BTC Recovers Post-FOMC as $9T 401(k) Battle Begins

Bitcoin increases post-FOMC meeting slide, and Congress urges SEC Chair Paul Atkins to open 401(k) retirement accounts to crypto investments now.

The Federal Reserve made its rate announcement in December, and Bitcoin felt the pressure instantly. The digital asset has since stabilised. The commentators observe different behavior in the market as compared to earlier meetings of the Federal Open Market Committee.

Bitcoin fell immediately after the FOMC announcement, according to CryptoRover on X. The asset has since stabilized. Downward movement continued in the previous meetings. It takes traders days to determine the real direction.

Source: CryptoRover

You might also like:Bitcoin Dip Deepens: Fed Rate Cut Signals More Pain Ahead

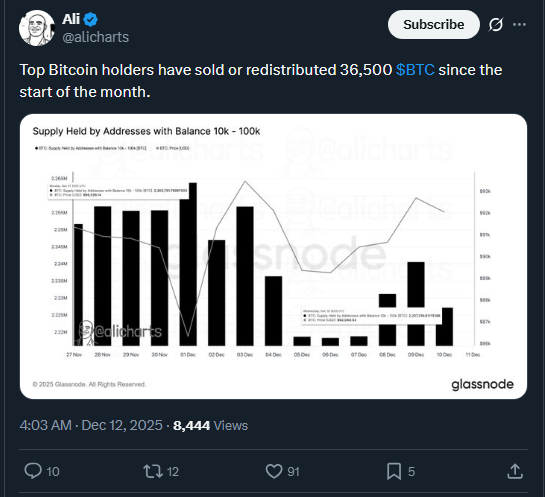

Whales Dump While Price Stabilizes

The big holders of Bitcoin sold their stakes this month by large margins. AliCharts reported on X that top holders sold or redistributed 36,500 BTC. This trend started at the beginning of December. The sales were made in a period of increased uncertainty in the market.

Source: AliCharts

The Federal Reserve reduced rates by twenty-five basis points. This was the third cut in 2025. Bitcoin was at first down but recovered to trade at approximately 92,000. Many players in the markets were taken by surprise by the stabilization.

You might also like:Bitcoin Treasuries Stall in Q4 as Large Investors Keep Accumulating

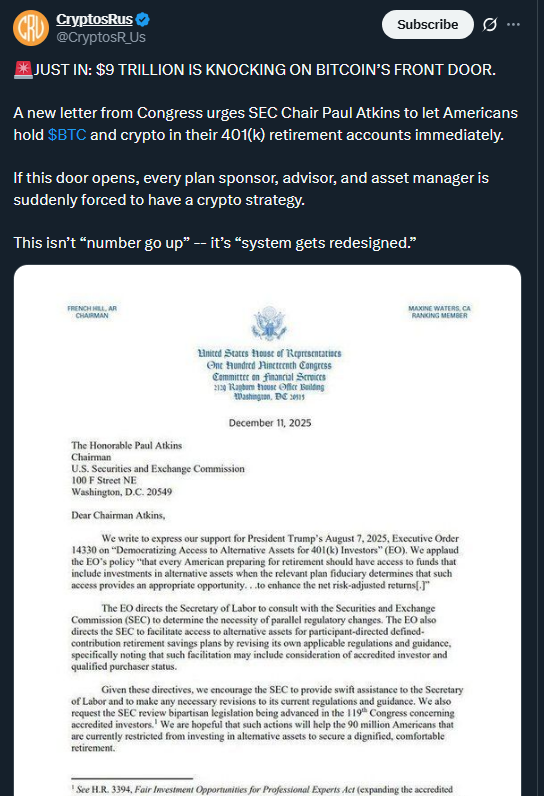

Congress Targets $9 Trillion Retirement Market

A new congressional letter requests immediate SEC Chair Paul Atkins’ action. Congressmen desire Americans to keep Bitcoin and crypto in 401(k)s. The relocation would potentially open up the door to 9 trillion retirement dollars.

This is a gigantic potential as CryptosR_Us tweeted on X. All the plan sponsors are suddenly in need of a crypto strategy. Asset managers have to adapt to new market realities. The transformation is not limited to mere price appreciation.

Source: CryptosR_Us

The letter was sent by the House Financial Services Committee on December 11. Members called for the revision of the rules of digital assets in retirement plans. The existing laws limit millions of people to the new classes of assets. Legislators state that these regulations are old-fashioned.

This policy change is guided by the August executive order of President Trump. The order focuses on democratizing access to alternative assets. It refers to cryptocurrencies and real estate, and private equity. The federal agencies need to increase the investment options to retirement savers.

You might also like:Bitcoin Builds Foundation: $100K Bounce Eyes $80K Retest

System Redesign on the Horizon

The congressional drive is on the SEC changes in regulations in the hands of SEC Chair Atkins. He initiated a project known as Project Crypto to explain the rules of digital assets. According to recent speeches, the majority of crypto tokens are not securities. Such differentiation facilitates retirement fund inclusion.

There is also a desire among lawmakers to broaden definitions of accredited investors. The existing regulations favor affluent persons. The proposal contains workers who are well-educated and experienced. New investment access could be developed by teachers, nurses, and engineers.

After the Fed announcement, Bitcoin was above the mark of 92,000. The market capitalization was at 1.85 trillion. The volume of trading per day was over 52 billion. The recovery followed the first pressure on the post-FOMC selling.

Critics caution against cryptocurrency instability in retirement portfolios. During market crashes, the price of Bitcoin has the potential to plummet. Proponents respond that younger employees require digital asset options. Cryptocurrency inclusion is growing in popularity among retirement providers.

The SEC has to liaise with the Department of Labor. The two agencies regulate retirement plans. The presence of congressional pressure is an indicator of possible policy change.

You might also like:SpaceX Moves $94M in Bitcoin Amid IPO Rumors and Future Plans

The post BTC Recovers Post-FOMC as $9T 401(k) Battle Begins appeared first on Live Bitcoin News.

You May Also Like

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected

Rap Star Drake Uses Stake to Wager $1M in Bitcoin on Patriots Despite Super Bowl LX Odds