Crypto Hack: CertiK Warns After $2.3 Million Stolen Fund Sent To Tornado Cash

The post Crypto Hack: CertiK Warns After $2.3 Million Stolen Fund Sent To Tornado Cash appeared first on Coinpedia Fintech News

Blockchain security company CertiK has issued an important warning after detecting a suspicious on-chain incident that led to the loss of nearly $2.3 million in digital assets.

According to CertiK, the suspicious activity was found using its Skylens monitoring system, which tracks unusual movements on the blockchain.

How the $2.3 Million Crypto Hack Happened

According to the CertiK report, there were two wallets involved in the attack. One wallet sent around $1.8 million, while the second wallet sent about $506,000. Both transfers went to the same unknown wallet, which was later marked as malicious.

This means the money was likely stolen, not sent by choice.

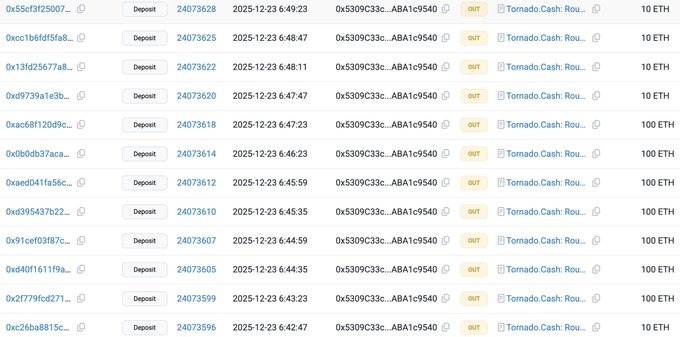

After receiving the stolen money, the attacker quickly moved the funds into Tornado Cash, a crypto privacy tool. Tornado Cash is often used to hide transaction trails, making it very hard to track or recover stolen funds.

Blockchain data shows multiple Ethereum transfers, including small and large amounts like 10 ETH and 100 ETH, being sent through Tornado Cash within minutes. This fast movement is a common sign of a planned attack.

The Victim asks for Negotiation

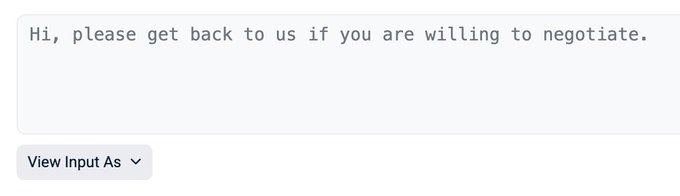

What makes this case unusual is what happened next. CertiK’s data shows that both compromised wallets sent an on-chain message to the receiving address, asking whether negotiation was possible.

This suggests the transfers were not intentional trades, but likely the result of a security breach where wallet access was lost.

Sharp Warning For Crypto Users

This incident once again highlights the growing risks around wallet security. Even without smart contract exploits, attackers can drain funds using compromised private keys, phishing links, or malicious approvals.

Meanwhile, some experts have started closely monitoring and flagging the wallet address, even though recovering the stolen funds may not be possible.”

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688