XRP Is Vanishing From Binance at Alarming Pace – What’s Happening?

- XRP balances on Binance fall sharply as structured withdrawals accelerate.

- Exchange outflows suggest strategic custody shifts rather than retail panic.

- Liquidity movement highlights preparation for utility, not speculative trading.

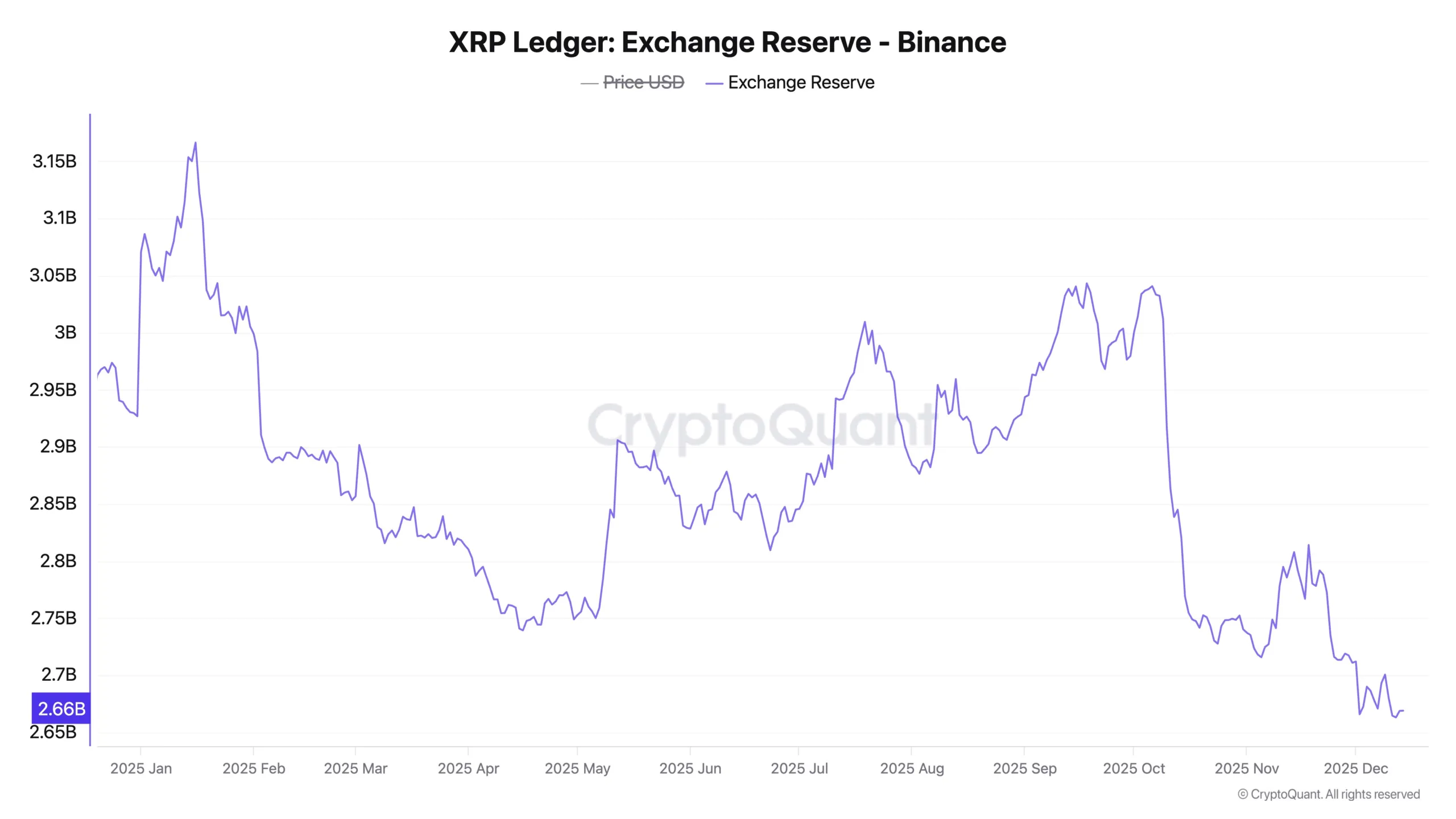

XRP reserves on Binance have continued to decline, drawing attention to a shift in exchange liquidity trends. On-chain data shows a steady reduction in XRP held on the platform, with balances falling to multi-month lows, currently at 2.66 billion XRP. Commentary from market analyst Stellar Rippler on X links the movement to structured withdrawals rather than retail-driven selling activity.

Instead of flowing into exchanges for liquidation, XRP has been consistently leaving Binance wallets. This pattern contrasts with typical retail behavior, where heightened selling pressure usually increases exchange-held supply. The ongoing withdrawals appear measured and deliberate, indicating repositioning rather than reaction.

Moreover, retail participants often respond quickly to price movements, and their activity tends to cluster during volatility spikes. The XRP outflows have persisted despite relatively calm price action, suggesting a different class of participants driving the movement.

Additionally, large-scale holders generally avoid abrupt transfers that could disrupt market conditions. The observed XRP withdrawals show no signs of urgency. This behavior aligns more closely with long-term allocation strategies.

Source: CryptoQuant

Exchange Activity Signals Strategic Repositioning

Exchange reserve data often reveals intent before price responds. In this case, the reduction in XRP liquidity on Binance has occurred without a corresponding increase on other major exchanges. This absence weakens the argument for short-term arbitrage or speculative reshuffling.

Also Read: Bitcoin Activity Slumps as On-Chain Data Signals Deep Bear Market Pressure

Furthermore, assets are leaving exchanges and moving into private custody solutions. Long-term holders and institutions prefer direct control, especially when assets support functions beyond trading. XRP’s gradual exit fits that historical pattern.

Stellar Rippler stressed that liquidity is rarely removed ahead of unfavorable developments. Instead, such movements tend to precede anticipated use or allocation shifts. “You don’t drain liquidity before bad news, you drain liquidity before utility turns on,” he said.

Utility-Focused Liquidity Comes Into View

XRP serves as a bridge asset within cross-border payment systems. That role depends on immediate access to liquidity rather than exchange-based exposure. Assets positioned for settlement or treasury operations typically move into wallets optimized for transfers.

As blockchain infrastructure evolves, liquidity management has become more strategic. Payment rails, interoperability frameworks, and settlement layers require assets to be accessible off-exchange. XRP’s movement away from Binance aligns with this operational requirement.

Additionally, XRP institutional involvement across digital finance continues to expand. This trend has increased emphasis on custody, control, and readiness. XRP’s exchange outflows reflect that broader structural shift.

Market Prices Lag Behind Structural Signals

Price action alone often fails to capture early-stage transitions. Periods of reduced exchange liquidity can coincide with muted price movement. This disconnect can lead to misinterpretation of market strength or weakness, in which, over time, lower exchange supply may reshape trading dynamics. When new demand emerges, reduced liquidity can amplify its impact. These effects usually appear after repositioning is complete.

Exchange flows, therefore, provide a clearer signal of intent. XRP’s continued removal from Binance highlights a focus on positioning rather than liquidation. XRP’s rapid decline in Binance reserves reflects a meaningful change in holding behavior. The data points to strategic liquidity management linked to utility and long-term positioning, not retail selling pressure.

Also Read: Binance Under Fire as $144m Flows Through Flagged Accounts After US Deal

The post XRP Is Vanishing From Binance at Alarming Pace – What’s Happening? appeared first on 36Crypto.

You May Also Like

Ethereum Options Expiry Shows Risks Below $2,900

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected