21Shares Drops 3 XRP Price Predictions For 2026: What’s The Upside?

21Shares has outlined a three-scenario price outlook for XRP in 2026, arguing that the token is moving from a litigation-defined trade to one increasingly priced on ETF-driven demand and measurable on-ledger adoption.

In a Jan. 23 research note, 21Shares’ Matt Mena frames 2026 as a “defining turning point” in which XRP’s valuation becomes “anchored in institutional fundamentals” after the August 2025 settlement that ended the SEC case overhang. The firm says that resolution removed a structural constraint that had limited XRP’s upside “regardless of underlying utility,” allowing the market to reprice to a new all-time high of $3.66 and then consolidate with the former $2.00 ceiling acting as support.

XRP Price Predictions For 2026

21Shares describes the post-settlement regime as a tougher environment for the asset: less narrative optionality, more accountability. With the legal cloud cleared, the note argues XRP “can no longer rely on courtroom hype or regulatory uncertainty to drive its valuation or excuse underperformance,” introducing a “sell the news” risk if usage fails to scale and the market re-rates the asset on realized adoption rather than legal relief.

The firm’s view is that clarity expands the addressable buyer base and product surface area in the US “US-based institutions. Regulated funds and ETP issuers. Banks and payment companies.” In 21Shares’ telling, those channels were previously constrained by compliance risk, and their re-entry sets up a new phase of price discovery.

The second pillar is flows. 21Shares says US spot XRP ETFs have “fundamentally rewritten” XRP’s demand profile, reaching more than $1.3 billion in assets under management in their first month and logging a 55-day streak of consecutive inflows. The note leans heavily on a supply-demand argument, pairing ETF absorption with what it characterizes as unusually sticky retail positioning.

“Exchange reserves are at a seven-year low of 1.7 billion XRP. Institutional ETF demand is colliding with a community that refuses to sell.” That collision, the firm argues, is the “primary engine” for a potentially non-linear repricing, while also warning that reflexivity cuts both ways if inflows slow.

To ground the reflexivity case, 21Shares points to the first year of US Bitcoin spot ETFs as a template, citing nearly $38 billion in net inflows and a price move from roughly $40,000 to $100,000 inside 12 months. The distinction, in its view, is liquidity overhead: XRP launched its ETF era at a much smaller market cap than Bitcoin did at its debut, implying a larger marginal impact per dollar of net buying, provided those early capture rates persist through 2026.

The third pillar is utility, with 21Shares positioning XRPL as “financial plumbing” for tokenization and stablecoin settlement. The note highlights RLUSD’s growth to more than 37,000 holders and a market cap increase of over 1,800% from $72 million to $1.38 billion in under a year, alongside XRPL DeFi TVL expanding nearly 100x over two years to above $100 million. It also points to the Multi-Purpose Tokens standard as a mechanism for institutions to issue RWAs with embedded metadata and compliance rules.

Still, 21Shares flags execution risk: progress is “evolutionary, not explosive,” and XRPL trails rivals on developer and user engagement, with competition for RWA flows cited from Canton, Solana, and other ecosystems.

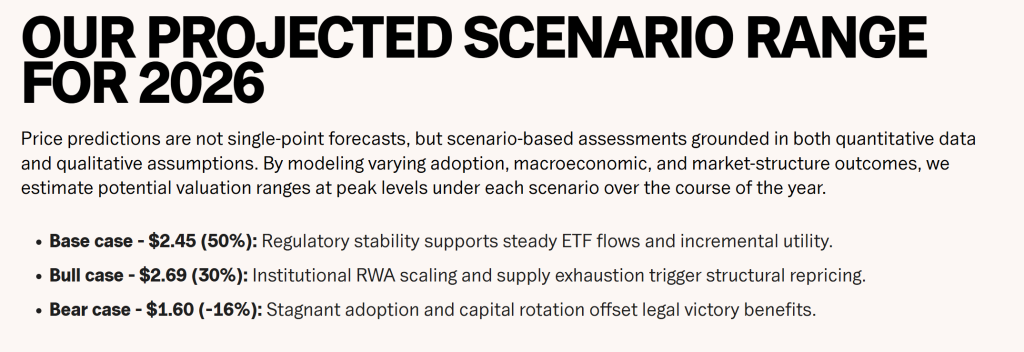

21Shares’ modeled peak ranges for 2026 put a base case at $2.45 (50% probability), a bull case at $2.69 (30%), and a bear case at $1.60 (implied -16%), with key swing factors being sustained ETF inflows, meaningful tokenization volumes, and RLUSD maintaining institutional traction.

At press time, XRP traded at $1.8792.

You May Also Like

Crypto Shows Mixed Reaction To Rate Cuts and Powell’s Speech

US Cryptocurrency Stocks Face Decline Amid Market Volatility