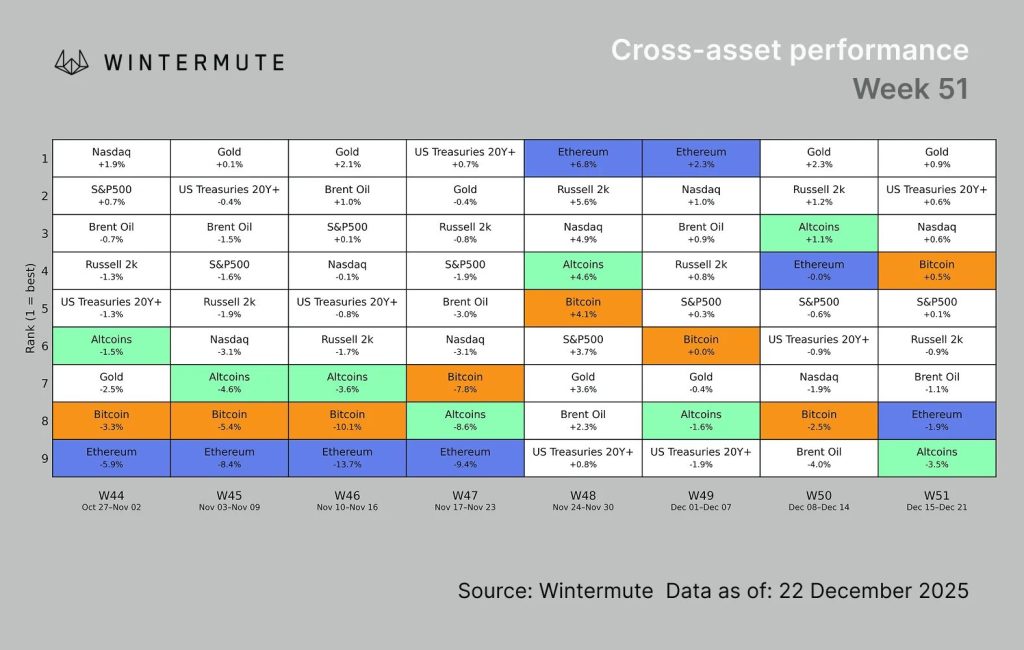

Wintermute’s latest market update confirms what many traders feared. Retail investors are rotating out of altcoins and back into major assets, signaling the end of the anticipated altcoin rally that typically follows Bitcoin’s strong performance.

The broader crypto market extended losses over the past 24 hours, with Bitcoin slipping 1.12% below $87,000 and Ethereum dropping 1.5% near $3,000.

Several altcoins saw sharp pullbacks, with the NFT sector leading declines at over 9% as weak short-term risk appetite dominated trading activity.

Source: Wintermute

Source: Wintermute

Bitcoin and Ethereum Absorb Market Pressure

Crypto markets saw intense downside pressure early last week, with Bitcoin falling below $85,000 midweek and Ethereum breaching $3,000.

Liquidations surged to approximately $600 million on Monday, followed by another $400 million each day on Wednesday and Thursday as choppy conditions forced leveraged positions out rapidly.

Bitcoin gradually recovered toward $90,000 later in the week, but the price action remained constrained.

Perpetual open interest dropped $3 billion for Bitcoin and $2 billion for Ethereum overnight, leaving markets vulnerable to sharp moves despite reduced leverage heading into the Christmas holiday period.

Wintermute’s internal flow data reveals aggregate buying pressure returning to major assets, with institutional flow providing consistent support since the summer.

The more notable shift involves retail traders rotating out of altcoins and back into Bitcoin and Ethereum, aligning with the growing consensus that Bitcoin must lead before risk appetite sustainably moves down the market cap curve.

For now, Wintermute stood on the path that “the market continues to trade choppy as liquidity continues to be thin and discretionary desks winding down into year end.”

Macro Headwinds Compound Altcoin Struggles

Markets remain range-bound as liquidity thins and discretionary desks wind down into year-end.

Downside moves stay abrupt but increasingly self-contained as leverage flushes quickly and capital retrenches into the most liquid assets.

Bitcoin and Ethereum continue acting as primary risk absorbers while the broader market struggles under supply pressure and limited risk appetite.

“Funding and basis across majors remained relatively compressed through the sell-off,” Wintermute said, with options markets continuing to price a wide range of outcomes as implied volatility stays elevated.

Notably, a recent Galaxy Research analysis shows that Bitcoin never crossed $100,000 when adjusted for inflation using 2020 dollars, despite reaching an all-time high above $126,000 in October.

“If you adjust the price of Bitcoin for inflation using 2020 dollars, BTC never crossed $100,000,” Alex Thorn, head of research at Galaxy, said. “It actually topped at $99,848 in 2020 dollar terms.“

Traditional Finance Entry Offers Medium-Term Support

Traditional financial players continue entering the space despite recent market volatility, providing a more durable foundation for future growth.

Bitmine added another 67,886 ETH worth $201 million to its treasury, bringing total December purchases to approximately $953 million.

However, Bitcoin and Ethereum ETF net flows have turned negative since early November, signaling reduced institutional participation and broader crypto-market liquidity contraction.

Bitcoin ETFs recorded $650.8 million in outflows over the past four days, led by BlackRock’s Bitcoin ETF (IBIT), which recorded the largest single-day outflow of $157 million.

Ethereum spot ETFs also recorded a net outflow of $95.52 million, with all nine ETFs posting no inflows, according to SosoValue.

Farzam Ehsani, co-founder and CEO of VALR, outlined two plausible scenarios heading into 2026.

“Either the current drawdown reflects strategic positioning by large players ahead of renewed accumulation, or the market is undergoing a deeper reset driven by macro headwinds and Federal Reserve policy,” he told Cryptonews.

David Schassler, head of multi-asset solutions at VanEck, also maintained a constructive outlook despite current weakness.

“Bitcoin is lagging the Nasdaq 100 Index by roughly 50% year-to-date, and that dislocation is setting it up to be a top performer in 2026,” he wrote in the company’s 2026 outlook report.

Ehsani sees scope for Bitcoin to revisit the $100,000–$120,000 range in the second quarter of 2026, though he cautioned that “without the emergence of new major players, there will be no altcoin season; at best, we can expect a market recovery to previous levels.“

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Offchain Labs Purchases Additional ARB Tokens as Arbitrum Surpasses $20 Billion TVL