Bitcoin (BTC) Price: Top Hedge Fund Predicts Gold Catch-Up Rally Coming Soon

TLDR

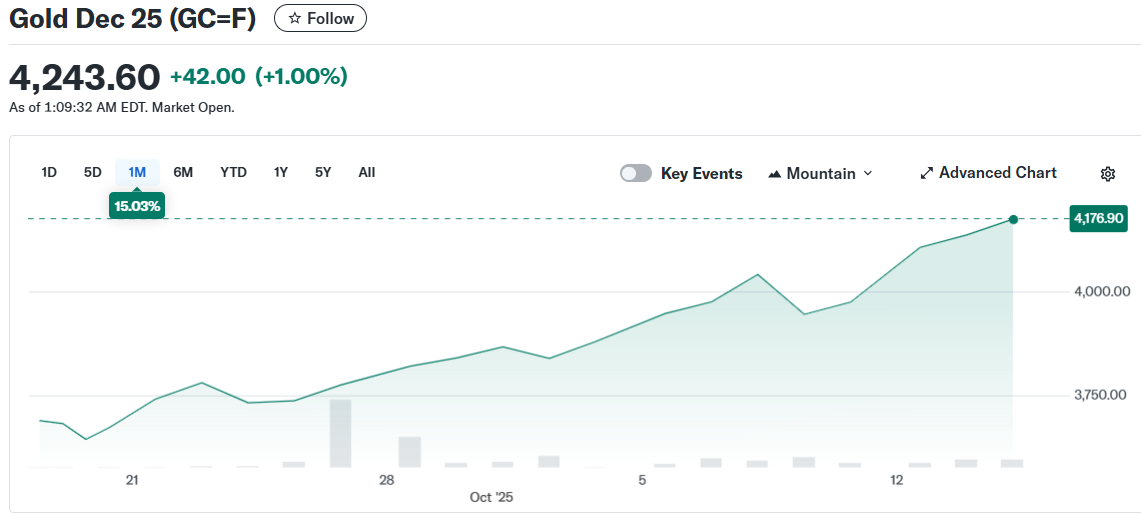

- Bitcoin trades near $111,000 while gold and silver hit new record highs, showing relative weakness in October price action

- Lekker Capital’s Quinn Thompson says Bitcoin will catch up to gold soon with a move similar to November 2024 and October 2023 rallies

- 21Shares analyst Matt Mena projects Bitcoin could reach $150,000 by year-end based on ETF inflows and dovish Fed policy

- Federal Reserve’s Beige Book shows labor market weakness, supporting expectations for continued rate cuts at remaining 2025 meetings

- A $1.3 billion wallet transfer and proposed $9.3 trillion 401(k) crypto bill are fueling renewed market optimism

Bitcoin dropped 1.2% to $111,500 over the past 24 hours while gold and silver surged to fresh record highs. The performance gap has frustrated some crypto bulls, but analysts see the price stability as a positive sign.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ether fell 3% and XRP declined 3% in the same period. Solana and dogecoin each dropped roughly 2%.

Quinn Thompson, chief investment officer at Lekker Capital, told attendees at the Digital Asset Summit in London on Wednesday that Bitcoin’s rally is imminent. He said the cryptocurrency will catch up to gold’s recent gains.

Gold Dec 25 (GC=F)

Gold Dec 25 (GC=F)

Thompson predicted the upcoming move will resemble November 2024 and October 2023 price action. Those periods saw strong rallies in the crypto market.

Matt Mena, a crypto research analyst at 21Shares, shared a similar view. He said Bitcoin’s ability to hold up during global uncertainty shows structural demand remains strong.

Mena pointed to ETF inflows and dovish monetary policy as key support factors. He projects Bitcoin could climb to $150,000 before the end of 2025.

Federal Reserve Policy Outlook

The Federal Reserve released its Beige Book on Wednesday, showing signs of growing weakness in the labor market. The report covers economic conditions across the Fed’s 12 regional banks.

Market expectations for rate cuts at both remaining policy meetings this year remain intact. Fed Chair Jerome Powell acknowledged labor market “softness” during Tuesday remarks.

Powell did not provide specific guidance on future rate decisions. However, his comments reinforced market beliefs that further easing is likely.

The U.S. Department of Justice revealed a $15 billion crypto seizure following a $1.3 billion Bitcoin transfer from a wallet linked to China’s LuBian mining pool. The wallet moved 11,886 BTC in its first major transaction in three years.

The DOJ’s case targets Cambodia’s Prince Holding Group for money laundering through LuBian. Under President Trump’s executive order, seized Bitcoin could join the U.S. strategic reserve once approved.

Retirement Account Access

U.S. Representative Troy Downing proposed legislation to make cryptocurrency access in 401(k) accounts permanent. The bill follows the Labor Department’s reversal of Biden-era restrictions on crypto in retirement plans.

The measure would give Americans long-term access to Bitcoin through 401(k) plans, which manage over $9.3 trillion in assets. Even small allocations could bring billions into the crypto market.

The crypto market rebounded after Friday’s $1.2 billion selloff. Total NFT market value fell from $6.2 billion to $5 billion before stabilizing near $5.5 billion.

Bitcoin bounced back after briefly dipping on Trump tariff comments. Crypto funds received $3.17 billion in new inflows despite heavy liquidations.

Source: TradingView

Source: TradingView

Technical analysis shows Bitcoin forming a triple-bottom pattern near $109,600. The setup has triggered multiple reversals since late September.

Bitcoin trades below the 100-period SMMA at $116,054. A close above $114,600 would validate the pattern and likely accelerate buying.

The RSI at 43 is curving upward from oversold levels. A sustained move above $120,000 could open targets at $125,000 and $130,000.

The post Bitcoin (BTC) Price: Top Hedge Fund Predicts Gold Catch-Up Rally Coming Soon appeared first on CoinCentral.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Fraudulent Token Scheme Smashed as Judge Delivers Crushing $3.34M Blow