From JD.com’s trial of stablecoins, we can see the next growth blue ocean for Web3 practitioners

Author: Lawyer Niu Xiaojing

How much is a channel worth?

We begin with an ancient yet epoch-making story.

In 1859, the construction of the Suez Canal began. It took a full ten years to dig an artificial waterway connecting the Mediterranean Sea and the Red Sea. The cost was 416 million francs, equivalent to 1.5% of France's GDP. Today, this is an investment comparable to national infrastructure.

Why did it cost so much to dig an "artificial river" back then?

You will understand after looking at a set of data:

-

Each ship passing through Suez has to pay about $250,000;

-

18,000 to 21,000 ships pass through each year;

-

Annual revenue exceeds $6 billion;

-

Average daily revenue exceeds 15 million US dollars.

Because it is not an ordinary river, but a "golden channel" connecting Europe and Asia.

Without this canal, all ships would have to go around the Cape of Good Hope at the southern tip of Africa, which would not only take 4 or 5 days longer, but also cost 2 to 3.7 times more than it does now. Each detour could cost hundreds of thousands to millions of dollars more.

Therefore, this is not a water problem, but a "channel" problem. An efficient, safe and legal channel not only saves time and cost, but also holds the key to taking the initiative in global trade.

The channel value of stablecoins is being rediscovered

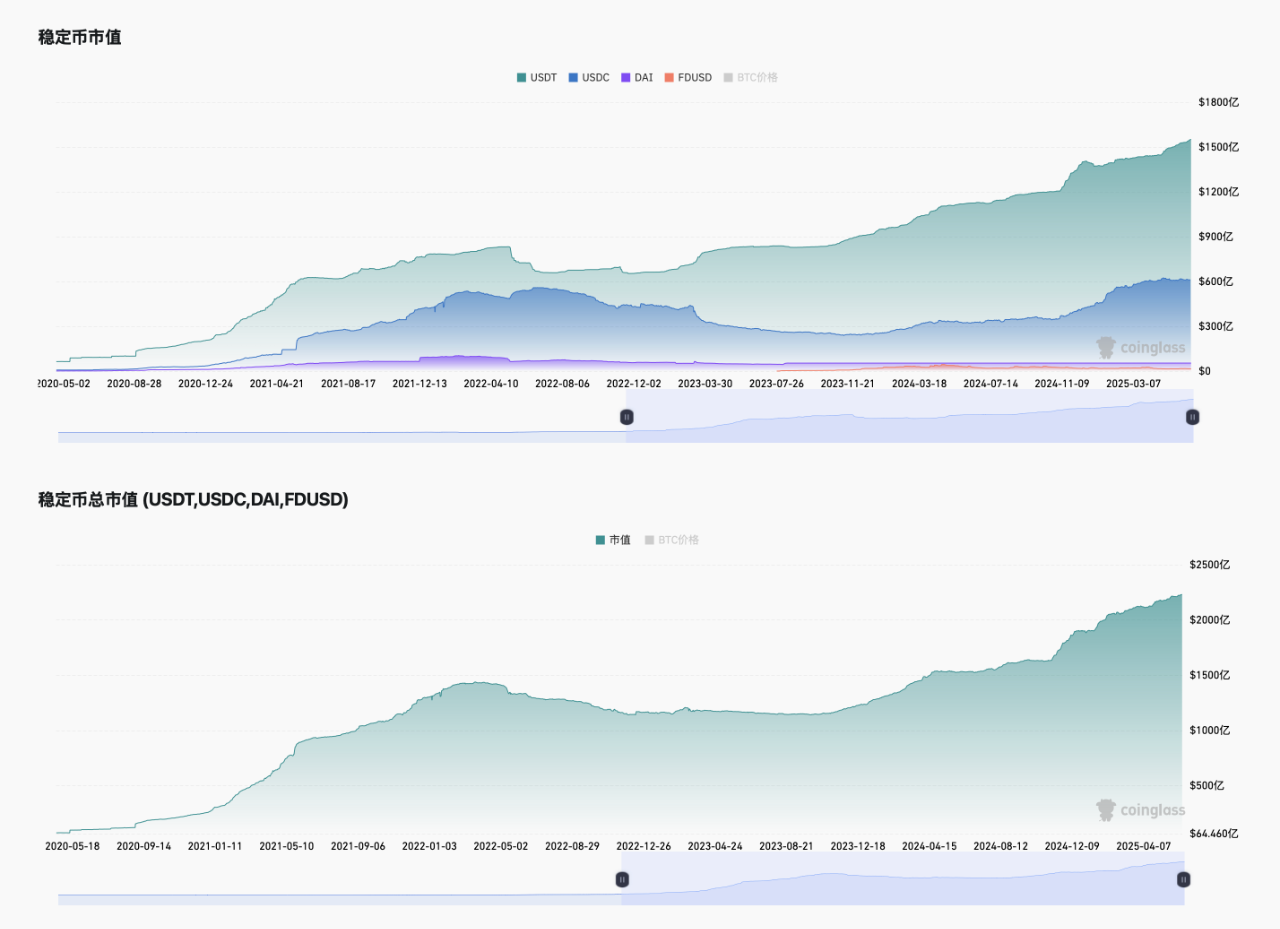

Today, we are standing at a new starting point of the "channel revolution". Many countries around the world are promoting stablecoin legislation to open up the main road to the real financial system for the on-chain world. In other words, it opens a fast channel for on-chain finance for traditional businesses. It is predicted that the global stablecoin market value will reach US$250 billion in 2025; Standard Chartered Bank is more optimistic, expecting its potential to be magnified to US$2 trillion, thereby leveraging US$10 trillion in capital flows.

More importantly: regulators are beginning to recognize the legitimacy of stablecoins.

Just like the Suez Canal is not only for water, but also for trade; the moment the stablecoin legislation is passed, it means that capital can finally enter the chain legally and directly. No longer relying on springboard companies or going through gray channels, it reduces costs and increases efficiency.

This is a landmark moment: the compliance channel is officially opened.

The story of USDT: It’s not about issuing a coin, it’s about seizing a structural position

Before talking about JD.com, we have to take a look at the "big brother" Tether, the issuer of USDT.

What opportunity did Tether seize? When Bitcoin was first created, it was designed for peer-to-peer payments, but due to its high volatility, it was difficult to use it for daily settlement. USDT fills this gap. It was not "born out of thin air", but was born out of real market demand: providing anchor assets, liquidity hubs, and hedging tools for on-chain transactions. Someone said it well: After each round of bull market bubble bursts, stablecoins are the "sparks" left in the market, allowing funds to wait for the next wave of market conditions at any time without having to withdraw. Tether's returns are also staggering:

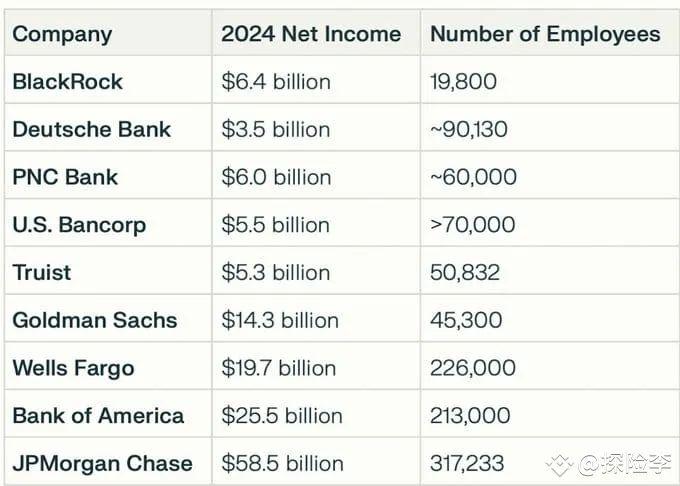

The net profit in 2024 is 13.7 billion US dollars. The team has only 100 people, and the average output per person exceeds 68 million US dollars, far exceeding JPMorgan Chase, American Express and Berkshire.

Does this rely on technology? No. It relies on its structural position - it stands on the necessary channel for the flow of funds on the chain. Even though it has been investigated and fined by regulators, it did not evade compliance, but instead made improvements while going along, and eventually made hundreds of millions of users around the world "dare to use" it. This is the structural dividend. And now, a new dividend window has been opened.

Why does JD.com want to develop a stablecoin?

Many people say that JD.com has entered Web3. But I don’t think so.

JD.com is developing stablecoins not for the purpose of “issuing coins”, but to solve the old problems of cross-border e-commerce:

-

Long settlement cycle

-

High cost

-

Serious capital pressure

-

Complicated banking procedures

The value of stablecoins is that they are the shortest path between reality and the chain. They can:

-

Real-time payment

-

Cross-border payments without intermediaries

-

Significantly reduced handling fees

-

The system can be automatically orchestrated and audited

Therefore, stablecoins are not necessarily exclusive to Web3, but rather a new tool for Web2 companies to build financial infrastructure.

This is not just an opportunity for JD.com, but an opportunity for all Chinese companies that want to go abroad and connect with the world.

Stablecoin 2.0 Era: System-level Solutions

In the past, stablecoins served the purpose of currency speculation. Today, stablecoins serve enterprises. It is no longer a "coin", but a system module, a part of the financial settlement system, a part of user incentives, supply chain closed loop, and cross-border settlement process. The next stage of stablecoins is the development of systematization, compliance, and structure. The opportunity behind this is to provide enterprises with "stablecoin infrastructure" services.

The role transformation of Web3 practitioners: from "speculator" to "structurist"

The real opportunity does not lie in whether you can issue coins, but in whether you can:

-

Designing a payment system for stablecoin access

-

Building a cross-chain settlement bridge

-

Implement automatic account splitting and risk control strategies

-

Help enterprises implement compliance

If you understand chains, structures, and enterprises, then you are standing at this intersection.

It is not enough to just hang around in Web3, you also have to become a service provider, architect, and channel builder for more Web2 companies.

We are experiencing a “Suez moment” for stablecoins

Back to the original question: How much is a channel worth?

No one complains about the high toll on the Suez Canal, because everyone knows that the longer route is expensive, slow and dangerous.

The same is true for stablecoin channels. You can take the gray path, engage in arbitrage, and build a springboard, but those risks are "temporary dividends" rather than long-term moats.

What is really valuable is the structure and the channel. The next explosion point of this industry is not the lively coin issuance trend, but the steady structure construction. Those who can really earn long-term value are those who "build channels" for enterprises.

I command that this river be opened, so that ships may follow it directly to Persia, which is what I wish. The oath of Darius the King of Persia is still applicable today. Now, it is time for our generation of Web3 people to dig the next new channel.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High