Chainlink Extends Lead in On-chain Finance as Institutional Adoption Grows

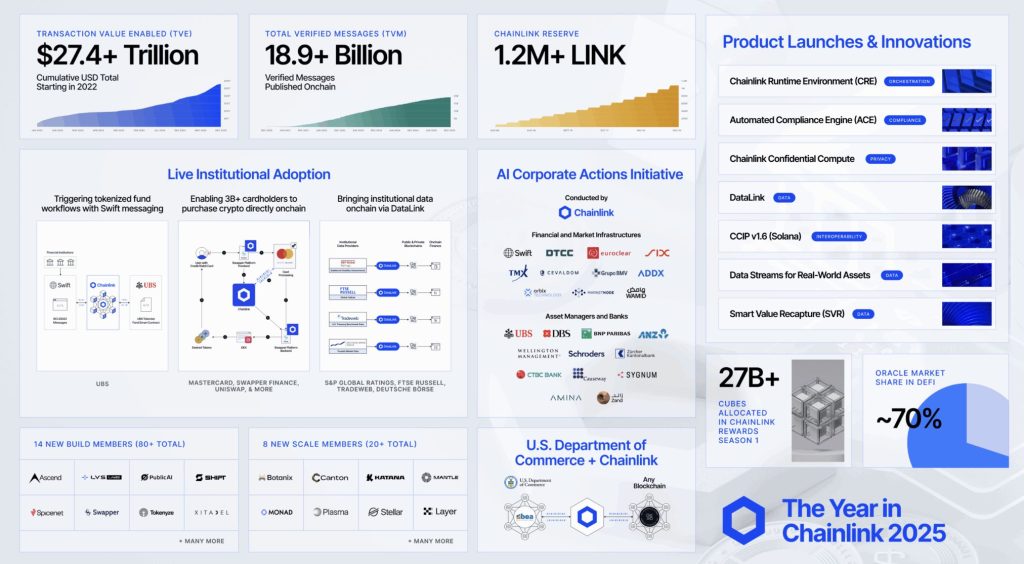

Chainlink said it has strengthened its position as the industry-standard infrastructure for on-chain finance in 2025, as governments, banks, and asset managers increasingly adopted its technology to move real-world financial activity onto blockchains, according to a blog post published by the company.

The report emphasized 2025 as an important year in which Chainlink’s oracle and interoperability standards became embedded across public- and private-sector financial systems used for everything from government data publication to institutional tokenized funds.

Government Adoption Accelerates

Government use of blockchain infrastructure marked progress during the year. Chainlink said the U.S. Department of Commerce partnered with the network to publish macroeconomic data on-chain using Chainlink Data Feeds sourced from the Bureau of Economic Analysis.

Chainlink co-founder Sergey Nazarov also participated in high-level policy discussions in Washington, including the White House Digital Asset Summit, as U.S. President Donald Trump signed the GENIUS Act into law.

The engagement reflects growing coordination between policymakers and blockchain infrastructure providers as regulatory clarity improves.

Banks and Capital Markets Move On-chain

In banking and capital markets, global financial institutions increasingly relied on Chainlink to execute production-grade on-chain workflows.

The research cites a partnership with Mastercard allowing more than three billion cardholders to purchase crypto assets directly on-chain via a Chainlink-powered application.

Asset managers also expanded tokenized offerings. UBS completed what Chainlink described as the world’s first live, end-to-end tokenized fund workflow using its Digital Transfer Agent standard, while firms such as WisdomTree and FTSE Russell began publishing institutional-grade net asset value and index data on-chain.

Financial market infrastructures, including DTCC, Euroclear, and SWIFT, collaborated with Chainlink to streamline corporate actions processing and cross-chain settlement using standardized messaging formats.

DeFi and Tokenization Scale Up

Decentralized finance and tokenization platforms also adopted Chainlink at scale in 2025. Coinbase selected Chainlink’s Cross-Chain Interoperability Protocol (CCIP) as the exclusive bridge infrastructure for its wrapped assets, while DeFi protocols, including Aave and Lido, upgraded their oracle and cross-chain infrastructure to support institutional-grade use cases.

Chainlink said the expansion of CCIP to non-EVM blockchains, including Solana, unlocked access to tens of billions of dollars in assets across multiple ecosystems.

Infrastructure Push Sets Stage for 2026

Beyond adoption, Chainlink said it also introduced new platform capabilities in 2025, including its Runtime Environment, Automated Compliance Engine, and Confidential Compute service intended to support privacy-preserving and compliant on-chain applications.

The report concludes that 2025 marked a turning point for on-chain finance, with 2026 expected to see tokenization adoption accelerate further as institutions standardize around shared infrastructure.

“Governments, financial institutions, and market infrastructures are increasingly aligning around Chainlink standards,” the company said, positioning its network as core plumbing for the global shift toward on-chain capital markets.

You May Also Like

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026

US Stock Market Could Double By End Of Presidential Term