XRP Price Holds Support After Selloff as On-Chain Data Shows Reduced Downside Risk

The post XRP Price Holds Support After Selloff as On-Chain Data Shows Reduced Downside Risk appeared first on Coinpedia Fintech News

XRP price started today’s session under heavy pressure, sliding close to 5% lower amid broad crypto market weakness. However, as the day passed, the selling momentum faded, with price beginning to recover steadily, trimming losses to roughly –2% by mid-session. This rebound was not driven by a sudden spike in volume or speculative momentum. Instead, buying interest emerged gradually near lower levels, suggesting measured dip accumulation rather than forced short covering.

The absence of follow-through selling indicates that downside pressure is being absorbed, even as broader sentiment remains cautious. While XRP has not confirmed a trend reversal, the intraday recovery highlights a shift from aggressive selling to price stabilization, often seen when markets enter a reassessment phase.

On-Chain Metrics Signal a Market in Balance, Not Breakdown

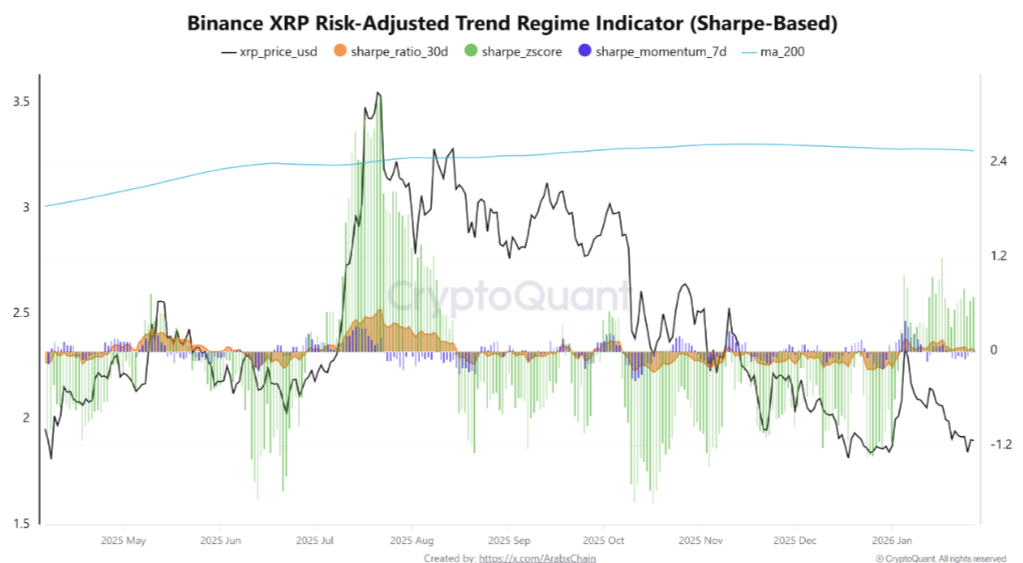

On-chain metrics shows that XRP continues to trade well below its 200-day moving average, with price hovering near the $1.8–$1.9 zone while the 200DMA sits closer to $2.5. This roughly 25% gap confirms that the broader trend has not flipped bullish yet. However, the absence of sharp downside continuation suggests the market is operating in a corrective equilibrium, not a structural collapse. Looking deeper, the 30-day Sharpe Ratio remains close to zero, around 0.03–0.04, indicating that recent returns have barely compensated for risk. Historically, such readings emerge during consolidation phases, when volatility compresses and directional conviction fades.

At the same time, the Sharpe Z-Score, near +0.7, shows modest improvement relative to recent history. While still below levels associated with strong trend formation, it signals that downside efficiency has weakened. While short-term momentum metrics echo this view, with the 7-day Sharpe Momentum slightly positive but subdued consistent with early base-building rather than impulsive upside. Together, these indicators suggest XRP is losing bearish momentum, even if it has not yet regained bullish dominance.

Ripple Escrow Activity Draws Attention

Ripple’s escrow mechanism returned to focus after on-chain trackers flagged a series of large XRP unlocks during the session. Data shows that close to 1 billion XRP was unlocked in multiple tranches, including 100 million and 400 million XRP transactions, with individual releases valued between $160 million and $650 million at prevailing prices.

Despite the scale, the unlocks followed Ripple’s predefined, transparent escrow schedule, a system that has been in place for years. Importantly, an escrow unlock does not automatically translate into spot market selling. Past cycles show that a significant portion of unlocked XRP is either re-locked into escrow or used for liquidity operations tied to Ripple’s payment infrastructure. The market response this time reinforces that pattern. Spot order books showed no surge in sell-side aggression, and price remained stable following the unlocks. In practical terms, the escrow activity added supply visibility, but failed to trigger distribution behavior, suggesting traders had largely anticipated the event.

XRP Price Rebounds Highlights Buyer Accumulation at Key Levels

XRP’s price action tells a more nuanced story than the headline selloff suggests. The session began with downside continuation, pushing XRP close to –5% intraday and briefly threatening to extend the broader corrective structure that has defined recent weeks. XRP price action trading close to a well-defined demand zone that has capped downside attempts since late January. As price dipped into this region, sell-side momentum visibly weakened, and buying interest emerged almost immediately. This allowed XRP to reclaim lost ground and recover toward –2% on the day, signaling active dip-buying rather than passive consolidation.

Structurally, XRP remains below its longer-term trend markers, meaning the broader bias is still corrective rather than bullish. The chart continues to reflect a descending structure, with lower highs guiding price action since the breakdown. The $1.70–$1.80 region remains the key level to watch. A sustained hold above this zone keeps XRP in a base-building phase, opening the door for a relief bounce toward nearby resistance if broader market conditions cooperate. Conversely, a clean breakdown below the $1.40-$1.60 area would invalidate the intraday recovery and expose XRP to renewed downside pressure.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Telos Advisers Welcomes Stephen Gardner as a Strategic Advisory Board Member