Bitcoin Pushes Past $90k on Mixed ETF Flows, While Analysts Warn of Fragile Support

- Bitcoin gained 4.6% over 24 hours and reclaimed the US$90k level, though it remains nearly 20% down on the monthly chart.

- Ethereum and Solana ETFs have seen strong inflows, with Ethereum recording four consecutive days of net inflows totalling US$241.5 million.

- Solana ETFs experienced their first net outflows on Wednesday, with US$8.2 million exiting across US funds, suggesting potential momentum shifts.

- Analysts suggest the market is in a “low-conviction consolidation” phase, with recent volatility driven by leverage unwinding rather than fundamental trend changes.

Bitcoin has posted a 4.6% gain over the past 24 hours and has pushed back above the US$90k (AU$137.8k) level. At the time of writing, one BTC sells for US$91,546 (AU$140,221), still down almost 20% over the past month.

Monthly BTC chart, source: CoinMarketCap

Monthly BTC chart, source: CoinMarketCap

Most other major cryptocurrencies have followed the OG’s lead: Ethereum (ETH) is up 2.7% over the past day, trading for US$3,039 (AU$4,654), while Solana (SOL) is up 2.8% and XRP up 1.4%.

Altcoin and Bitcoin ETF Trends

XRP and SOL have seen successful exchange-traded fund (ETF) launches, with hundreds of millions in net inflows.

After a record streak, though, the SOL ETFs saw some net outflows for the first time on Wednesday. Across the five US funds, there were US$8.2 million (AU$12.55 million) in net outflows, with 21Shares’ TSOL being the only ETF with significant losses – US$34.4 million (AU$51.15 million) left the fund.

Ethereum ETFs, on the other hand, have had four consecutive days of net inflows, bringing in a total of US$241.5 million (AU$369.8 million) over that period (with results for BlackRock’s ETHA still pending). This ends an eight-day streak of net outflows, during which US$1.2 billion (AU$1.8 billion) left the funds.

For US Bitcoin spot ETFs, it’s a much more mixed bag. After a run of net outflows, inflows and outflows have alternated.

The most recent trading days saw a net outflow of US$151 million (AU$231.2 million) on Monday, net inflows of US$128.7 million (AU$197.1 million) on Tuesday, and net losses of US$21.7 million (AU$33.2 million) on Wednesday (with BlackRock’s numbers still pending and capable of swinging the totals either way).

US Spot Bitcoin ETF flows in million USD since 10 November, source: farside.co.uk

US Spot Bitcoin ETF flows in million USD since 10 November, source: farside.co.uk

Related: Mortgage On Chain Debuts as Australia’s First Crypto-Focused Mortgage Broker

Analysts React to Market Volatility

While the interest in ETFs could indicate that buyers are returning, not everyone is convinced. A recent analysis by Glassnode concluded that markets may continue in what they call a “low-conviction consolidation”.

Their analysis noted that Bitcoin is stuck in a fragile range as short-term holders realise steep losses and market liquidity thins, while long-term holder momentum also shows early signs of cooling.

Across futures and options, positioning remains defensive with reduced leverage and elevated volatility, leaving sentiment cautious, while “recovery requires reclaiming major cost-basis models and renewed inflows”, they added.

Related: Japan Moves to Boost Crypto Safety With New Liability-Reserve Rules for Exchanges

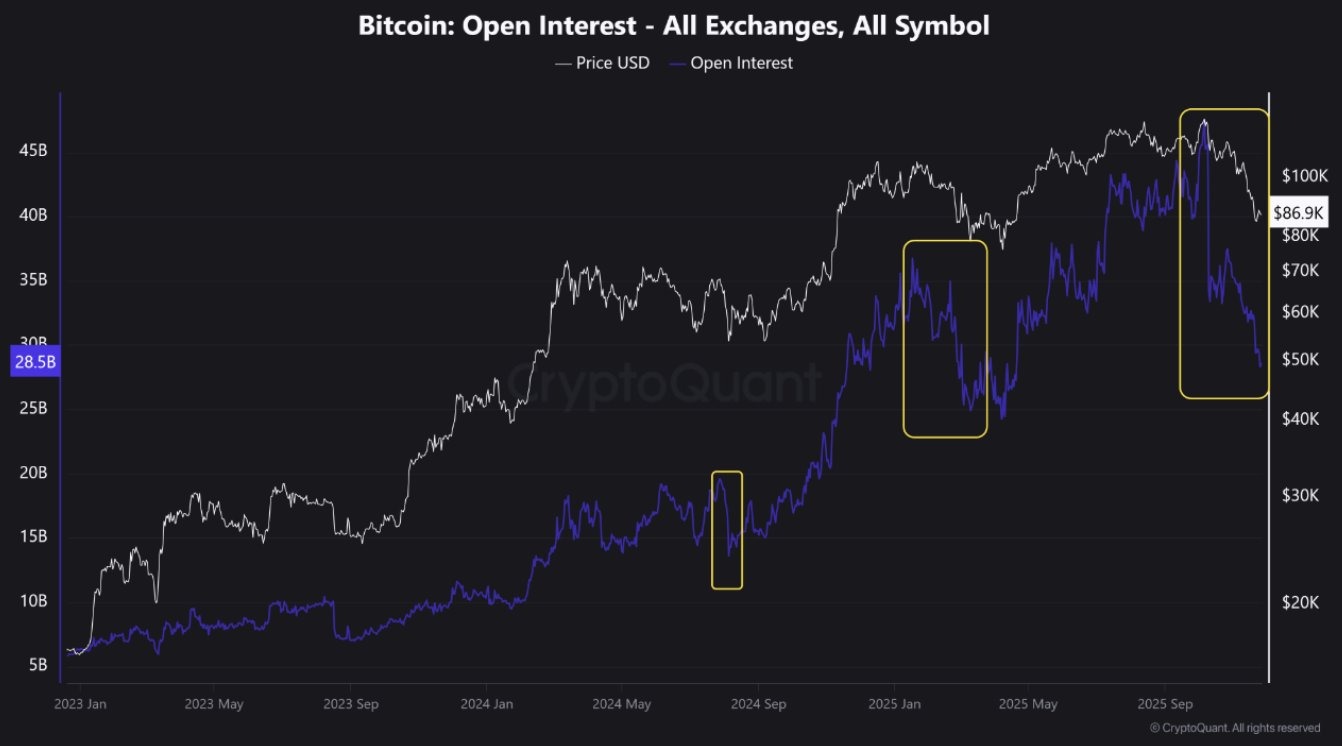

Adding to this picture, derivatives data suggests that the recent volatility comes from leverage unwinding rather than a deeper trend shift, as one CryptoQuant analyst noted:

“Market just witnessed the largest drop in Open Interest of the current cycle… This move does not signal the start of a bear market; rather, it reflects a major leverage washout (Long Squeeze).”

Bitcoin OI, source: CryptoQuant

Bitcoin OI, source: CryptoQuant

The post Bitcoin Pushes Past $90k on Mixed ETF Flows, While Analysts Warn of Fragile Support appeared first on Crypto News Australia.

You May Also Like

The Channel Factories We’ve Been Waiting For

What is the Outlook for Digital Assets in 2026?