Pepe and SHIB Flippers Are Now Targeting Ozak AI for 2026’s Big Move

Crypto markets thrive on rotation, and one of the clearest trends emerging in 2025 is the shift from meme coin flipping into AI-powered utility projects. Traders who have ridden the waves of Pepe (PEPE) and Shiba Inu (SHIB) are now turning their attention to Ozak AI (OZ)—a presale project many analysts believe could deliver the biggest move heading into 2026.

Meme coins still generate quick momentum and social hype, but their long-term upside becomes increasingly limited as market caps grow. Meanwhile, Ozak AI’s early-stage valuation of $0.012 provides room for 50x–100x expansion, especially as the AI narrative dominates global technology and spills deeper into blockchain adoption. For PEPE and SHIB flippers looking for the next high-upside opportunity, Ozak AI is quickly becoming the top target.

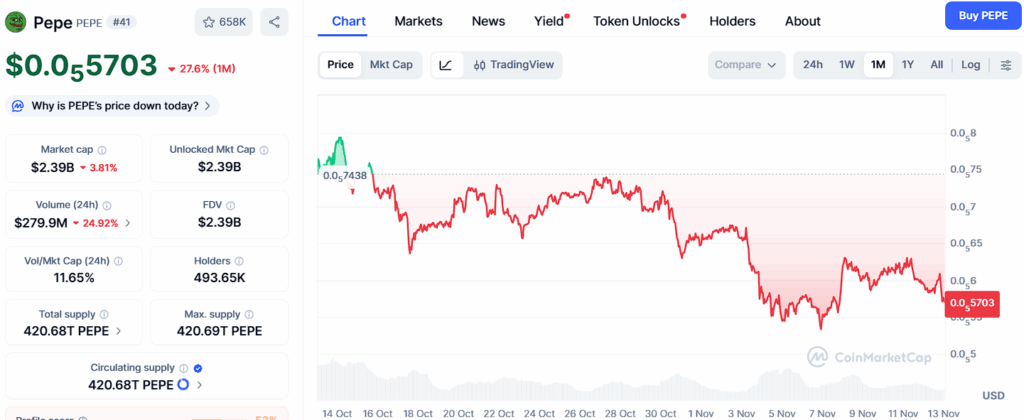

Pepe (PEPE)

Pepe (PEPE) remains a top-three meme coin and continues to attract heavy volume thanks to its viral nature and deeply entrenched community. Trading around $0.000005703, PEPE maintains impressive liquidity, making it ideal for quick flips.

Its price structure shows:

- Resistance: $0.00000632, $0.00000711, $0.00000845

- Support: $0.00000516, $0.00000462, $0.00000403

PEPE could still deliver 3x–10x during peak meme season, especially if social momentum intensifies. But experienced traders understand that meme coin cycles move fast—once a rally loses steam, profits evaporate just as quickly. That’s why the smartest flippers are now securing gains early and rotating a portion of those profits into Ozak AI’s presale before the next price stage reduces their token allocation.

Pepe remains powerful for short-term moves, but its ability to generate massive long-term wealth is limited compared to emerging AI-based tokens with real-world utility.

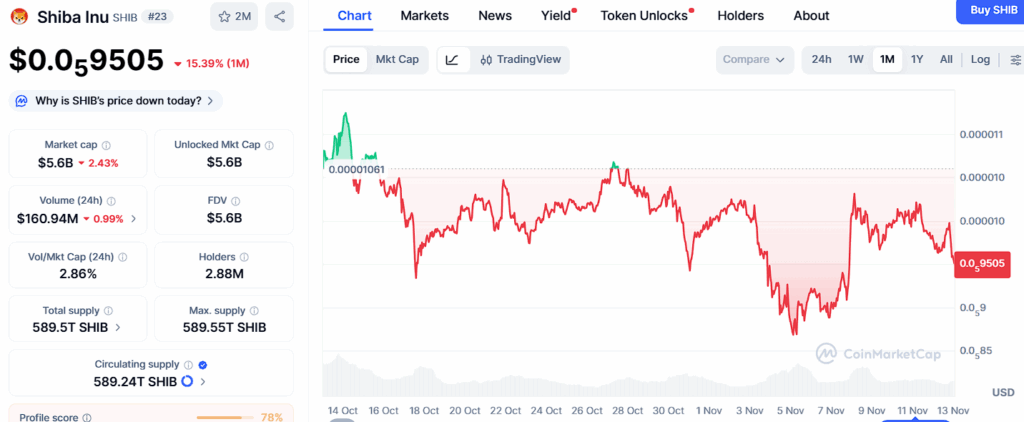

Shiba Inu (SHIB)

Shiba Inu (SHIB) continues to be a dominant force in the meme category, backed by one of crypto’s largest communities. Trading at $0.000009505, SHIB benefits from strong support zones and reliable liquidity.

Current levels show:

- Resistance: $0.00001012, $0.00001103, $0.00001240

- Support: $0.00000912, $0.00000854, $0.00000796

SHIB’s ecosystem upgrades—including Shibarium and its expanding DeFi utilities—help keep the token relevant, but its market cap puts a natural cap on its explosive potential. A 5x–8x rally is still possible in a full bull cycle, yet SHIB’s ability to deliver 20x or 50x returns is diminishing.

For this reason, SHIB flippers are reallocating a slice of their profits into projects that replicate what SHIB once was: early-stage, high-upside, and narrative-driven. Ozak AI fits that profile perfectly—but with real, scalable utility behind it.

Ozak AI (OZ)

Ozak AI is attracting the exact type of attention that preceded early breakouts like Fetch.ai, Render, Solana, and even SHIB before its legendary run. The project is building a self-learning blockchain ecosystem powered by AI prediction agents, intelligent autonomous systems that analyze data, forecast outcomes, and perform on-chain actions independently.

Its foundation is remarkably strong for a presale:

- Over $4.5 million raised

- More than 1 billion tokens sold

- Audited by CertiK and Sherlock

- Listed on CoinMarketCap and CoinGecko

- Partnered with Perceptron Network (700,000+ AI nodes), HIVE (30 ms signals), and SINT.

At just $0.012, Ozak AI gives investors a rare combination of early pricing, real tech, and massive potential upside. Analysts project a realistic move to $1 by 2026, representing an 83x gain, with more bullish predictions placing it even higher.

For PEPE and SHIB flippers accustomed to fast gains, Ozak AI provides something even better—a chance to enter a long-term, utility-powered rocket before it leaves the launchpad.

The Rotation From Memes to AI Is No Longer a Trend—It’s a Movement

Pepe and SHIB will always be part of crypto culture, and they still offer strong momentum plays. But the smart money—the early movers, the flippers, and the whales—is already rotating into AI projects with real fundamentals.

Ozak AI is leading that shift. It offers early-stage pricing, powerful utility, audited credibility, and a narrative that will define the next cycle. For traders aiming to turn meme profits into long-term wealth, Ozak AI is becoming the #1 target for 2026’s biggest move.

About Ozak AI

Ozak AI is a blockchain-based crypto venture that offers a technology platform that focuses on predictive AI and advanced records analytics for monetary markets. Through machine learning algorithms and decentralized network technologies, Ozak AI permits real-time, correct, and actionable insights to help crypto fanatics and companies make the precise choices.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High