CZ Hints at ‘Uptober’ Bitcoin Rally After Green September – Could the Bitcoin Hyper Presale Benefit?

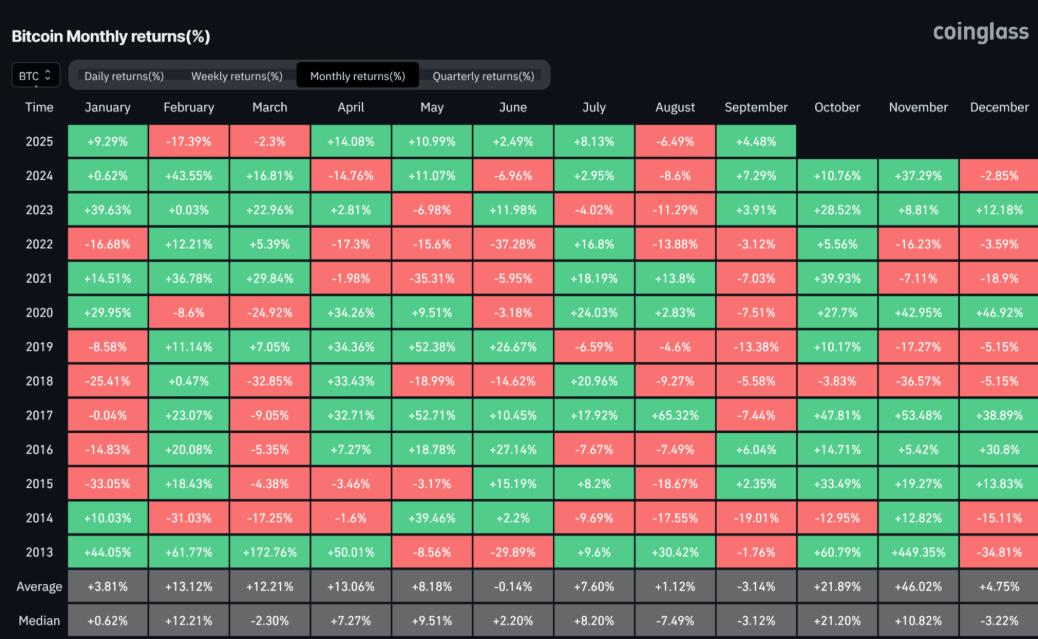

He pointed to $BTC’s 7,656% surge from mid-2015 to late-2017 as a precedent, teasing the possibility of another ‘Uptober’ rally. Supporting this outlook, data also reveal that Q4 has historically been a powerful quarter for $BTC (average gains +78.88%).

In light of this prediction, analysts and traders are closely watching seasonal patterning, rising ETF flows, gold price correlation, Fed rate-cut expectations, and pending US crypto regulatory clarity as major catalysts to drive $BTC’s price up.

Concrete historical price data points show that $BTC, trading in the low hundreds in 2015, rose to around $4,229 on October 4, 2017, reflecting the dramatic price action from 2015 to 2017.

When influential figures like CZ highlight past runs in the crypto space, it often steers investor sentiment and investment flows. This renewed momentum not only benefits $BTC but also spills over into emerging Bitcoin-based projects.

CZ Signals ‘Uptober’ — How Seasonality, ETF Inflows and Macro Drivers Could Fuel Bitcoin’s October Rally

Multiple market data providers indicate that Q4 is the strongest quarter for Bitcoin, as the coin has historically averaged gains of +78.88%.

Traders are more attentive to these seasonal edges because crowd behavior and self-fulfilling momentum can further fuel the rally.

Source: Coinglass

Source: Coinglass

It’s important to note that CZ did not promise a repeat. He instead signalled that $BTC’s history shows a pattern. With public figures like CZ citing historical runs, it should drive investor sentiment and adoption ahead of October.

To add to CZ’s narrative, $BTC is up by about 5% in September, which supports this seasonal argument. Not to mention, a green September has historically preceded a green October, according to Coinglass data, which analysts and traders use as a conditional hint.

Now, let’s take a look at the catalysts that could make an ‘Uptober’ real.

- Recent ETF inflows and discussions of continued institutional allocation could drive more money into $BTC, significantly boosting investor risk appetite. Bigger regulated vehicles make entry easier for large pools of capital.

- If the Fed leans toward rate cuts or the market pricing tightens around easing, Bitcoin could benefit from such macro tailwinds.

- Solid legislative or regulatory clarity (CLARITY Act) could reduce uncertainty around digital assets, unlocking new flows and exchange product approvals.

Historical October strength, combined with September’s green close, is drawing strong momentum from traders and algos. This renewed enthusiasm isn’t limited to Bitcoin alone. It has also put a spotlight on Bitcoin-based Layer-2 solutions, like the Bitcoin Hyper.

Bitcoin Hyper: Turning $BTC Into a High-Speed, Low-Fee Powerhouse

Bitcoin Hyper ($HYPER) is the native token of the upcoming Bitcoin Hyper network, a Layer 2 solution that aims to bring instantaneous, near-zero-cost, and scalable smart contracts to the Bitcoin ecosystem. The L2 will utilize a canonical bridge and integrate the Solana Virtual Machine (SVM) to deliver its promise of fast and low-cost transactions.

To put this into perspective, when you deposit $BTC into a wallet address on the Bitcoin chain, the Bitcoin Hyper smart contract will mint the equivalent amount of wrapped Bitcoin on the Hyper network, processing the transaction off the main chain.

SVM integration also allows $HYPER to support seamless dApps, unlocking endless possibilities such as Bitcoin-compatible NFTs, DeFi, blockchain gaming, and more.

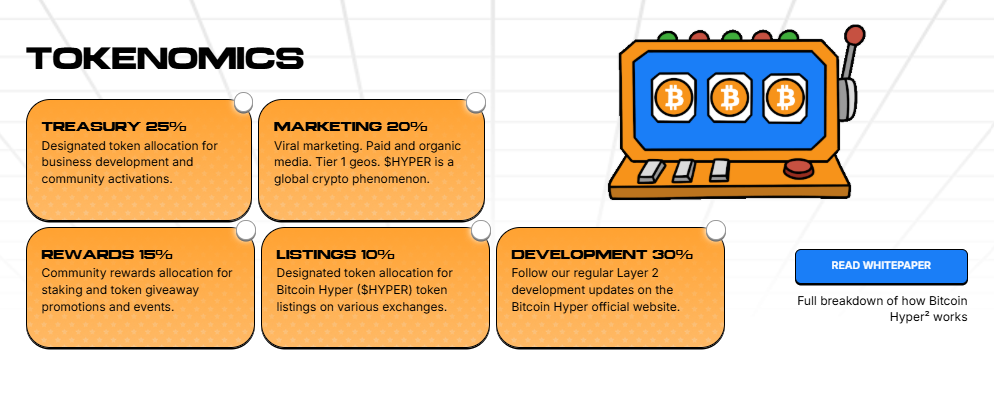

$HYPER has allocated 20% of its tokenomics to marketing initiatives, prioritizing rapid growth, visibility, and liquidity. As more resources get invested in exchange listings, community growth, and promotional campaigns, $HYPER’s demand could rally significantly.

The presale has already raised $19.5M, making waves across the market. Whales are already circling in staking their bags with $HYPER worth $11.4K and $12.5K in the past week alone.

As staking rewards taper with the addition of more participants, and with the next price rise expected tomorrow, early backers stand to capture the maximum upside.

Visit the Bitcoin Hyper website today to lock in max staking APY and potential gains.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post CZ Hints at ‘Uptober’ Bitcoin Rally After Green September – Could the Bitcoin Hyper Presale Benefit? appeared first on Coindoo.

You May Also Like

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be