TRON Network Hits Record User Growth as TRX Price Faces Worst Q4 Decline

User participation and trader engagement on the Tron network increased in December, with the total number of accounts reaching a new all-time high.

However, despite growing network adoption, TRX price performance has lagged. The token is down more than 16% this quarter and is on track for its worst fourth-quarter performance since launch.

TRON Network Continues Expanding Despite Market Slowdown

According to data from Tronscan, the network’s total number of accounts has grown by 26.3% since the beginning of the year. It reached a record peak of 355.4 million in December 2025, with over 240,000 new accounts being created daily.

Furthermore, DeFiLlama data revealed that active addresses have also remained steady even as the wider cryptocurrency sector faced reduced user activity and rising fear.

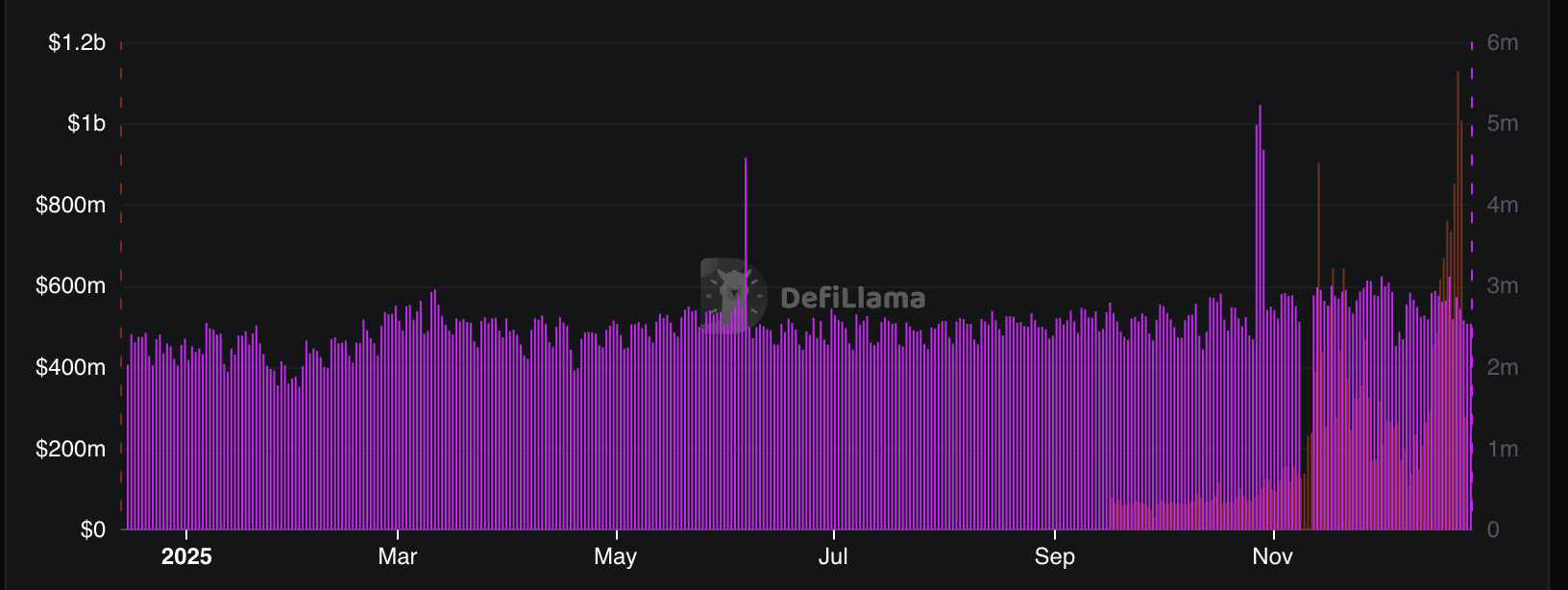

TRON derivatives trading activity also saw sharp growth. Perpetuals volume hit $1.1 billion on December 23. This suggests heightened interest in leveraged trading on TRON.

Perpetual Volume and Active Addresses on TRON. Source: DeFiLlama

Perpetual Volume and Active Addresses on TRON. Source: DeFiLlama

TRON’s advantage is its prominence in stablecoin issuance. The network comprises 26% of the stablecoin market, boasting a $80.842 billion stablecoin market capitalization, according to DeFiLlama’s tracker. As a result, TRON plays a crucial role in the global digital dollar movement.

TRX Token Performance and Path Forward

Despite recent expansion, TRX has continued to face market headwinds. According to data from CryptoRank, the altcoin has lost 16.2% of its value since October, marking its worst fourth-quarter decline since 2017.

BeInCrypto Markets data showed that over the past day, TRX has recorded a decline of 0.096%. At the time of writing, it was trading at $0.27.

TRX Price Performance. Source: BeInCrypto Markets

TRX Price Performance. Source: BeInCrypto Markets

Nonetheless, some market participants believe a recovery may still be possible. An analyst noted that TRX has confirmed an upside breakout from a falling wedge pattern on the daily timeframe, a technical formation often associated with bullish reversals.

Meanwhile, besides price, TRX also faces concerns about decentralization. A Bloomberg report alleged that Justin Sun controls over 60% of TRX tokens, casting doubt on TRON’s claims of decentralization and raising comparisons to the centralized systems cryptocurrencies aim to disrupt.

The doubts extend to other tokens launched within Sun’s ecosystem. One social media analysis sharply contrasted TRX’s survival with steep losses in Sun-linked coins. While TRX has yielded returns from its ICO, other tokens have experienced even more significant declines.

Thus, while network adoption continues to grow, centralization concerns and broader market pressure continue to weigh on TRX. As 2026 enters, whether the price will catch up to these expanding fundamentals remains to be seen.

You May Also Like

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim

MoneyGram Taps Stablecoins To Shield Colombians From Peso Weakness