Tucker Carlson Asks Peter Schiff If Bitcoin Can Replace U.S. Dollar

TLDR

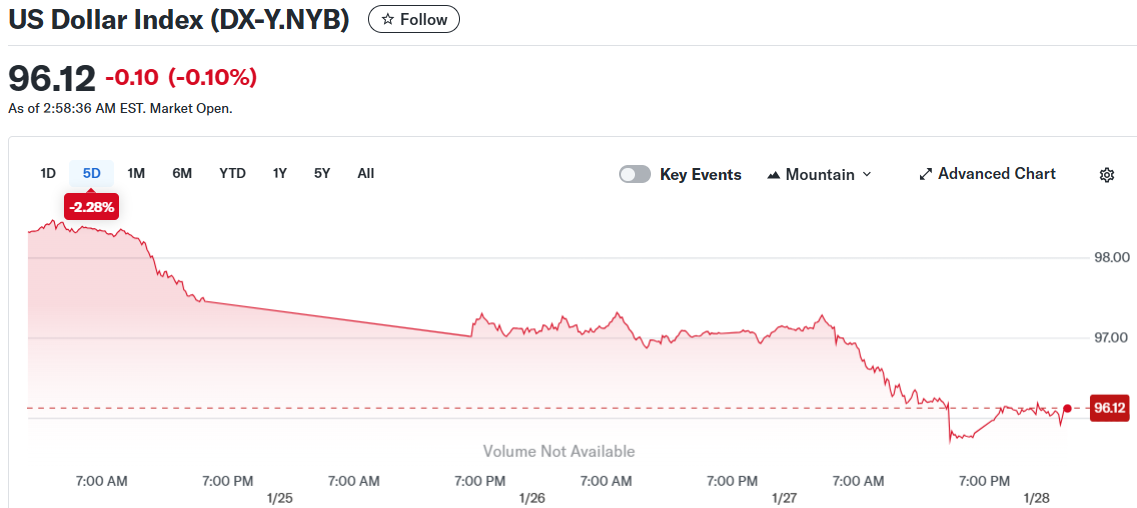

- The U.S. dollar index fell to 96.16 on January 27, its lowest level since mid-February 2022, raising concerns about its status as the global reserve currency.

- Tucker Carlson interviewed economist Peter Schiff on January 26 about whether Bitcoin could replace the U.S. dollar as the global reserve currency.

- Schiff argued that Bitcoin cannot replace the dollar because it lacks intrinsic value and operates on the “greater fool” theory, with buyers hoping to sell at higher prices later.

- The economist stated that Bitcoin shares nothing with gold and has no actual use beyond speculation, making it unsuitable as a reserve currency for central banks.

- Gold prices rose above $5,000 in January with a 17% increase, while Bitcoin dropped below $86,000 during the same period.

The U.S. dollar index dropped to 96.16 on January 27, marking its lowest point since mid-February 2022. This decline has sparked fresh debate about the dollar’s future as the world’s primary reserve currency.

US Dollar Index (DX-Y.NYB)

US Dollar Index (DX-Y.NYB)

Conservative commentator Tucker Carlson addressed this issue by interviewing economist Peter Schiff on January 26. The discussion centered on whether Bitcoin could serve as a replacement for the weakening dollar.

Schiff, known for his pro-gold stance and skepticism of cryptocurrencies, firmly rejected the idea. He explained that Bitcoin cannot function as a global reserve currency because it lacks intrinsic value.

The economist compared Bitcoin to the “greater fool” theory. This theory suggests people buy assets not for their inherent worth but hoping to sell them to someone else at higher prices later.

The Gold Standard and Modern Fiat Currency

Schiff traced the dollar’s history to provide context. From the late 1800s to World War I, the global economy operated on the gold standard. Each currency unit represented a specific amount of gold.

After World War II, the Bretton Woods system emerged. The U.S. dollar became backed by gold while other currencies were backed by the dollar. This established the dollar as the global reserve currency.

President Richard Nixon ended dollar-to-gold convertibility in 1971. The dollar became a fiat currency, backed only by government authority rather than physical gold.

Carlson argued that the current system already lacks “real money.” He said the dollar’s value depends on faith, and that faith is declining as the currency gets used as a political weapon.

Schiff responded that both the dollar and Bitcoin rely on faith. However, he stressed that most people buy Bitcoin hoping to get more dollars through price appreciation, not as a safe store of value.

Bitcoin’s Market Performance

Bitcoin has a market capitalization of $1.7 trillion since its 2009 launch. Despite this size, Schiff maintained that Bitcoin has no actual use beyond speculation.

He argued that Bitcoin will never generate income as it is a non-income-producing digital asset. Central banks need reliable, long-term stores of value, which Bitcoin cannot provide, according to the economist.

Gold prices climbed above $5,000 in January with a 17% increase during the month. Bitcoin fell below $86,000 in the same timeframe.

Schiff used this price movement to support his argument. He said investors are choosing traditional stores of value over speculative assets during uncertain times.

Schiff stated that gold has tangible uses in jewelry, electronics, aerospace, and medicine. Bitcoin, by contrast, has no intrinsic utility for central banks or global monetary systems.

U.S. debt has risen above $37 trillion. Trade tensions and monetary policy continue to drive debates about the dollar’s future role in global markets.

The post Tucker Carlson Asks Peter Schiff If Bitcoin Can Replace U.S. Dollar appeared first on CoinCentral.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

XAU/USD stalls at $5,000 with the bullish trend in play