RAIN Hits All-Time High After WhiteBIT Listing, Gains 17% in 24 Hours

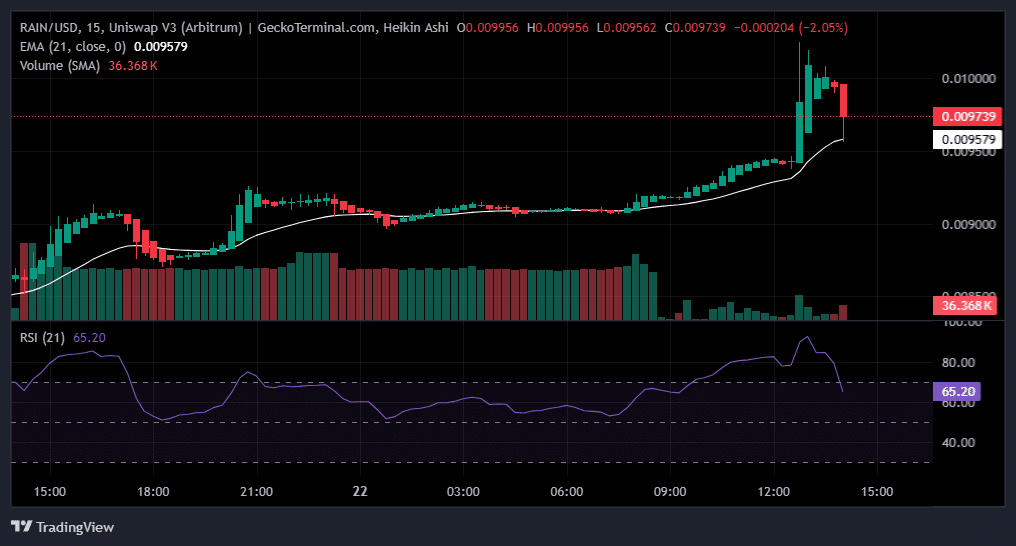

RAIN gained 16.62% over 24 hours to reach $0.0100. The token hit an all-time high of $0.0102 as trading activity increased following a new exchange listing.

The token’s 24-hour trading volume reached $46.68 million, down slightly from $48.81 million the previous day, according to CoinGecko data.

Over the past week, RAIN moved from a low of $0.00835651 to its current levels. The token’s market capitalization stands at $3.39 billion, placing it at rank 44 among cryptocurrencies.

RAIN/USD 15-minute chart showing the price spike to $0.01 on Jan. 22. | Source: GeckoTerminal

Exchange Listing Drives Activity

Rain Protocol announced the WhiteBIT listing went live on Jan. 21. The listing expands the token’s availability to the European exchange’s user base of over 35 million customers globally.

WhiteBIT welcomed RAIN to its platform. Rain operates as a prediction market where users can bet on outcomes of real-world events, from elections to sports to financial milestones.

Market Context

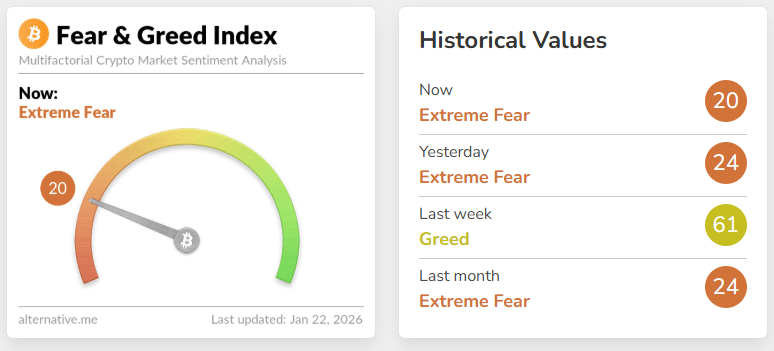

RAIN’s rally to all-time highs came against this backdrop of general market weakness, with the token’s 16.62% gain outpacing the overall market’s 1.59% rise.

The Fear & Greed Index registered 20, indicating extreme fear, down from 24 the previous day and sharply lower than the Jan. 15 reading of 61.

Fear & Greed Index at 20 (Extreme Fear) on Jan. 22, down from 61 (Greed) the previous week. | Source: Alternative.me

The token competes in the prediction market sector alongside platforms such as Polymarket.

Nasdaq-listed Enlivex Therapeutics announced a $212 million investment deal in November 2025 to build a RAIN-focused cryptocurrency reserve.

The move made Enlivex the first U.S.-listed company with a prediction-markets-oriented treasury strategy. A Coinspeaker analysis of high-potential cryptocurrencies for 2026 included RAIN among tokens to watch largely due to that institutional backing.

nextThe post RAIN Hits All-Time High After WhiteBIT Listing, Gains 17% in 24 Hours appeared first on Coinspeaker.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures