Bitcoin Price Repeats 2021 Patterns, Whales, Shark Wallets on Decline

Bitcoin BTC $87 083 24h volatility: 0.5% Market cap: $1.74 T Vol. 24h: $35.93 B price weakness continues to persist as every bounce in recent weeks is met with instant selling pressure. As BTC is flirting with $87,000, on-chain data shows that total wallet addresses across sharks and whales are on a decline. This, coupled with Bitcoin ETF outflows, demonstrates that the overall sentiment is turning bearish.

Bitcoin Price Chart Repeats 2021 Pattern

Crypto market analyst Tracer has warned that Bitcoin may be repeating a price pattern similar to the 2021 cycle. In a recent post, the analyst pointed to a structure marked by a double top, followed by a sharp sell-off.

The image above also shows signs of a temporary rebound and another leg lower. Crypto analyst Tracer noted that many market participants could be unprepared for a renewed downside move. As per the above image, the Bitcoin price could see a temporary bounce to $100K. However, if the pattern repeats, it might crash later, all the way under $60K levels.

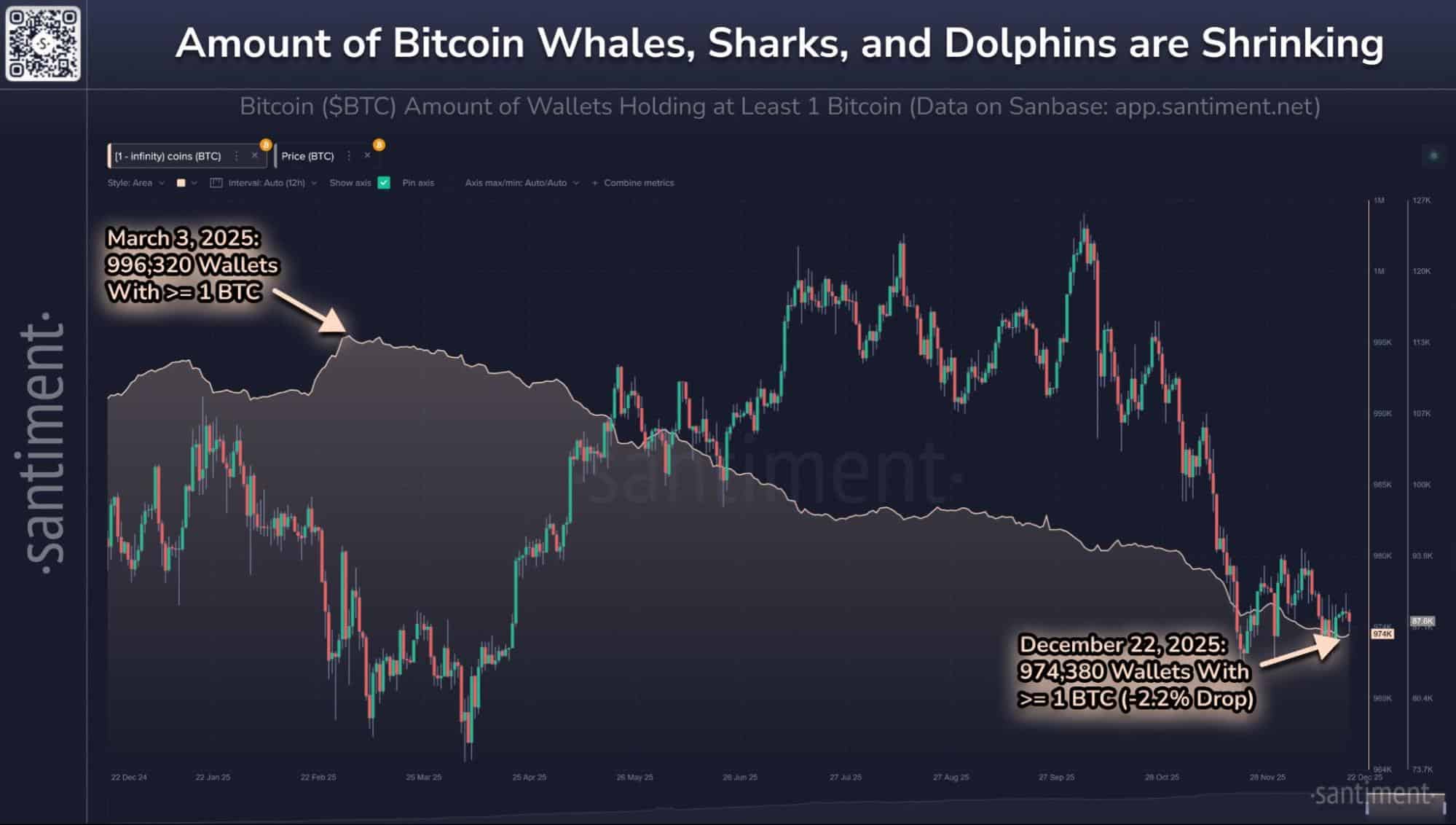

Furthermore, blockchain analytics firm Santiment has reported a shift in Bitcoin wallet distribution. According to the on-chain data, the number of wallets holding at least one Bitcoin has declined by 2.2% since reaching a one-year peak on March 3.

Bitcoin wallet data | Source: Santiment

However, Santiment noted one good thing. Wallets holding more than one Bitcoin have collectively increased their holdings by approximately 136,670 BTC over the same period.

After seeing a bounce to $90,000 earlier this week, BTC has once again faced rejection. It has shown a strong negative correlation with US tech stocks as well as top-performing metals like Gold and Silver.

Bitcoin ETFs Continue to Bleed

The US spot Bitcoin ETFs have seen major outflows over the past few trading sessions. After $497 million in outflows last week, this week the outflows have continued as well.

As data from Farside Investors shows, total outflows across all US Bitcoin ETFs have shot to $188 million. BlackRock iShares Bitcoin Trust (IBIT) recorded the most outflows at $157.3 million, with 1,792 Bitcoins moving out of the fund. The IBIT share price continues to flirt with $50.

nextThe post Bitcoin Price Repeats 2021 Patterns, Whales, Shark Wallets on Decline appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Egypt to invite investors for projects in ‘golden triangle’