LYS Labs Moves Beyond Data and Aims to Become the Operating System for Automated Global Finance

Bucharest, Romania, September 26th, 2025, Chainwire

LYS Labs, the Web3 data infrastructure company building the intelligence layer for machine finance on Solana, today announced a series of significant milestones that underscore its rapid growth and adoption. The company is expanding its data capabilities and gearing up to introduce a new trading product on Solana, LYS Flash, aiming to optimize transaction execution.

LYS Labs recently announced its seed round with participation from Alchemy Ventures, Auros Global, and Frachtis, among others, expanded its ecosystem through integrations with QuickNode, and joined the Chainlink Build on Solana Program. The company has also launched new developer-facing initiatives that are already driving significant traction.

Phase 1 of LYS Development has been completed, with its ultra-low latency, structured Solana data now available to the public. Additionally, its aggregated data is in testnet with a few selected partners.

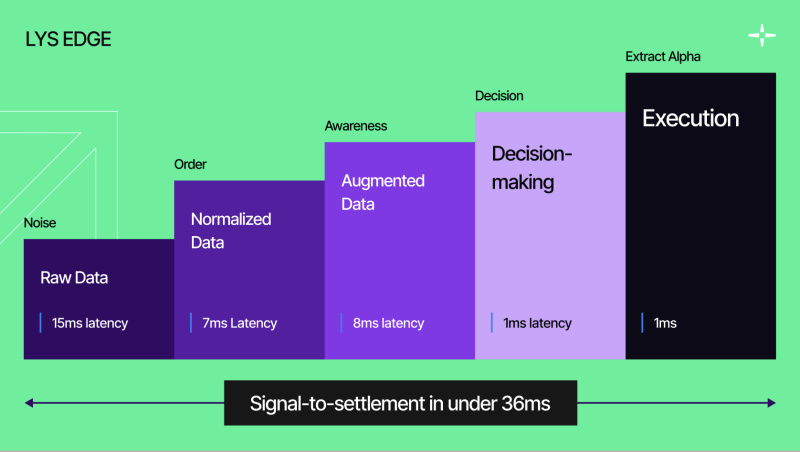

For Phase 2, LYS Labs will release a new product that complements its stack, aimed at Solana traders. Execution on Solana can be complex: every DEX has its own contract quirks, associated token account logic, and fee structures. Priority fees, bribes, and MEV protection require careful tuning to avoid failed transactions or suboptimal fills. LYS Flash smart relay engine abstracts this complexity away, enabling machines to get from signal to settlement in under 36 milliseconds.

QuickNode Integration: Latency as Low as 14ms

QuickNode Integration: Latency as Low as 14ms

As part of Phase 1, LYS Labs integrated with QuickNode Marketplace, where it now delivers structured Solana data with latency as low as 14 milliseconds. Traders and developers can access wallet flows, token insights, and liquidity events from Solana’s largest DEXes and launchpads like Meteora, Raydium, Pump, Bonk, and others directly through the QuickNode Marketplace. This gives builders near-real-time access to event-driven data pipelines, closing the gap between analysis and execution.

Chainlink Build on Solana

LYS Labs is also joining the Chainlink Build on Solana Program, a Chainlink initiative focused on builders on Solana. By collaborating with Chainlink, LYS Labs gains enhanced technical support, cryptoeconomic security, and access to new dApp integrations.

Developer Ecosystem Momentum

The launch of the LYS Developer Portal and LYS Builders Program has generated strong early traction, with hundreds of developers gaining direct access to APIs, structured datasets, and community support. In its first month alone, LYS Labs recorded over 620 active users, 16B events processed and, and 14+ TB of data transferred, a strong signal of market demand for structured blockchain data on Solana. Demand for LYS Flash is also lining up.

Leadership with Proven Impact

LYS Labs co-founder, Marian Oancea, a veteran builder who coded the original Ethereum crowdsale contract in 2014 and later developed Ethstats.dev to make Ethereum’s state more transparent. Reflecting on his journey, Marian commented:

The Operating System for Internet Capital Markets

LYS Labs’ mission is to become the operating system for the machines powering automated global finance. It’s stack transforms raw blockchain events into contextualized, AI-ready insights and optimizes execution, thus enabling traders, protocols, and autonomous agents to execute strategies at the speed of the chain. By delivering consistency, semantic structure, and reliability at scale, LYS Labs is laying the foundation for the next generation of programmable finance.

About LYS Labs

LYS Labs is building the operating system that powers automated global finance on Solana, featuring contextualized AI-ready insights and a smart execution engine.

Media & Contact

Website: https://lyslabs.ai

Twitter: https://x.com/LYS_Labs

Blog: https://substack.com/@lyslabs

Press Contact: [email protected]

Contact

Co-founder

Andra Nicolau

LYS Labs

[email protected]

The post LYS Labs Moves Beyond Data and Aims to Become the Operating System for Automated Global Finance appeared first on Live Bitcoin News.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Hoskinson to Attend Senate Roundtable on Crypto Regulation