Are Stablecoins Quietly Draining Banks? Standard Chartered Thinks So

For decades, bank deposits have been one of the quiet foundations of the financial system, supplying lenders with the low-cost funding needed to extend credit and support economic growth.

Standard Chartered believes the risk of stablecoin slowly pulling money out of traditional accounts is real, even if it is unfolding gradually.

In a recent analysis cited by Bloomberg, the bank warned that as stablecoins continue to gain traction, as much as $500 billion in deposits could exit banks in developed markets by the end of 2028.

Stablecoins Test Traditional Banking as Adoption Accelerates

Geoff Kendrick, Standard Chartered’s global head of digital assets research, said the growing role of dollar-pegged tokens threatens to redirect funds into the digital asset ecosystem, particularly if upcoming U.S. legislation provides clearer regulatory footing.

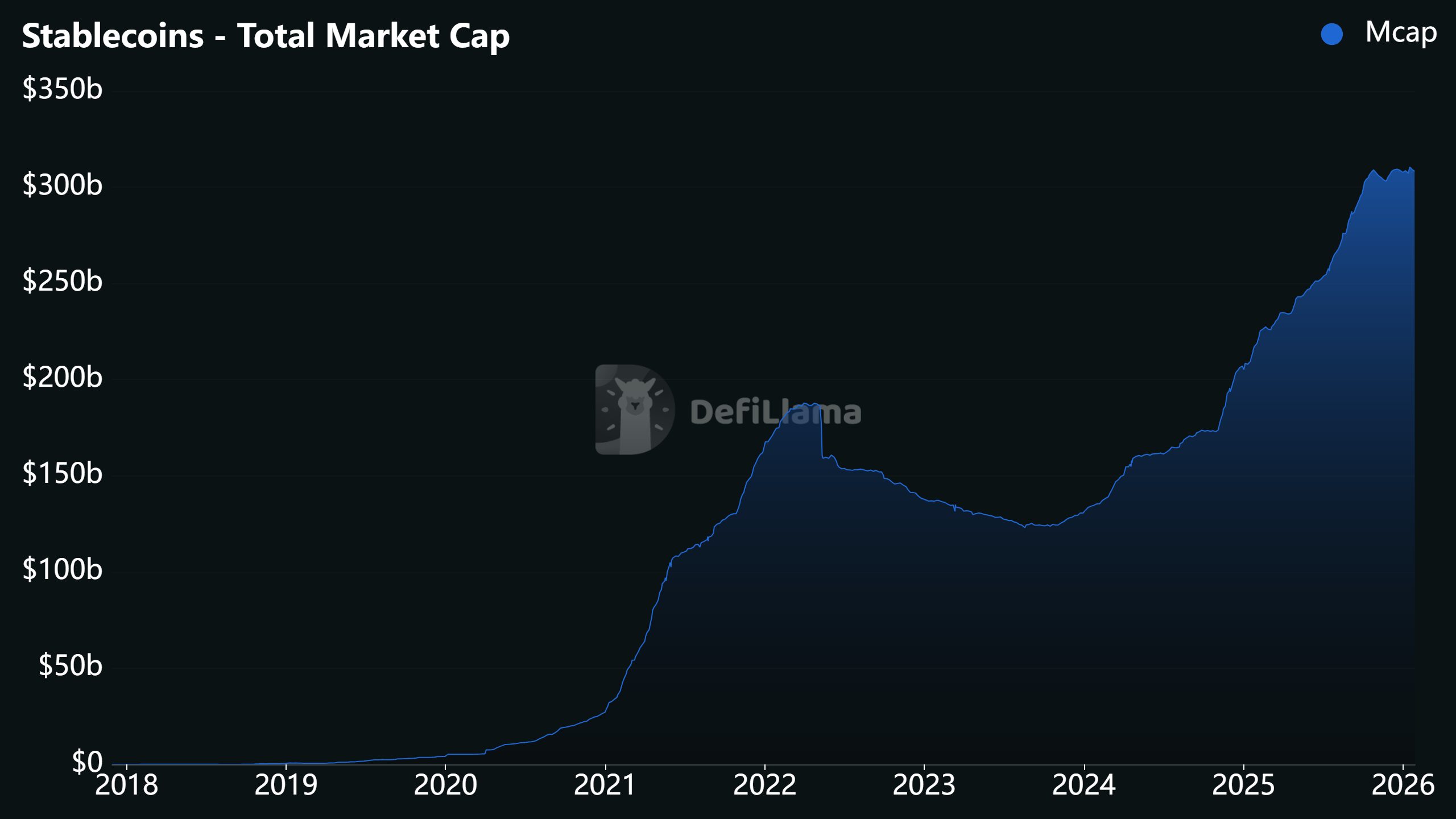

The numbers behind the concern are already taking shape. Stablecoin supply has climbed more than 40% over the past year to just over $300 billion, according to DefiLlama data.

Source: DefiLlama

Source: DefiLlama

Standard Chartered estimates that U.S. bank deposits could fall by roughly one-third of total stablecoin market capitalization, with growth expected to accelerate if Congress passes the proposed CLARITY Act.

The issue goes beyond payments alone. Kendrick noted that stablecoins are increasingly touching core banking functions, from transaction settlement to liquidity management.

At the same time, a central point of tension between banks and crypto platforms is whether consumers should be allowed to earn rewards on stablecoin balances.

Coinbase currently offers about 3.5% in rewards on holdings of Circle’s USDC, a practice banking lobby groups argue could encourage deposit flight by making crypto balances more attractive than traditional accounts.

Coinbase CEO Brian Armstrong has publicly pushed back on that argument, saying banks are attempting to use regulation to block competition rather than protect consumers.

Standard Chartered Points to Deposit Sensitivity at Regional Lenders

Standard Chartered’s analysis focused on net interest margin income as a share of total revenue, a metric closely tied to deposits. On that basis, regional U.S. banks appear more exposed than larger, diversified institutions.

Among the 19 banks and brokerages reviewed, Huntington Bancshares, M&T Bank, Truist Financial, and Citizens Financial Group were identified as the most vulnerable.

Regional lenders rely more heavily on deposits to fund loans, meaning even modest outflows could have an outsized impact.

For now, markets suggest the threat is not immediate. U.S. bank deposits have rebounded after sharp declines in 2022 and early 2023, reaching a record $18.72 trillion in December 2025.

Core deposits grew by about 4% in 2025, up from 1.5% the year before, supported by Federal Reserve rate cuts and a slowdown in quantitative tightening.

Bank shares have also held up, with the KBW Regional Banking Index rising nearly 6% in January, compared with just over 1% for larger banks.

Treasury-Backed Stablecoins Add New Twist to Deposit Debate

Still, Standard Chartered’s global head of digital assets research, Geoff Kendrick, argues that the longer-term shift is difficult to ignore. If stablecoin market capitalization reaches $2 trillion, he estimates deposit losses could approach $500 billion.

He also pointed out that reserve practices limit any recycling of funds back into the banking system.

Tether and Circle, the two dominant issuers, hold just 0.02% and 14.5% of their reserves in bank deposits, meaning most backing assets sit in Treasury bills rather than traditional accounts.

Not everyone agrees that stablecoins pose a destabilizing threat. In a recent Bloomberg opinion piece, historians Niall Ferguson and Manny Rincon-Cruz argued that fears of deposit flight are overstated.

Since USDC launched in 2018, U.S. bank deposits have increased by more than $6 trillion, while stablecoins have grown by about $280 billion.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

US-wed Irishman with no criminal record detained for months in 'traumatizing' conditions