Solana Continues Its Strong Market Push As SOL Adoption Grows Across DeFi And Institutional Platforms

Many analysts have been tracking Solana’s recent movements, and the network’s momentum continues to shape discussions in crypto news communities. Remittix also appeared in conversations around blockchain technology adoption today after its new product update, creating additional attention toward technical progress in the sector.

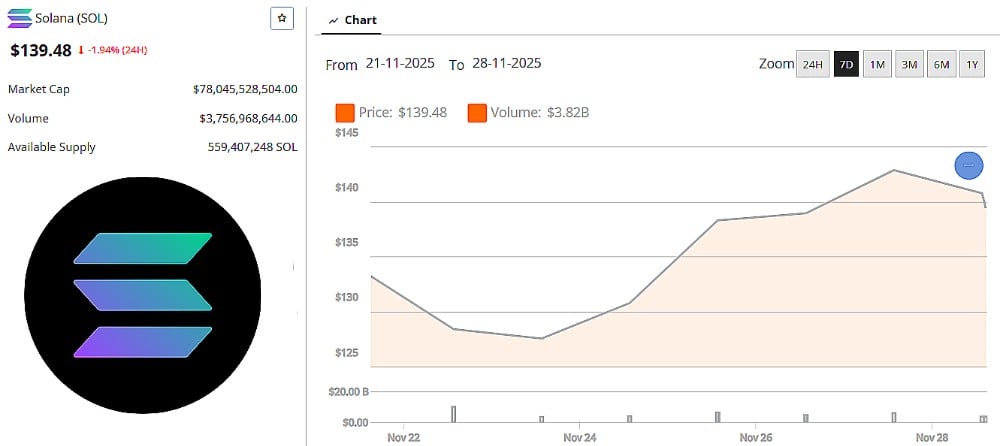

Solana Price Action And Market Structure

Solana has regained momentum heading into late November, reclaiming mid-range support and pressing into the heavily contested $144 to $145 resistance band. Currently trading around $140, analysts note that SOL has formed a sequence of higher lows beneath this ceiling, a structure often associated with pre-breakout compression when combined with rising volume. If price can break above this level with conviction, the next liquidity pocket sits at $152 to $155, reflecting unfilled inefficiencies from earlier trading ranges.

Currently sitting around $140, analysts are optimistic about Solana’s potential to break above the $144-$145 resistance zone. Solana price source: Brave New Coin, SOL market data.

Momentum strengthened as several analysts highlighted Solana’s ability to reclaim key higher-timeframe zones, with the token having repeatedly defended the $115 to $128 dollar demand region throughout 2025. This reclaim has reopened discussions about broader upside scenarios, including reactions toward $168 to $176, an area defined by former monthly imbalances and historical resistance.

In the short term, traders are focused on Solana’s immediate support at $137 to $138 and secondary zones at $132 to $134 and $126 to $128 dollars, all of which have consistently attracted buyers. Upside resistance remains firm at $144 to $145 dollars. A confirmed breakout above $145 would likely shift sentiment decisively and validate the improving technical landscape, but until that move arrives, SOL remains in a tight compression pattern. With strong buying interest, improving indicators and a reclaim of higher-timeframe structure, Solana’s setup is constructive, yet traders agree that its next move depends on clearing the month’s most important resistance zone.

Latest Remittix Update As The Wallet Goes Live

A major highlight today came from Remittix after announcing that its wallet is now officially available on the Apple App Store. The application operates as a fully functioning crypto wallet designed for secure storage and asset management. The team confirmed that the wallet’s Phase 1 release is stable and ready for wider ecosystem integration.

A more extensive upgrade is expected in December, when Remittix plans to introduce its crypto-to-fiat functionality inside the same application. This feature aims to streamline digital asset transfers into traditional financial systems. The team has also confirmed that the Android rollout is already in development.

A preview of the current build is visible in the beta demonstration shared on social media, including footage from community testers through the cryptoksic beta clip. Remittix has also undergone a full audit by CertiK, and the project’s verification status is publicly listed on the CertiK Skynet page. Their team verification is accessible under the project’s fundamental health section.

Remittix Technology Progress

Remittix continues to prepare additional ecosystem releases alongside the wallet. Community testing recently expanded, allowing more iOS users to participate in the feedback cycle as the wallet moves through successive development stages.

The Remittix token is currently priced at $0.1166, and the project has reported more than $28.2 million raised through private funding, along with over 686 million tokens distributed.

The ecosystem also introduced a referral program where users can generate daily USDT rewards through the dashboard, adding another engagement layer to the platform. Remittix has confirmed a future listing agreement with BitMart, followed by another with LBank, both planned for the project’s wider market rollout. A major CEX reveal is scheduled at the $30 million funding milestone.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

1. Will Solana go up in value?

Price movement depends on market sentiment, liquidity, network activity and external economic conditions. There is no guaranteed direction.

2. What affects the price of Solana?

Key factors include network performance, DeFi usage, validator activity, trading volume and overall crypto market conditions.

3. Can Solana reach higher price levels?

Analysts usually watch support and resistance levels. As mentioned above, a confirmed daily close above major resistance areas often indicates stronger momentum.

4. Is Solana a good long-term project?

Solana is known for high-speed performance and low transaction costs, which contribute to its adoption across DeFi and institutional platforms. Technical strength and consistent updates usually play a role in long-term interest.

5. What catalysts could influence Solana’s next major move?

DeFi protocol expansion, network upgrades, market-wide sentiment shifts, institutional usage and liquidity changes are some of the key factors that can affect future performance.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8