Amplify ETFs Launches Two Groundbreaking Crypto ETFs: Stablecoin & Tokenization Funds

BitcoinWorld

Amplify ETFs Launches Two Groundbreaking Crypto ETFs: Stablecoin & Tokenization Funds

In a significant move for the digital asset space, asset manager Amplify ETFs has launched two new exchange-traded funds (ETFs) focused on the core technologies of the future: stablecoins and tokenization. With $16 billion in assets under management, Amplify’s entry signals growing institutional confidence in these specific crypto sectors. This launch provides investors with a novel way to gain exposure to the infrastructure behind the next wave of financial innovation.

What Are These New Amplify ETFs?

Amplify’s new funds offer targeted exposure to companies building the backbone of the crypto economy. The first fund, trading under the ticker STBQ, concentrates on stablecoin technology. The second, trading as TKNQ, focuses on the broader world of tokenization technology. These are not funds that hold Bitcoin directly. Instead, they invest in the public companies developing the protocols, platforms, and services that enable these technologies to function and grow.

Breaking Down the STBQ Stablecoin Technology ETF

The STBQ ETF holds 24 different assets. Its strategy is to invest in companies involved in the development, use, or transaction processing of stablecoins. Therefore, its largest allocations include major crypto assets like XRP, SOL, ETH, and LINK, which are foundational to many blockchain networks that host stablecoin activity. This fund allows investors to bet on the ecosystem that supports dollar-pegged digital currencies, which are crucial for trading, payments, and DeFi.

What Does the TKNQ Tokenization ETF Offer?

Tokenization—the process of converting real-world assets like real estate, art, or commodities into digital tokens on a blockchain—is seen as a multi-trillion dollar opportunity. The TKNQ ETF provides exposure to this trend by holding 53 assets in companies working on tokenization platforms, security token offerings, and related infrastructure. This fund casts a wider net, targeting the entire value chain of converting physical assets into tradable digital securities.

Why Should Investors Pay Attention to These Amplify ETFs?

These launches are noteworthy for several reasons. First, they offer a regulated, familiar vehicle (an ETF) for accessing complex crypto themes. Second, they move beyond simple Bitcoin or Ethereum exposure to target specific technological growth engines within crypto. For investors, the benefits include:

- Diversified Exposure: Gain access to a basket of companies in one trade.

- Targeted Themes: Speculate directly on the success of stablecoin adoption and asset tokenization.

- Institutional Validation: The launch by a major asset manager adds credibility to these crypto subsectors.

However, challenges remain. These are still crypto-adjacent investments and will be subject to the volatility of the broader digital asset market.

The Bottom Line on Amplify’s Crypto Fund Launch

Amplify ETFs’ launch of the STBQ and TKNQ funds is a clever and timely development. It provides a bridge for traditional investors to participate in the structural growth of cryptocurrency, not just its price swings. By focusing on stablecoins and tokenization, Amplify is betting on two of the most practical and scalable applications of blockchain technology. This move could pave the way for more thematic crypto ETFs, further blending traditional finance with the digital asset revolution.

Frequently Asked Questions (FAQs)

Q: Do the STBQ and TKNQ ETFs actually hold stablecoins or tokenized assets?

A: No. These ETFs hold shares in public companies that are involved in the technology, development, or use of stablecoins and tokenization. They do not hold the underlying digital assets themselves.

Q: How can I buy shares in these Amplify ETFs?

A: Like any other ETF, shares of STBQ and TKNQ can be bought and sold through a standard brokerage account during market hours using their ticker symbols.

Q: Are these ETFs considered high-risk investments?

A: Yes. Because they are tied to the cryptocurrency and blockchain sector, which is known for high volatility, these ETFs are considered high-risk and speculative investments.

Q: What is the main difference between STBQ and TKNQ?

A> STBQ is narrowly focused on the ecosystem supporting stablecoins (like USDC or USDT). TKNQ has a broader mandate, investing in companies working on tokenizing any kind of real-world asset.

Q: Does Amplify have other crypto-focused ETFs?

A> Yes, Amplify previously launched the BLOK ETF, which invests in companies involved in blockchain technology more broadly.

Found this insight into the latest crypto investment vehicles helpful? Share this article with your network on Twitter or LinkedIn to spark a conversation about the future of thematic crypto investing!

To learn more about the latest crypto market trends, explore our article on key developments shaping institutional adoption and the future of digital assets.

This post Amplify ETFs Launches Two Groundbreaking Crypto ETFs: Stablecoin & Tokenization Funds first appeared on BitcoinWorld.

You May Also Like

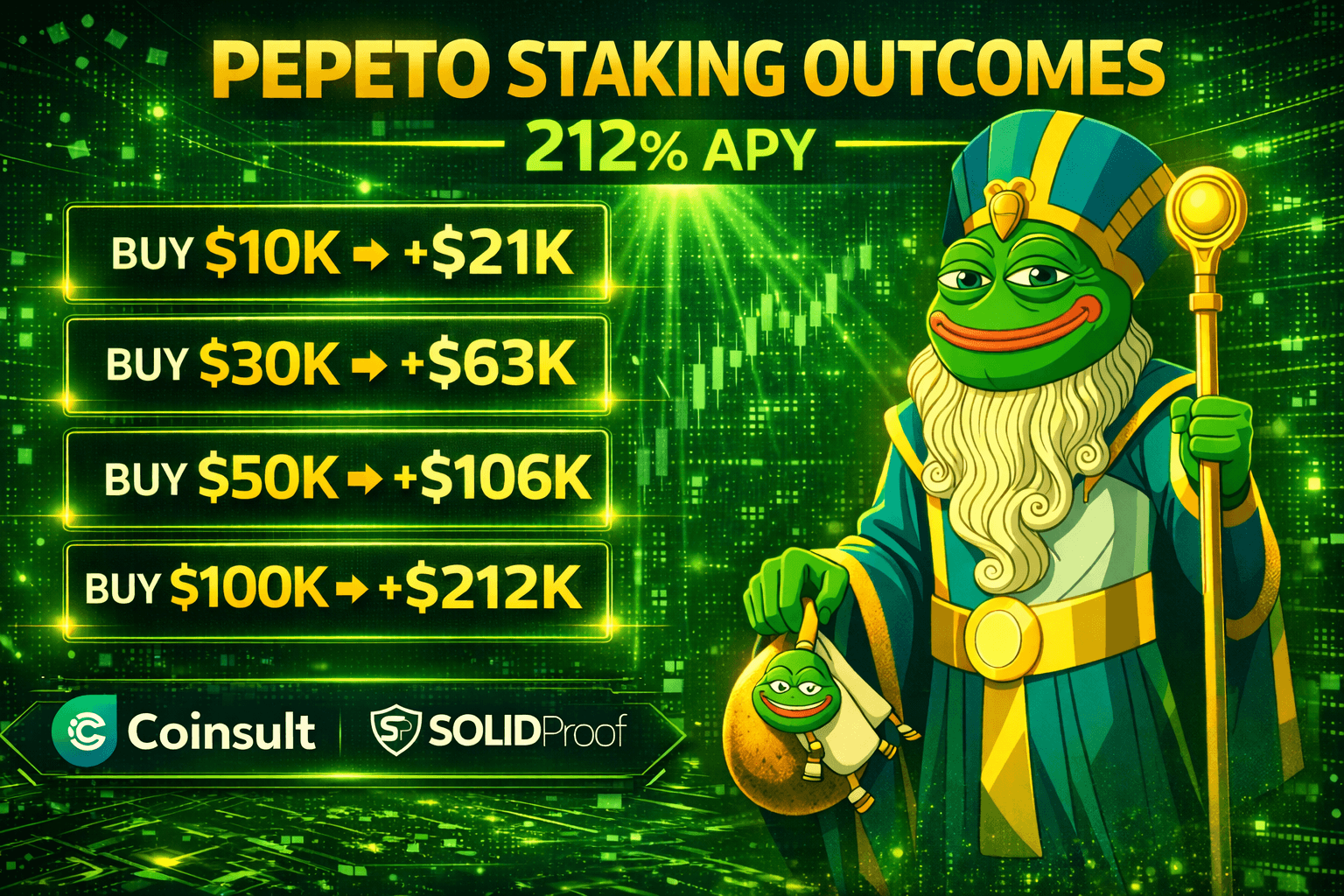

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.