The TechBeat: Stop the Generative AI Arms Race Before It Stops Us (12/24/2025)

How are you, hacker? 🪐Want to know what's trending right now?: The Techbeat by HackerNoon has got you covered with fresh content from our trending stories of the day! Set email preference here. ## The Hidden Cost of AI: Why It’s Making Workers Smarter, but Organisations Dumber  By @yuliiaharkusha [ 8 Min read ] AI boosts individual performance but weakens organisational thinking. Why smarter workers and faster tools can leave companies less intelligent than before. Read More.

By @yuliiaharkusha [ 8 Min read ] AI boosts individual performance but weakens organisational thinking. Why smarter workers and faster tools can leave companies less intelligent than before. Read More.

Debunking the "99.8% Accurate IP Data" Claim

By @ipinfo [ 4 Min read ] IPinfo explains why ‘99% accurate IP data’ is misleading and how real accuracy requires ongoing measurement, transparency, and ProbeNet validation. Read More.

HackerNoon and GPTZero Partner to Bring AI Transparency and Preserve What’s Human in Tech Publishing

By @pressreleases [ 3 Min read ] HackerNoon announces its AI-detection partnership with GPTZero. This AI detector will now analyse 5000+ monthly blog post submissions reviewed by the editors. Read More.

Should You Trust Your VPN Location?

By @ipinfo [ 9 Min read ] IPinfo reveals how most VPNs misrepresent locations and why real IP geolocation requires active measurement, not claims. Read More.

The Architecture of Collaboration: A Practical Framework for Human-AI Interaction

By @theakashjindal [ 7 Min read ] AI focus shifts from automation to augmentation ("Collaborative Intelligence"), pairing AI speed with human judgment to boost productivity. Read More.

SpaceX Goes Public: The Hidden Question Every Tesla Investor Should Ask

By @hunterthomas [ 4 Min read ] SpaceX is going public in 2026 at a potential $1.5 trillion valuation. Read More.

Stop the Generative AI Arms Race Before It Stops Us

By @cm0g4qf5i0000357s7xsi7icm [ 4 Min read ] As you read this letter, generative AIs like ChatGPT and DeepSeek are sweeping across the globe with millions of interactions per second. Read More.

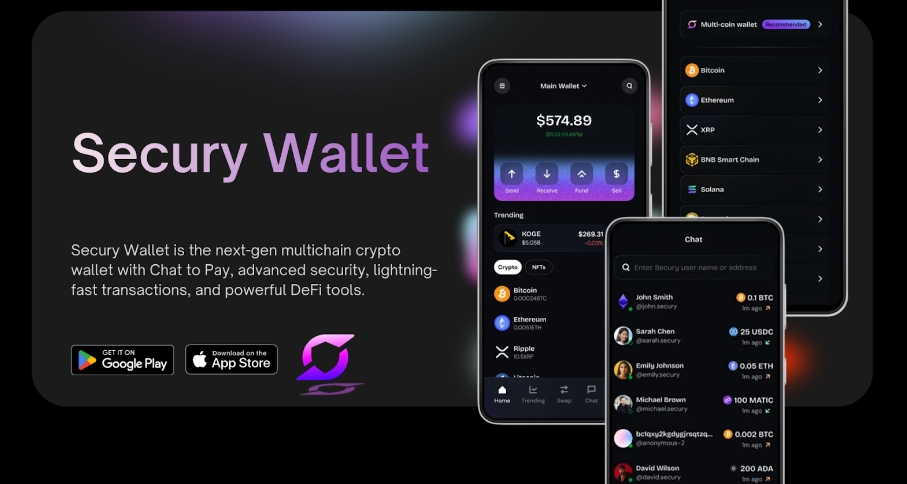

Secury Wallet Unveils Next-Generation Multichain Crypto Wallet With Chat to Pay, Opens $SEC Presale

By @btcwire [ 2 Min read ] The project has opened the $SEC token presale, including early staking opportunities offering up to 100% APY during the presale phase. Chat to Pay is an instant Read More.

Best Amazon Scraper APIs for 2025: Top Picks Compared

By @oxylabs [ 9 Min read ] Compare the best Amazon Scraper APIs for 2025, analyzing speed, pricing, reliability, and features for scalable eCommerce data extraction. Read More.

The "Stochastic Parrot" Narrative Is Dead. Physics Killed It.

By @tyingshoelaces [ 4 Min read ] Researchers found LLMs satisfy laws from thermodynamics. That changes everything. Read More.

Why Good Products Feel Broken

By @tanyadonska [ 4 Min read ] Lost $240K to a slower competitor. Users said our 400ms queries 'felt too fast to be real.' Started adding artificial delays on purpose. Trust isn't speed. Read More.

What You Already Know About Big Data

By @patrickokare [ 9 Min read ] Every micro-interaction is silently recorded, analyzed, and monetized. Read More.

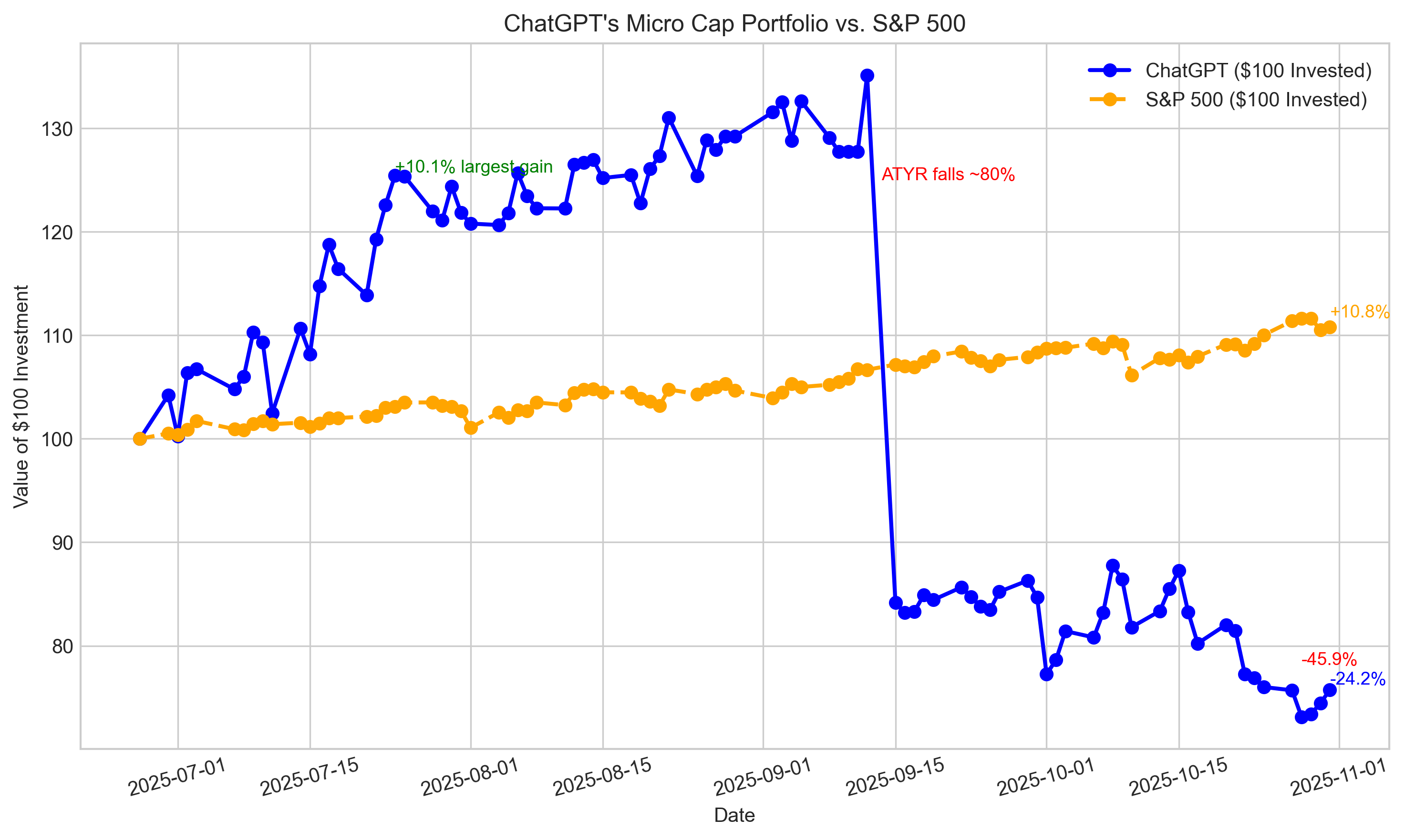

Can ChatGPT Outperform the Market? Week 18

By @nathanbsmith729 [ 7 Min read ] Monday marked a new max drawdown of -45.85%. Read More.

Tech's Attempt To Conquer Hollywood

By @3techpolls [ 5 Min read ] AI has been a major force in seemingly every career field. Now, it seems to have set its eyes somewhere else: Hollywood. Read More.

How to Build an n8n Automation to Read Kibana Logs and Analyze Them With an LLM

By @indrivetech [ 6 Min read ] How we built an n8n automation that reads Kibana logs, analyzes them with an LLM, and returns human-readable incident summaries in Slack Read More.

Why More VARs and SIs Are Embedding Melissa Into Their Enterprise Solutions

By @melissaindia [ 5 Min read ] Partner with Melissa to empower VARs and SIs with accurate data, seamless integrations, and scalable verification tools for smarter, faster client solutions. Read More.

Best AI Automation Platforms for Building Smarter Workflows in 2026

By @stevebeyatte [ 7 Min read ] From no-code tools to enterprise AI systems, discover the top AI workflow automation platforms to use in 2026, and learn which solution fits your business needs Read More.

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

By @beldexcoin [ 3 Min read ] The obscura hardfork enabled Bulletproofs++ on the Beldex mainnet at block height 4939549. Learn what this upgrades means for you. Read More.

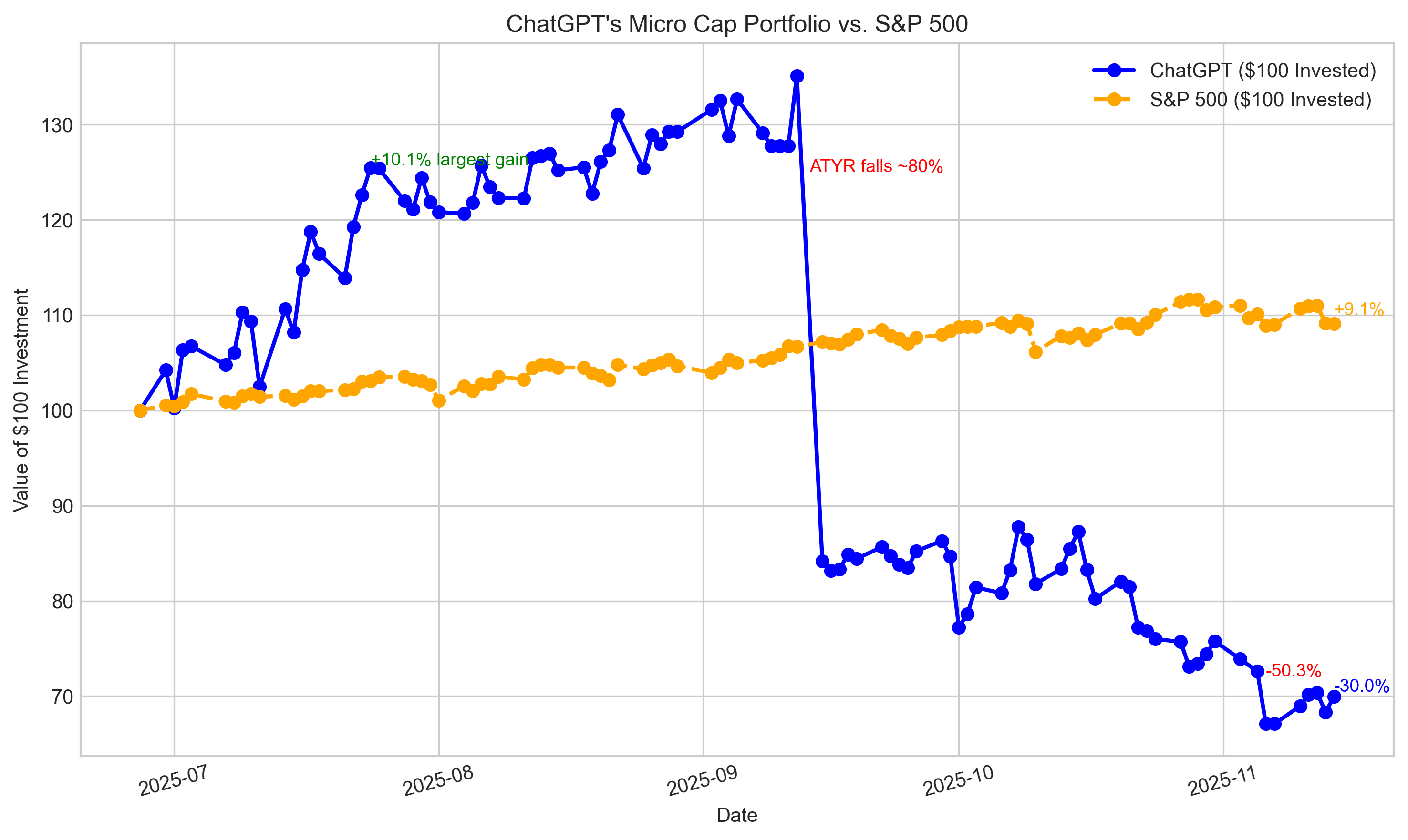

Can ChatGPT Outperform the Market? Week 20

By @nathanbsmith729 [ 6 Min read ] I need YOUR help for the future! Read More.

Why Developers Keep Picking the Wrong Testing Techniques

By @escholar [ 4 Min read ] A study shows developers often misjudge which testing techniques are most effective—leading to measurable drops in software quality. Read More. 🧑💻 What happened in your world this week? It's been said that writing can help consolidate technical knowledge, establish credibility, and contribute to emerging community standards. Feeling stuck? We got you covered ⬇️⬇️⬇️ ANSWER THESE GREATEST INTERVIEW QUESTIONS OF ALL TIME We hope you enjoy this worth of free reading material. Feel free to forward this email to a nerdy friend who'll love you for it. See you on Planet Internet! With love, The HackerNoon Team ✌️

You May Also Like

CME Group to launch options on XRP and SOL futures

The Rise of the Heli-Trek: How Fly-Out Adventures Are Redefining Everest Travel