Research: 97% of Pump.Fun Meme Coins Lost Half Their Value — 81% Are Dead

Key Takeaways:

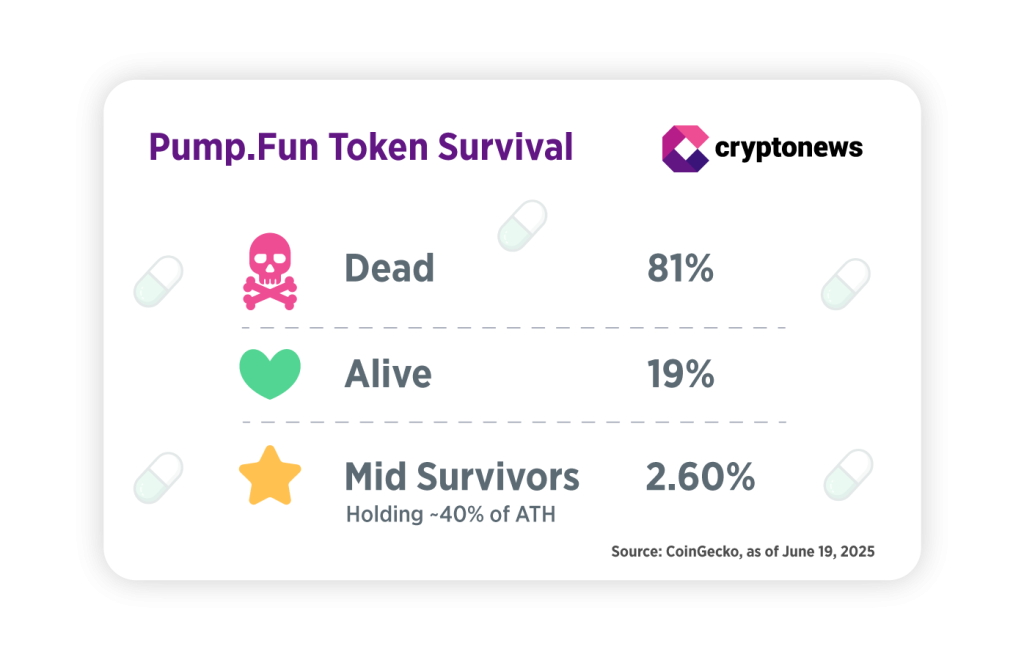

- Over 80% of Pump.Fun meme coins are “dead,” down 90% or more from their peak.

- Only a tiny 2.6% of tokens kept at least 40% of their ATH in the past month.

- Data shows Pump.Fun meme coins rarely generate the massive profits they were once known for.

- Revenue remains high, but Pump.Fun’s market dominance now faces threats from new rivals like LetsBonk.Fun.

Pump.Fun is the biggest meme coin factory in crypto. For over a year and a half, it has promised traders the dream: put in $100 and watch it double in no time. But does it really work like that?

Meme coins have always split the crypto community. Some chase them for quick gains, while others say they ruin the market’s reputation. Behind every wild pump, there are dozens of tokens that crash just as fast.

Read our research to see what’s really happening with Pump.Fun meme coins.

- In This Article

-

Most Pump.Fun Meme Coins Crash After LaunchThe Hype Is Gone — So Are the Big ProfitsGrowth, Collapse, and StabilizationConclusionHow We Did the Research

- In This Article

-

Most Pump.Fun Meme Coins Crash After Launch

-

The Hype Is Gone — So Are the Big Profits

-

Growth, Collapse, and Stabilization

- Show Full Guide

-

Conclusion

-

How We Did the Research

Most Pump.Fun Meme Coins Crash After Launch

As of June 19, 2025, 81% of all tokens launched through Pump.Fun have dropped by 90% or more from their all-time high (ATH). Only 19% of tokens can be considered “alive,” meaning they are still trading above that threshold.

Only 2.6% of Pump.Fun meme coins traded on average at around 40% of their ATH or higher during the last month. This data shows that most tokens on Pump.Fun rise quickly and then lose their value just as fast.

While maintaining 40% of ATH is often seen as a solid performance in the volatile crypto market, only a handful of Pump.Fun meme coins meet that standard.

The Hype Is Gone — So Are the Big Profits

When adjusted for market size, the token with the highest possible return from January to mid-June 2025 was Fartcoin (FARTCOIN), showing a market-weighted maximum ROI of 50.22%, based on data from CoinGecko. This metric estimates the maximum profit an investor could have achieved by buying at the lowest price and selling after it reached its highest point. It also takes into account the coin’s market cap at the beginning of the period.

In the first half of 2025, market-weighted ROIs for Pump.Fun meme coins remained modest even under this ideal scenario. Even during the spring hype peak, potential returns were limited. Fartcoin appeared multiple times as the top performer, but its highest modeled ROI reached only 26.56% in April. Outside of a few standout tokens, most monthly leaders delivered only small theoretical profits.

This pattern suggests that despite occasional spikes, strong returns remain rare on the platform. While some meme coins do surge by more than 1x within hours, they often crash just as quickly. These rapid moves are usually driven by insiders, making it difficult for average traders to predict which token will take off.

While a few tokens still grab attention with sharp price spikes, most Pump.Fun meme coins no longer deliver the strong returns that drove earlier hype. For many traders, meme coins have become less about quick gains and more about short-lived bets with limited upside.

Growth, Collapse, and Stabilization

From January to June 2025, Pump.Fun’s revenue fell from 137 million dollars to 32 million, a drop of 76.5%. The steepest monthly declines came in February and March, with minus 39% and 54%. During the same period, the broader crypto market also declined, which suggests a high correlation. Meme coins on Pump.Fun tend to follow Bitcoin’s (BTC) price during major moves.

In April, the platform partially recovered. May’s revenue stayed nearly flat, but in June it dropped by almost a third again. This could be linked to increased competition or a general drop in market hype. After stabilizing in spring, Pump.Fun slipped again at the start of summer.

Pump.Fun’s revenue grew rapidly in 2024, with total earnings reaching around 290 million dollars for the year and peaking at 137 million in January 2025. Although monthly revenue has declined since then, the platform still earned 384 million dollars in just the first half of 2025, well above last year’s results.

This suggests that while Pump.Fun remains a leading launchpad, maintaining its record highs may be challenging as market hype fades and competition increases.

Despite the recent slowdown, Pump.Fun still shows much stronger numbers than a year ago and remains one of the most profitable launch platforms in the meme coin sector. Whether the decline continues remains an open question.

Conclusion

Pump.Fun remains one of the most profitable meme coin launchpads. Its revenue is still higher than at the start of 2024, even after a sharp decline in March and April that mirrored the broader crypto market. While most tokens collapse quickly, a few like Fartcoin show signs of a slower growth pattern, or “slow cook,” which is unusual for meme coins but may reflect changing user behavior. With new competitors such as LetsBonk.Fun gaining traction, Pump.Fun’s dominance could soon be challenged.

How We Did the Research

We analyzed price and market cap data for 1,954 Pump.Fun tokens listed on CoinGecko.

To determine whether a coin was considered dead or alive, we checked if its price had dropped more than 90% from its ATH as of June 19, 2025. For coins that retained at least 40% of their value, we calculated their average price between May 18 and June 19, 2025.

To estimate the maximum potential market-weighted ROI, we used a theoretical model where a trader buys a coin at its lowest price and sells at its highest point within the same month. While this reflects an ideal scenario, it helps illustrate the best possible return — adjusted for the coin’s market cap at the start of that month.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates