IREN stock crashes 55% from YTD high amid AI bubble fears

IREN stock price has slumped by over 55% from its highest point this year amid elevated jitters on the artificial intelligence bubble.

- IREN shares have plunged by 55% from the year-to-date high.

- It has dropped to its lowest level since September this year.

- There are concerns about the ongoing AI bubble.

After soaring to a record high of $76 in November, the stock has tumbled to $35 today. This crash has coincided with that of other companies such as CoreWeave, Nebius, and Bitfarms.

IREN’s slump has accelerated following last week’s earnings reports from top AI companies such as Oracle and Broadcom. Oracle’s results showed that the highly indebted company made a negative free cash flow as it spends heavily on data centers. Its stock has now crashed by over 50% from its peak this year.

There are also lingering concerns about its funding. Just recently, the company raised over $2 billion through a combination of equity and convertible debt. This funding is necessary as it boosts its presence in the AI industry, where it recently received a $9.7 billion order from Microsoft.

Competition in the industry is also rising as more Bitcoin (BTC) mining companies move to the business. For example, Hut 8 secured a $10 billion order from Anthropic today. Other neocloud companies gaining market share include Lambda Labs, Nebius, and CoreWeave.

As such, potential customers now have greater negotiating power, a development that may affect its pricing and margins.

IREN stock is also falling as Bitcoin remains under pressure. It has dropped from $126,250 in October to the current $87,000. This is important because, although IREN is regarded as a neocloud infrastructure company, it currently derives most of its revenue from Bitcoin mining. As such, the decline in Bitcoin’s price may reduce its revenue.

IREN stock price technical analysis

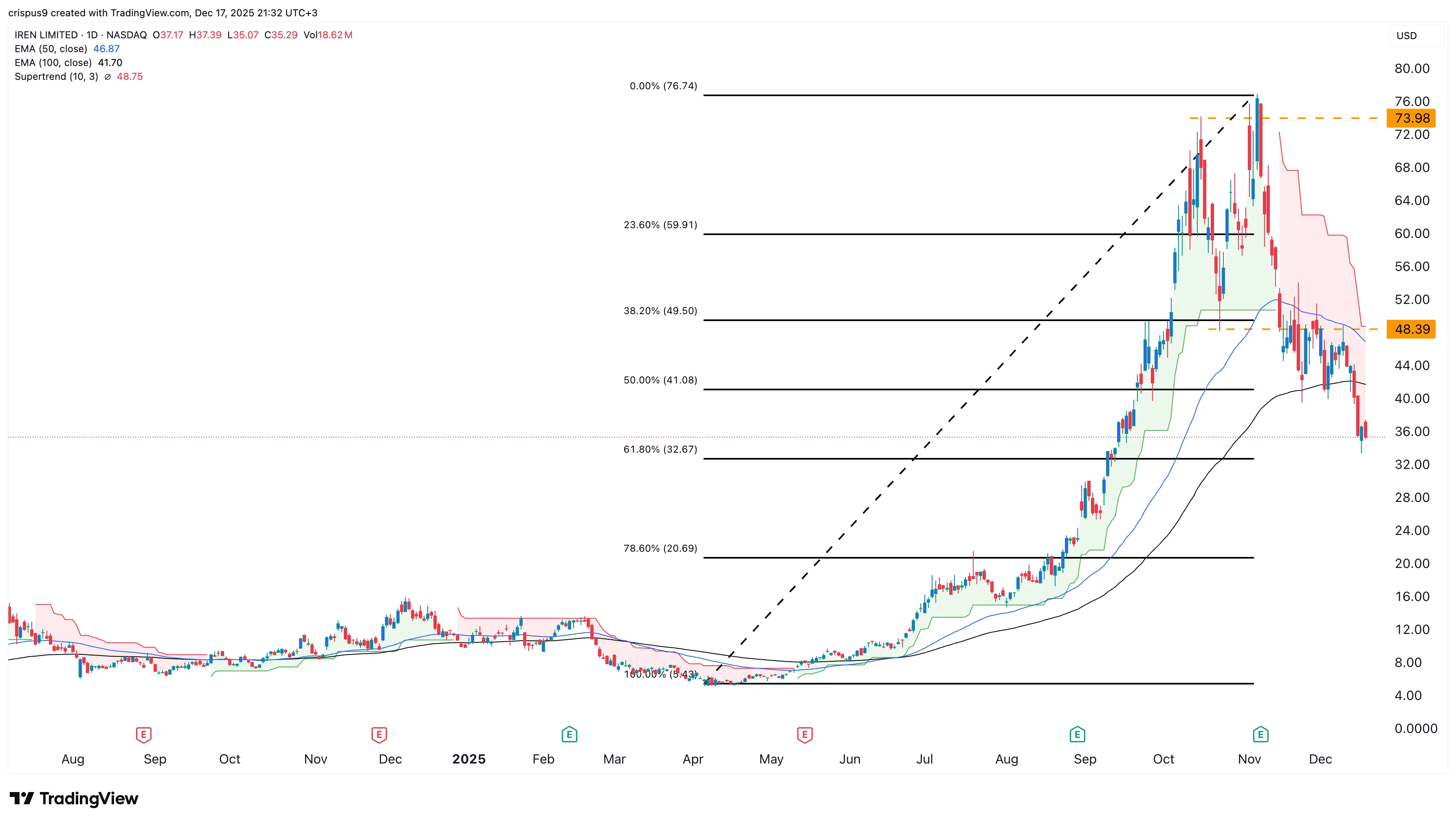

The daily chart indicates that the IREN share price has declined sharply over the past few days. It has dropped from $77 to $35, which is below the 50% Fibonacci Retracement level.

IREN remains below the 50-day and 100-day Exponential Moving Averages, a sign that bears have prevailed. It has dropped below the Supertrend indicator and the key support at $48.40, its lowest point on Oct. 23.

Therefore, the stock will likely continue falling as sellers target the key support at $20. A move above the $48 resistance level will invalidate the bearish outlook.

You May Also Like

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?

Expert Tags Ethereum’s ERC-8004 Mainnet Launch An “iPhone Moment”, Here’s What It Means