ETH Could Drop Below $2,600 as Mutuum Finance (MUTM) Nears Phase 6 100% Allocation

Ethereum is entering a difficult stretch as selling pressure rises and investor confidence cools. The price has slipped toward the lower end of its range, and many analysts now warn that ETH could be on track for another drop if support fails.

At the same time, a new DeFi crypto token priced at $0.035 is gaining strong attention, climbing 250% from early levels and approaching a full Phase 6 sellout. As Ethereum loses momentum, the shift in interest toward Mutuum Finance is becoming harder to ignore.

Ethereum Faces Strong Resistance

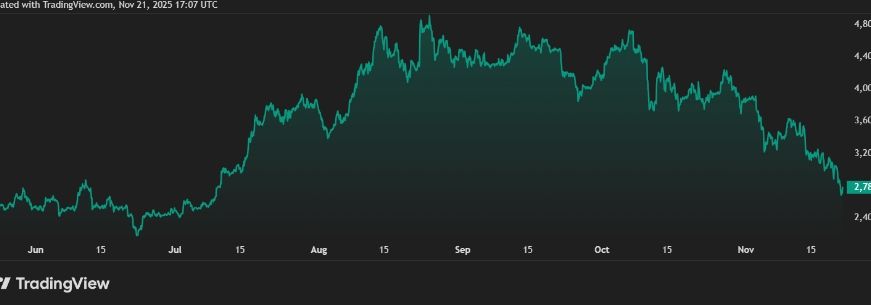

Ethereum trades near $2,795 with a market cap of about $329B. The chart has been weakening for several weeks. Heavy resistance is stacked between $3,300 and $3,450, with a second resistance zone close to $3,800. ETH has tested these levels multiple times, but each attempt ended with strong rejection. The pressure above remains intense.

Support near $2,700 is now critical. Many analysts say that if this level breaks, Ethereum could slide toward the $2,150 to $2,200 region. That scenario would represent a deeper correction that matches the trend seen in previous cycles. With BTC slowing and sentiment dipping across the market, this outcome has become more likely.

Support near $2,700 is now critical. Many analysts say that if this level breaks, Ethereum could slide toward the $2,150 to $2,200 region. That scenario would represent a deeper correction that matches the trend seen in previous cycles. With BTC slowing and sentiment dipping across the market, this outcome has become more likely.

Ethereum’s size also limits its upside. With a market cap above $300B, large % gains require massive inflows. Many investors searching for the best crypto to buy now are starting to look away from large assets and toward smaller tokens that offer higher growth potential. Some price models predict that ETH may only see a 5% to 15% bounce in the near term, which is far from attractive for traders aiming for strong returns entering Q2 and Q3 2025.

This stagnant outlook has pushed attention toward early stage tokens that still have room to grow. Mutuum Finance is now one of the fastest rising projects in that category.

Mutuum Finance Builds a Complete DeFi Lending System

Mutuum Finance (MUTM) is developing a decentralized lending and borrowing protocol built around chain liquidity and collateral backed loans. The platform uses a Peer to Contract model where users deposit assets into a shared pool and receive mtTokens in return. These mtTokens increase in value as borrowers pay interest, giving depositors predictable APY without complex tracking.

Borrowers access funds using clear Loan to Value rules. If the collateral becomes unsafe, the system triggers liquidations. Liquidators repay part of the debt and receive collateral at a discount. This keeps the protocol healthy and protects lenders during volatile conditions.

Mutuum Finance also confirmed an important milestone through its official X account. The team stated that the V1 protocol is scheduled for launch on the Sepolia Testnet in Q4 2025. The post noted that Halborn Security is reviewing the lending and borrowing contracts and that the code is finalized.

V1 will include the liquidity pool, mtTokens, the debt token and the liquidation bot. ETH and USDT will be the first supported assets. This early delivery provides strong confidence for investors looking for what crypto to invest in with real development behind it.

Presale Growth Shows Rapid Acceleration

The MUTM presale has been one of the most active in 2025. The token entered the market at $0.01 and rose to $0.035 as each phase sold out. That is a 250% climb driven by constant demand.

The project has raised about $18.85M, brought in more than 18,100 holders and sold around 805M tokens. Out of the total 4B supply, about 45.5% is allocated to the presale.

Phase 6 is now close to 100% allocation. Only a very small amount of tokens remain at $0.035, and traders expect them to sell out soon. This tight supply has created urgent activity as investors rush to secure the final low entry point. Many traders searching for the best crypto to invest in or cheap crypto with strong upside are moving fast before the price increases again.

The 24 hour leaderboard adds fuel to the rush. The top contributor each day receives $500 worth of MUTM. Large buyers often compete for this reward, which raises daily volume and accelerates the presale pace. Card payments are also active, making the process easier for new participants.

Ethereum continues to face heavy resistance and weakening momentum. Analysts warn that ETH may drop below $2,600 if support breaks. With limited upside in the near term, many top crypto investors are shifting their attention toward early stage tokens that offer more room for growth.

Mutuum Finance has emerged as one of the strongest new options. With a nearly complete Phase 6 sellout, a 250% presale climb, a working V1 on the way and a full security review in progress, the project is gaining serious traction. Only a small amount of allocation remains at $0.035. When it sells out, the next price increase takes effect. For investors looking for the best crypto to buy before the next cycle, the final stage of the Mutuum Finance presale may be the last chance to secure the lowest entry point before 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree:

:::tip This story was published as a press release by Btcwire under HackerNoon’s Business Blogging Program. Do Your Own Research before making any financial decision.

\ :::

\ \ \ \

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP price prediction as Standard Chartered cuts 2026 target

Pi Network v19–v23 Upgrade: From Experimental Nodes to Enterprise-Ready Infrastructure

Pi Network is undergoing a significant transformation with its ongoing v19–v23 upgrade, signaling a shift from a closed exper