Japan’s FSA plans to tighten regulations on crypto lending and cap Initial Exchange Offerings (IEOs)

Japan’s Financial Services Agency (FSA) has today announced plans to tighten regulations on crypto lending and IEO controls. The agency aims to protect inexperienced investors from losing substantial amounts of money by ensuring accurate risk disclosures and custody security.

The FSA held its fifth meeting of the Financial System Council’s Working Group on Cryptocurrency Systems today. It concluded that crypto lending businesses should be subject to the Financial Instruments and Exchange Act regulation. The meeting also presented a proposal to cap IEOs to prevent overinvestment.

Cryptopolitan previously reported that Japan has been enhancing its legal and tax regimes for crypto assets since April this year. The FSA stated that it intends to implement stricter regulations for registering, taxing, and licensing crypto businesses. The plan is to set rules classifying crypto under the Financial Instruments and Exchange Act as early as 2026. The initiative shifts cryptos from their current classification under the Payment Services Act as a means of payment.

FSA claims a loophole allows unregistered operations

The FSA determined that under the current system, managing and offering crypto for staking requires registration as a crypto exchange. However, there is a loophole that allows unregistered crypto businesses to operate if the activity is carried out in the form of lending.

The agency is concerned that some crypto business operators may not be subject to the obligation to maintain cold wallets or manage segregated funds. However, it notes that users still bear the business operator’s price fluctuation and credit risks.

The FSA further emphasized that the new policy requires crypto businesses to set up risk management measures for sub-lending parties and staking contractors. They will also be required to establish robust custody controls and clearly explain the risks to customers while regulating advertising.

Meanwhile, the meeting confirmed cases of services limiting repayments within specific loan periods (in years) or promising high annual interest rates of up to 10%. Some operators were found to have inefficient risk controls, such as the risk of asset confiscation as a penalty by lending contractors (slashing). Some operators also lacked sufficient risk management to counter the risk of loan defaults by sub-lending recipients.

However, several FSA committee members were skeptical about whether the proposal to include off-chain exchanges under the regulations aligns with market realities. They noted and agreed that staking is inherently an on-chain activity.

FSA committee proposes IEO investment caps

The FSA committee members also proposed setting investment caps on crowdfunding frameworks to prevent overinvestment due to sales pressure. They noted that issuers raising IEO funds from a large number of general investors do not require a financial audit.

The committee members proposed that investment amounts exceeding 500,000 Yen will be limited to 5% of revenue or net assets of up to a maximum of 2 million Yen. The purchase amount per person was 500,000 Yen or less in nearly 90% of past domestic IEO cases.

However, one committee member argued that additional secondary market purchases can easily exceed the limit. The lone ranger noted that IEOs are usually traded in the secondary market immediately following issuance, even if the investment cap is set in the primary market. Investors may also circumvent investment limits by using multiple accounts on offshore platforms.

The committee member also acknowledged that the nature of crypto markets complicates jurisdiction-specific rule enforcement. The member claimed that teaching investors about proper risk management and diversification could provide longer-term protection than setting investment caps.

Meanwhile, the new IEO regulations address several key concerns, such as preventing market manipulation during IEO processes.. It also addresses maintaining market stability during high-volatility trading sessions.

However, the FSA members agreed that while regulations aim to protect investors, they must avoid stifling market growth or technological progress. They added that while investment caps and lending rules may appear to address immediate concerns, their effectiveness in the long run remains uncertain.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Kalshi debuts ecosystem hub with Solana and Base

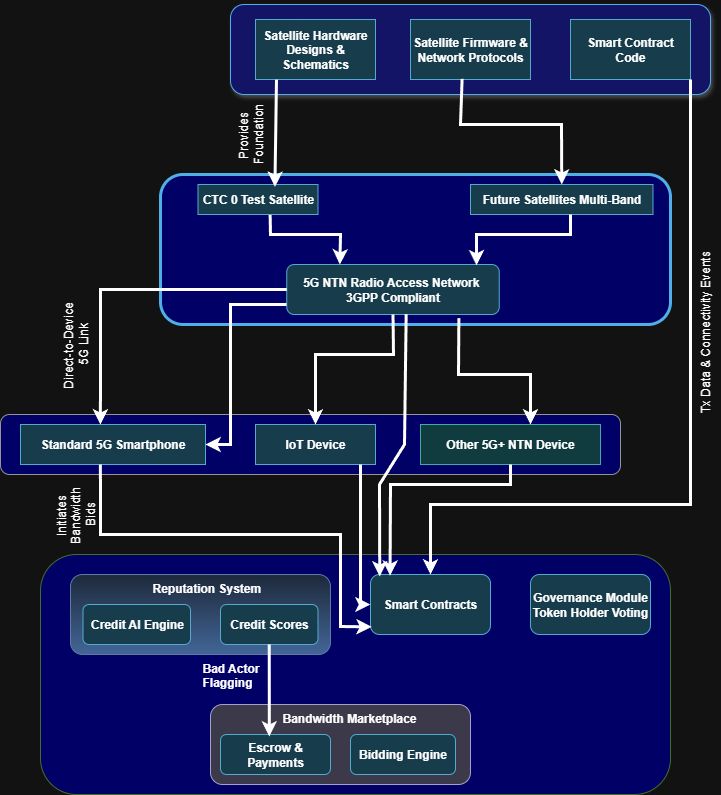

Spacecoin Saving Lives with Decentralized Connectivity