This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital

Digital assets investment firm Pantera Capital says a leading Ethereum (ETH) competitor has the highest chances of being economically sound.

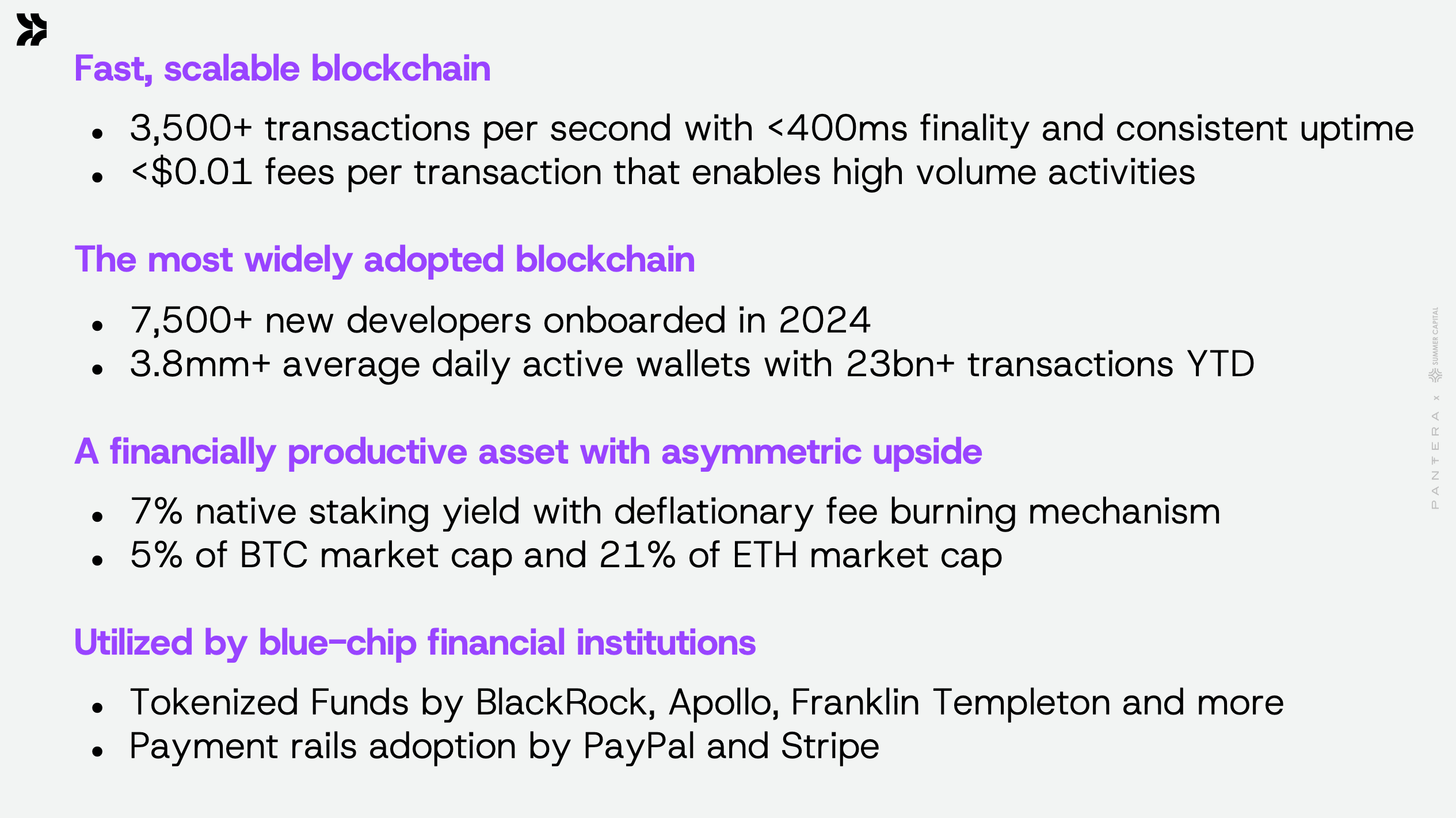

Pantera Capital says Solana (SOL) is the “most commercially viable blockchain for global markets and payments.”

According to Pantera Capital, some of Solana’s strengths include affordability, scalability and the speed of processing transactions.

“Solana has taken a “monolithic” design approach, focused on creating a unified user experience and maximizing the capability of its core chain, similar to the design philosophy of Apple.

High-performance and low-cost, capable of 65,000 transactions per second at the base layer.”

To enable blockchain adoption by mainstream consumers, Pantera Capital says factors such as speed and affordability are critical.

“We believe we are at the early stages of blockchain adoption, with a more than 100x increase in blockchain activity ahead. For these mass-market applications, we believe Solana has the user experience edge.”

According to Pantera Capital, Solana has recorded more than 23 billion transactions year-to-date and boasts of 3.8 million daily average active wallets, a number higher than that of Bitcoin (BTC) and Ethereum despite having a lower market cap. The transaction fees on the Solana blockchain are less than one cent per transaction.

Source: Pantera Capital

Source: Pantera Capital

Pantera Capital further says that Solana possesses massive upside potential amid an under-allocation in SOL by institutions.

“Institutions are currently under-allocated, holding less than 1% of the total SOL supply, compared to 7% ownership of ETH and 16% of BTC. With a Solana ETF approval expected as early as Q3/Q4 2025, we believe the SOL adoption story is just beginning and offers asymmetric upside potential.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital appeared first on The Daily Hodl.

You May Also Like

Moto completes $1.8 million pre-seed funding round for its Solana eco-credit card project.

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?