Citadel CEO’s Solana Bet Sparks Altcoin Momentum – Why It’s Time to Invest in $SNORT

KEY POINTS:

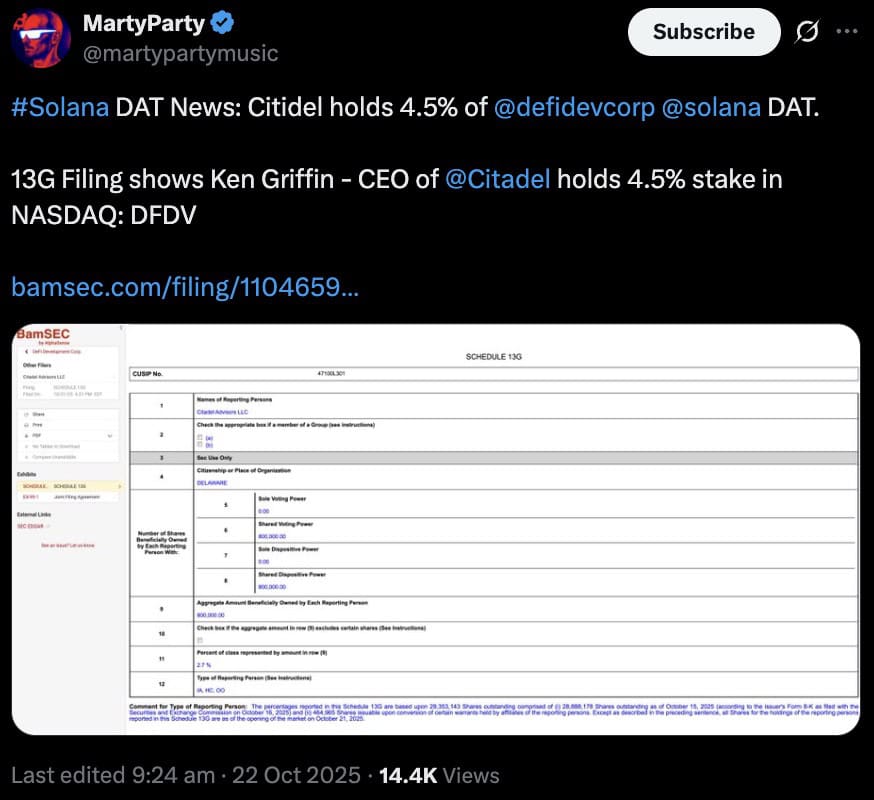

Citadel’s CEO discloses a 4.5% personal stake in Solana treasury firm Defi Development Corp.

Citadel’s CEO discloses a 4.5% personal stake in Solana treasury firm Defi Development Corp. DeFi Development Corp holds over 2.19M $SOL worth around $415M.

DeFi Development Corp holds over 2.19M $SOL worth around $415M. Solana’s price has almost doubled since April, and analysts eye a potential breakout to $260.

Solana’s price has almost doubled since April, and analysts eye a potential breakout to $260. Snorter Token ($SNORT) is a utility-driven gateway to Solana’s next liquidity wave. It’s raised over $5.45M ahead of its Oct 27 claim event.

Snorter Token ($SNORT) is a utility-driven gateway to Solana’s next liquidity wave. It’s raised over $5.45M ahead of its Oct 27 claim event.

This move has placed Griffin among the first Wall Street giants to take a direct equity position in a company built around Solana’s blockchain.

According to a filing with the US Securities and Exchange Commission, Griffin holds 1.3M shares. Meanwhile, Citadel Advisors owns another 800K to bring their combined ownership to 7.2%.

Source: X/@martypartymusic

DeFi Development Corp itself has built one of the largest Solana treasuries in the world. It currently holds 2.19M $SOL worth around $415M. This is up over 106% since it started accumulating $SOL in April 2025.

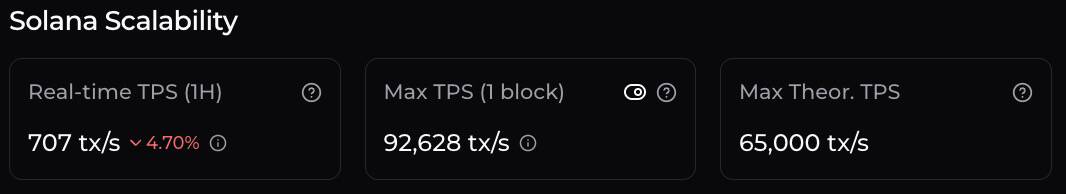

The move signals a clear change in institutional hunger. Traditional funds that once stuck to Bitcoin are now rotating toward Layer-1 ecosystems they believe can offer better returns due to their higher throughput.

If you couple that with its low fees and the thousands of active projects available on-chain, you can see why it is an attractive pick for both yield-seeking firms and DeFi builders.

Source: Chainspect

This growing demand for Solana exposure is part of a broader trend where crypto treasuries are becoming a new institutional asset class. Griffin’s stake is a signal that Solana is maturing into credible collateral on Wall Street.

History shows what happens next. Not long after institutions start buying treasuries, retail traders follow with speed. They turn to tools and tokens that amplify every on-chain move.

And that’s where Snorter Token ($SNORT) – one of the best altcoins to buy right now – shines. This Solana-powered Telegram bot is built for traders who want to move as fast as the market itself.

The Institutional Solana Play

DeFi Development Corp’s strategy is simple. Buy and stake Solana ($SOL) to generate yield while the asset appreciates.

For a hedge fund like Citadel, this approach offers a hedge against inflation, diversification away from equities, and direct exposure to blockchain growth.

The timing also aligns with Solana’s strong recovery since April. Technical charts show a double-bottom reversal pattern, hinting at a possible breakout toward $260 if resistance clears.

Institutional entry also acts as a massive confidence signal for the whole Solana ecosystem. DeFi protocols like Jupiter and Raydium, NFT marketplaces, and meme coins all will benefit from increased liquidity and visibility.

And that’s the point. Institutional conviction brings deep liquidity. Liquidity fuels meme seasons. So the next rotation could reward Solana-native tools that help you trade faster, cheaper, and smarter.

Cue Snorter Token ($SNORT).

Snorter Token ($SNORT) – Final Chance to Buy Before Claim Opens

Built as a Telegram-native trading bot token spanning Solana and Ethereum, $SNORT will turn your chats into a trading terminal.

You’ll be able to swap, snipe, copy trade, and track portfolios all without having to leave Telegram. It’s frictionless. Fast. Purpose-built for meme chaos.

Holding the $SNORT token will also cut your trading fees from 1.5% to just 0.85%, making it one of the cheapest bots on the market.

In its closed beta, its rug and honeypot detection was able to flag bad contracts with 85% accuracy. This adds a layer of security to the wild west that is meme coin trading.

Learn how to buy Snorter Token in our step-by-step walkthrough.

Learn how to buy Snorter Token in our step-by-step walkthrough.

However, there are only four days left to join the presale before the claim event goes live on October 27 at 2 PM UTC. Staking yields of 102% are also available from now until then to increase your bag size.

If Citadel and Ken Griffin are stocking Solana for yield, retail traders are chasing it for speed. $SNORT offers both. You’ll get trading, staking, and analytics in one place.

Join the Snorter Token presale before the claim window opens.

You May Also Like

Crucial ETH Unstaking Period: Vitalik Buterin’s Unwavering Defense for Network Security

XRP holders hit new high, but THIS keeps pressure on price