Leading Monero Wallet Cake Adds Privacy-Focused Zcash Support, Swaps

Cake Wallet—a multichain crypto hot wallet for mobile and desktop and one of the most used and recommended light wallets for Monero XMR $715.5 24h volatility: 6.8% Market cap: $13.20 B Vol. 24h: $450.40 M —has added support for shielded Zcash ZEC $414.2 24h volatility: 5.2% Market cap: $6.84 B Vol. 24h: $740.39 M with other privacy-focused features and NEAR Intents-powered swaps on Jan. 15, 2026.

The wallet was created eight years ago, in January 2018. It was launched as the first open-source Monero wallet for iOS, founded by Vikrant Sharma with a mission to make financial privacy and self-custody accessible to everyone. Cake Wallet has been working towards that goal adding support for other privacy coins and features like Bitcoin BTC $95 814 24h volatility: 0.6% Market cap: $1.92 T Vol. 24h: $62.84 B silent payments, Litecoin LTC $72.10 24h volatility: 7.4% Market cap: $5.54 B Vol. 24h: $1.22 B MWEB, and more.

Now, the official account has announced the Zcash integration with shielded addresses being the default setup. Yet, users can opt to use transparent addresses and, in this case, Cake Wallet has implemented a transparent address rotation function that will provide a new transparent Zcash address each time users request them, which strengthens their privacy even when using the non-private address.

Adding up to that, Cake Wallet offers background blockchain sync and passphrase wallets, which improve the user experience and security, respectively. Moreover, the team has implemented the NEAR Intents framework for in-app swaps, leveraging the cross-chain infrastructure that has been receiving significant support in the industry, seen exponential growth in adoption, volume, and fee revenue.

Commenting on the implementation, Seth for Privacy, Cake Wallet’s vice president (VP) highlighted that Zcash transactions “can be private and straightforward” if “done right.”

Monero (XMR) and Zcash (ZEC) Price Analysis

Zcash had an expressive growth in 2025, covered by Coinspeaker in multiple pieces highlighting the growing support and market capitalization for now one of the leading privacy-focused cryptocurrencies. Monero, however, has recently taken back its leadership in the segment, price-wise, while remaining one of the most-used privacy coins by onchain transaction volume.

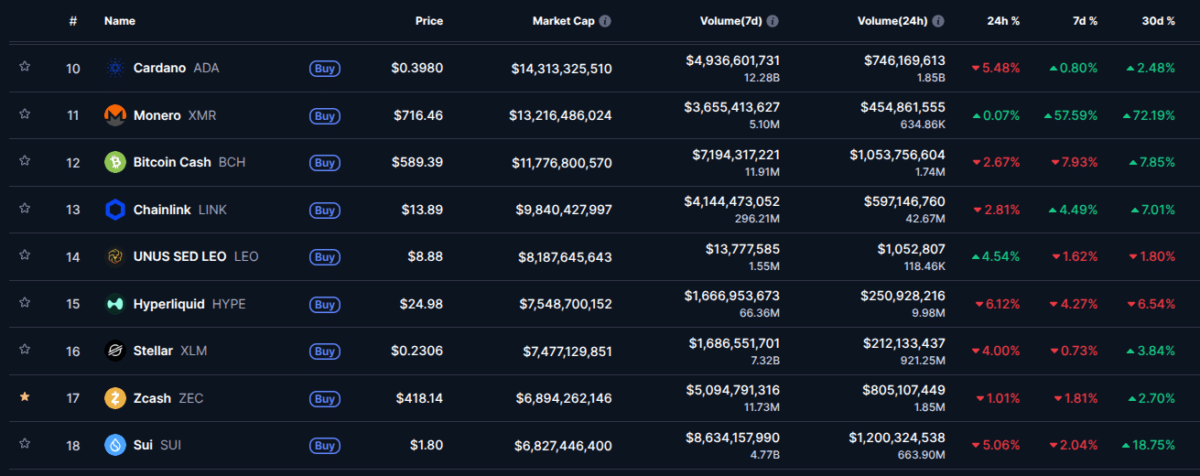

As of this writing, XMR is the number-one privacy coin, ranking 11th on CoinMarketCap with a $13.21 billion capitalization, trading at $716—up 57% in a week and 72% in a month. ZEC is currently trading at $418, down 1.81% in a week and up 2.7% in a month—going with a $6.9 billion market cap, ranking 17th in the index.

Crypto market cap ranks 10th to 18th and data as of Jan. 15, 2026 | Source: CoinMarketCap

Cake Wallet’s implementation comes with a notable timing as Zashi, Zcash’s most popular shielded wallet, goes through a governance dispute between a non-profit organization, Bootstrap, and the former Electric Coin Co. (ECC) staff, led by Josh Swihart.

nextThe post Leading Monero Wallet Cake Adds Privacy-Focused Zcash Support, Swaps appeared first on Coinspeaker.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth