Solana ETF Investments Surge Despite SOL Dropping Below Crucial Price Level

The recent activity in the cryptocurrency market highlights a nuanced landscape for Solana (SOL) and other leading digital assets. Despite persistent institutional interest in Solana ETFs, the token’s price has experienced a significant correction, raising questions about the network’s technical outlook amid broader market uncertainties. Investors are closely watching key support levels as volatility continues to define the current trading environment across crypto markets.

- The spot Solana ETFs have recorded inflows for 13 consecutive days, indicating ongoing institutional appetite for SOL.

- Despite ETF inflows, SOL’s price has declined sharply, breaching critical technical support levels.

- The decline has been amplified by broader market outflows from Bitcoin and Ethereum ETFs, reflecting bearish sentiment.

- Technical indicators signal a potential deeper correction if SOL cannot defend key support zones.

Investor interest in Solana’s native ETF products remains robust, with SoSoValue data showing that the ETFs added another $1.49 million on Thursday, bringing cumulative inflows to $370 million and total assets surpassing $533 million. Notably, the Bitwise Solana ETF (BSOL) was the only fund to see inflows on that day, albeit at the lowest levels since its launch on October 28. This continued demand underscores growing institutional confidence in Solana’s ecosystem despite recent price volatility.

Solana ETFs inflows. Source: SoSoValueThe market sentiment, however, remains bearish as total inflows into Bitcoin and Ether ETFs declined sharply—Bitcoin recorded $866 million in daily outflows, its second-largest since launching, while Ether ETFs shed over $259 million in a single day, diminishing their overall gains. These outflows reflect a broader risk-off mood affecting the entire crypto sector, including the DeFi, NFTs, and blockchain-focused assets.

The persistent demand for Solana ETFs has not translated into sustained strength for the token itself. Technical analysis indicates that SOL’s price has breached a multi-year uptrend, falling over 34% in the last two weeks, and now tests critical support at around $140. The drop also broke the 100-week simple moving average (SMA), a significant long-term support level, with the yearly low at $95 still in sight.

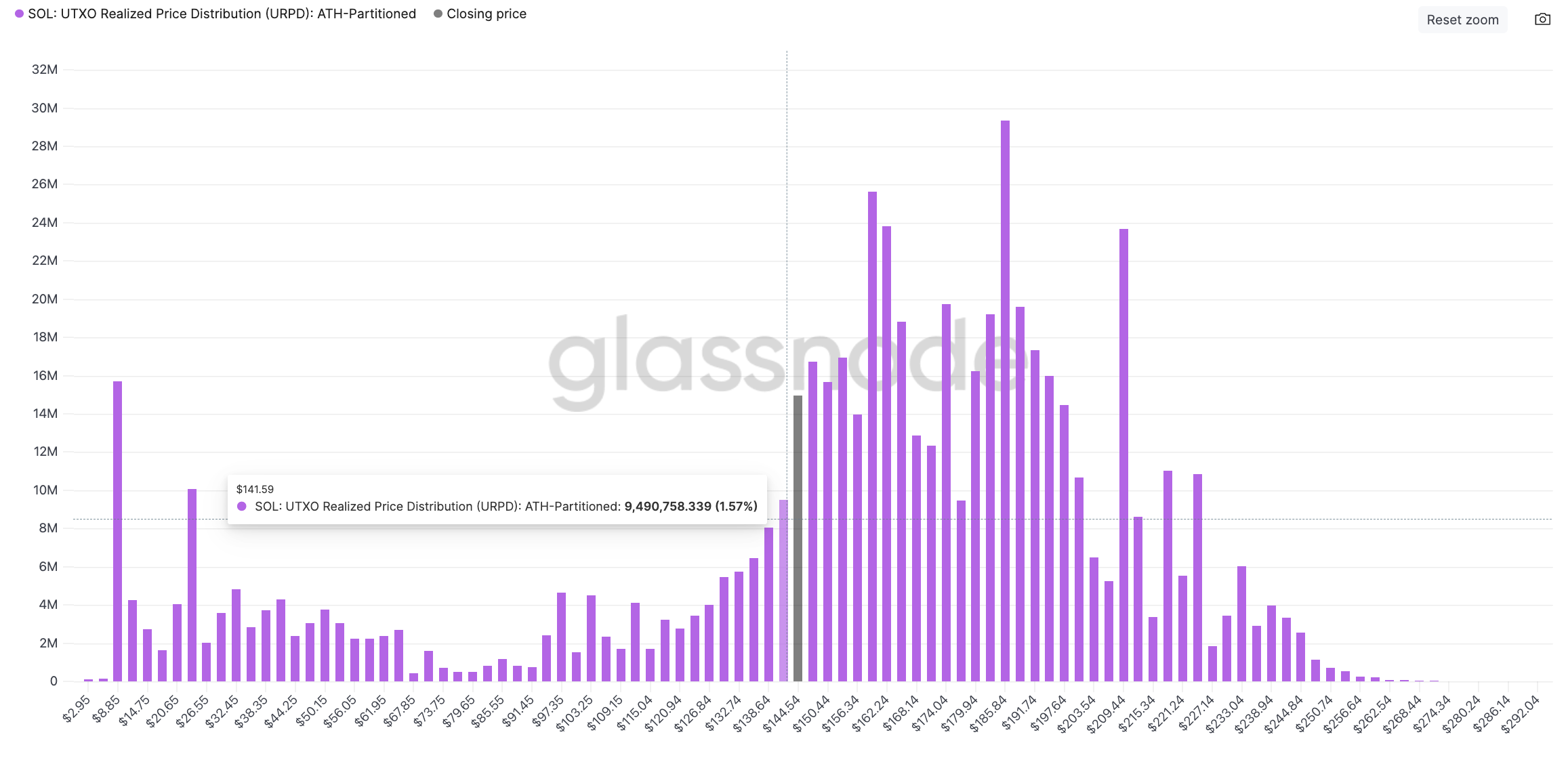

Current market data from Glassnode highlights that SOL’s price could face further downside if it fails to hold at the immediate support zone. The UTXO Realized Price Distribution (URPD) shows limited buy support below $140, suggesting that weak hands are defending the level. If breached, the next major support lies near the 200-week SMA at approximately $100, which could serve as a last line of defense for the token in this corrective phase.

SOL: UTXO Realized Price Distribution. Source: Glassnode

SOL: UTXO Realized Price Distribution. Source: Glassnode

Adding to the downside pressure, the relative strength index (RSI) for SOL has plunged to its lowest since April 2025, emphasizing heightened bearish momentum. As technical charts suggest, a break below the $150 support could potentially lead to further declines toward the $126 level and ultimately test the pivotal support zone at $100, posing a challenge for traders and investors alike.

One-day chart: Source: Cointelegraph / TradingView

One-day chart: Source: Cointelegraph / TradingView

In sum, while institutional appetite for Solana via ETFs remains resilient, the underlying token faces technical headwinds, with the potential for a deeper correction if key support levels are breached. Market participants should stay alert to technical signals and macro trends influencing the crypto markets, particularly in times of heightened volatility and regulatory scrutiny. As always, thorough research and risk management are essential for navigating the current crypto landscape.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article was originally published as Solana ETF Investments Surge Despite SOL Dropping Below Crucial Price Level on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

SM Offices investing P1B in Cebu expansion

BlackRock Increases U.S. Stock Exposure Amid AI Surge