Resolv: 340 million TVL + 50,000 users endorsement, a Delta neutral stablecoin protocol with a dual token model

Author: Pink Brains

Compiled by: Tim, PANews

Interest-bearing stablecoins have become the focus of the current cycle with their three characteristics of real returns, low volatility, and airdrop opportunities. Resolv is about to become the next stablecoin protocol to issue tokens.

Here are the key things you need to know about Resolv and the RESOLV token:

Resolv is a stablecoin protocol that aims to solve the following specific problem: How to build a stablecoin that can obtain real and sustainable returns without taking unnecessary risks? Their answer is: scalable structure, transparency and yield mechanism.

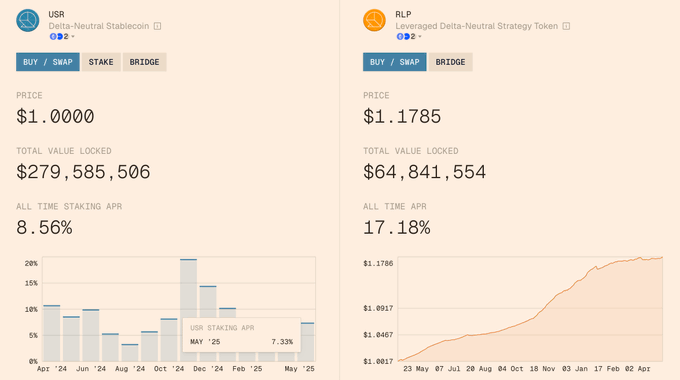

Resolv's core product is the stablecoin USR, which is backed by ETH and BTC. The platform uses a Delta-neutral strategy (mainly hedging with perpetual contracts) to transform highly volatile assets into productive collateral while maintaining price stability. This is not a pioneering model (such as Ethena's USDe), but Resolv has also found a point of fit between product and market.

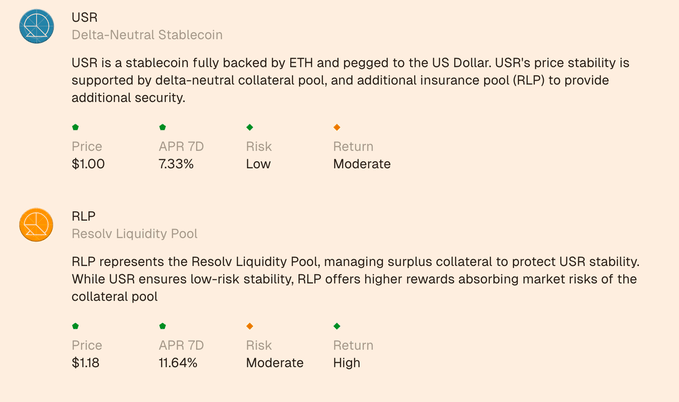

Resolv divides risk into two parts:

- stUSR: Low-risk, interest-earning stablecoin

- RLP: A medium-risk, high-return position that earns returns by taking on protocol performance risk

This dual structure is crucial as it allows capital to make autonomous choices based on risk appetite, which is also the common way traditional finance handles returns.

Where does the income come from?

Resolv has three ways to realize stablecoin income:

1. ETH/BTC staking via Lido and Binance

2. Perpetual contracts on Binance, Hyperliquid, and Deribit

3. US dollar neutral strategy (Superstate USCC)

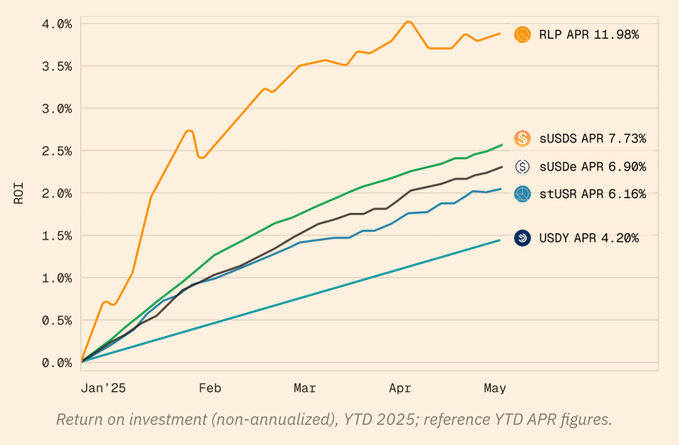

stUSR offers a yield comparable to sUSDe and sUSDS, while enhancing the insurance mechanism through RLP.

At the same time, RLP’s high yield is also reflected in another aspect. By capturing the upside of the Resolv strategy, it outperforms stablecoins backed by U.S. Treasuries such as $USDY.

Since its public launch in September 2024, Resolv has achieved the following: $344.1 million TVL (across Ethereum, Base, and BNB chains); over $1.7 billion in total minting and redemption; over $10 million in actual earnings distributed; over 50,000 users (56% of monthly active users)

In addition, USR and stUSR are jointly managed by top DeFi protocols (such as Pendle, Morpho, Euler, Curve, Hyperliquid, etc.) and other capital allocators.

This is quite impressive performance for a newly launched stablecoin protocol.

Now, Resolv plans to launch its native token, RESOLV, in the first two weeks of this month.

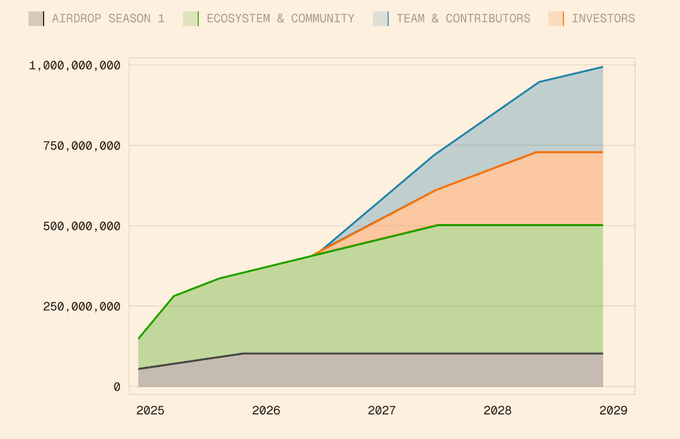

RESOLV Token Economics:

- Total supply: 1 billion

- Season 1 airdrop: 10% (unlocked at TGE)

- Ecosystem and community: 40.9% (10% unlocked at TGE, remaining tokens released linearly over 24 months)

- Team: 26.7% (1 year lock-up period, followed by 30 months of linear release)

- Investors: 22.4% (1-year lock-up period, followed by linear unlocking over 24 months)

Token Utility:

- Governance (treasury strategy + incentive plan);

- Double rewards (token issuance + external partner benefits);

- Points multiplier; obtain the qualification of future airdrops from partners;

After TGE, what are Resolv’s next plans?

Resolv aims to be an architecture that seamlessly integrates stable yield into every layer of on-chain finance.

1. Optimizing the Segregated Vault for Delta Neutral Returns

2. Allocate funds to treasury bonds and stablecoins backed by RWA

3. Altcoin Vault

4. External income (treasury cooperation, swap instruments and redemption)

Resolv's goal is to build an efficient revenue cycle that continuously returns value to RESOLV holders.

Resolv is not just a stablecoin, it is evolving into an on-chain currency. If you have been using USR and stUSR to gain experience points, now is the time to reap the rewards! TGE and airdrops are coming soon, stay tuned!

You May Also Like

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm

Patriots Hall Of Famer Julian Edelman Is A Rising Media Star At FOX Sports