Why is crypto down today : SOL, XRP and memecoins plummet amidst Bitcoin dominance rise

The crypto market is experiencing a downturn as major tokens like Bitcoin, XRP and Solana plummet, with the SOL ecosystem and PayFi sector both dropping over 4%. Why is crypto down today?

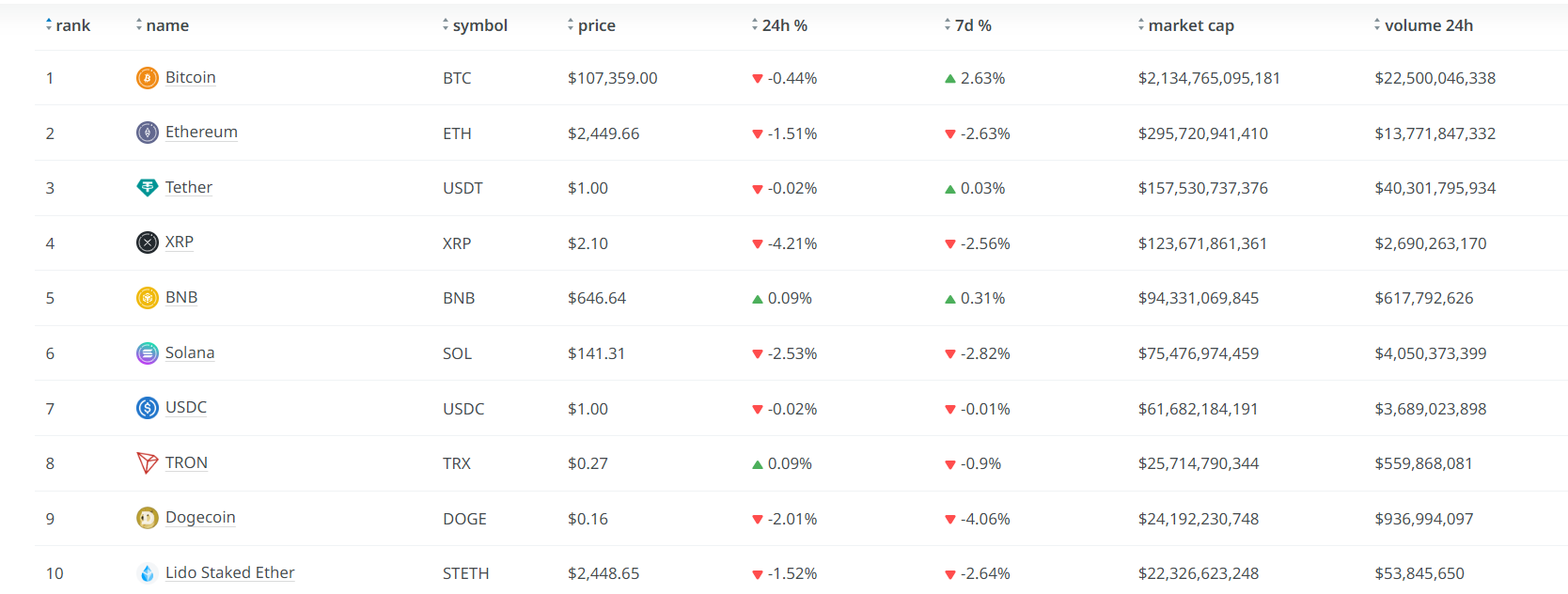

According to data from CoinGecko, the overall market cap for crypto has fallen by 2.6% in the past 24 hours. It currently stands at $3.39 trillion. The drop is reflected by many of the major tokens experiencing a decline in the past day of trading. Traders are now left wondering why is crypto down today.

So far, Bitcoin (BTC) has remained mostly steady compared to other tokens. At press time, BTC dipped by 0.4%. It is currently trading hands at $107,355. Similarly, Ethereum (ETH) has dropped by 1.5% in the past 24 hours to a value of $2,447.

However, the biggest drops can be seen in Solana (SOL) and XPR (XRP). In the past 24 hours, XRP fell by 4.2%. It has experienced the worst fall compared to the other tokens ranked among the top ten cryptocurrencies by market cap. Solana comes in second place after XRP, having fallen by more than 2.5% in the past trading day.

Meanwhile, smaller tokens like Ethena (ENA) specifically has dropped by 5%, as it trades near the $0.25 threshold. Pressure from Germany’s BaFin ordering a 42-day redemption after stopping sales of Ethena’s stablecoin USDe (USDE) in March, bringing it near the $0.21 support area.

Adding to Solana’s price drop, the Solana ecosystem has also experienced a decline. According to data from SoSoValue, the Solana ecosystem sector fell 4.24% in 24 hours. Within the sector, Solana and Jupiter (JUP) both fell 4.12% and 4.94% respectively. Meanwhile, the PayFi sector followed suit with a 4.03% decline.

On the other hand, the memecoin sector has suffered a 3.91% drop, with major tokens like SPX6900 (SPX) experiencing corrections. Out of the top 10 memecoins by market cap, SPX has taken the worst dive by 10.21% in the past day. Meanwhile, top three tokens like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) only saw modest corrections of 2.31%, 3.27% and 3.24% respectively.

Why is crypto down today?

Today’s crypto market dip seems to be driven by underlying market fears and technical bearish indicators. Although the crypto market cap has dropped, the overall crypto trading volume has remained in the green. This could indicate that traders are selling more tokens amidst the decline instead of holding on for the long haul.

The answer to why is crypto down today lies in the current geopolitical state of the world which shows no signs of cooling down anytime soon.

Despite recent news of a ceasefire that brought Bitcoin above and beyond the $105,000 mark, investors are taking profits and staying cautious amid upcoming macroeconomic events like the Fed rate decision.

In addition, analysts have noted that BTC has entered a critical supply zone at around $108,000 to $110,000, with indicators like RSI and MACD signaling cooling momentum to the current cycle. This could explain why is crypto down today, considering Bitcoin dominance has climbed above 65%.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator