Pi Network (PI) Collapses to a New All-Time Low: More Pain Ahead?

Pi Network’s bulls suffered yet another setback as the token’s price plummeted to a new record low, further dampening market sentiment.

Additionally, some key indicators suggest the downturn could deepen in the short term.

Finding a New Bottom

Just hours ago, Pi Network’s PI tumbled to $0.17, which is the lowest level recorded since the token began trading in February last year. Its market capitalization fell under $1.5 billion, making it the 75th-largest cryptocurrency.

PI Price, Source: CoinGecko

PI Price, Source: CoinGecko

The latest move to the south could be partially driven by the broader market’s bearish environment, where Bitcoin (BTC) slipped below $88,000, and Ethereum (ETH) briefly plunged to $2,780.

Some important factors hint that PI’s price has yet to chart fresh lows. Data shows that almost 150 million coins are expected to be unlocked in the next 30 days, a development that could increase selling pressure, as it will give investors the opportunity to offload assets they have been waiting for a long time.

The average token unlocks are just south of 5 million, which is far more aggressive than those in the previous weeks and months. The record day will be February 7, when approximately 6.1 million tokens will be freed up.

Huge Adoption on the Way?

While PI’s price performance over the past several months indeed seems depressing, some X users remain optimistic about the project. Kosasi Nakomoto recently noted that the asset’s “earn while you wait” model looks “childish” to many crypto natives, but predicted that in a couple of years, most people in emerging markets will probably have a Pi wallet.

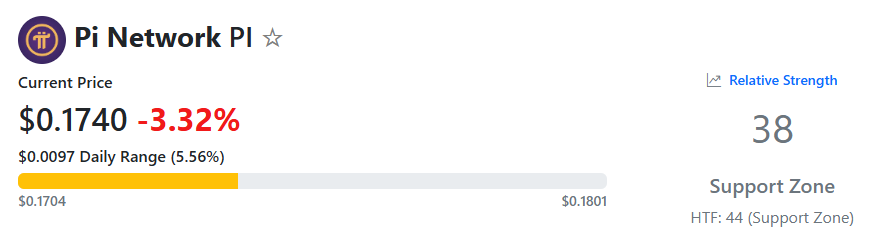

Meanwhile, PI’s Relative Strength Index (RSI) suggests that the worst might be over and could be time for a short-term rebound. The metric ranges from 0 to 100 and shows whether the asset is overbought or oversold. Ratios below 30 indicate the valuation has slipped too much in a short period and might be due for a rally, while anything above 70 is considered bearish territory.

Recently, the RSI fell below 30 and has since increased to 38.

PI RSI, Source: RSI Hunter

PI RSI, Source: RSI Hunter

The post Pi Network (PI) Collapses to a New All-Time Low: More Pain Ahead? appeared first on CryptoPotato.

You May Also Like

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?

Luxembourg Sovereign Wealth Fund invests 1% holdings in Bitcoin ETFs