Who Is Kevin Warsh? Why His Fed Chair Odds Are Shaking Bitcoin Markets

The post Who Is Kevin Warsh? Why His Fed Chair Odds Are Shaking Bitcoin Markets appeared first on Coinpedia Fintech News

Former Federal governors, Kevin Warsh’s rising odds as the next Federal Reserve Chair are making crypto investors nervous. As the White House prepares to announce its choice, Warsh has emerged as the leading pick.

His history of supporting tight monetary policy is why markets see him as bearish for Bitcoin.

Fed chair To Be Announced Next Week

During a recent cabinet meeting, Donald Trump said the next Fed chair will be announced next week. After the Federal Reserve kept interest rates unchanged, Trump again criticized current chair Jerome Powell, saying rates are too high and should be cut by two to three percentage points.

While no official nomination has been confirmed, one name has been popping out the most, i.e., Kevin Warsh. Reports suggest the administration is preparing to nominate Kevin Warsh, who served on the Federal Reserve Board from 2006 to 2011.

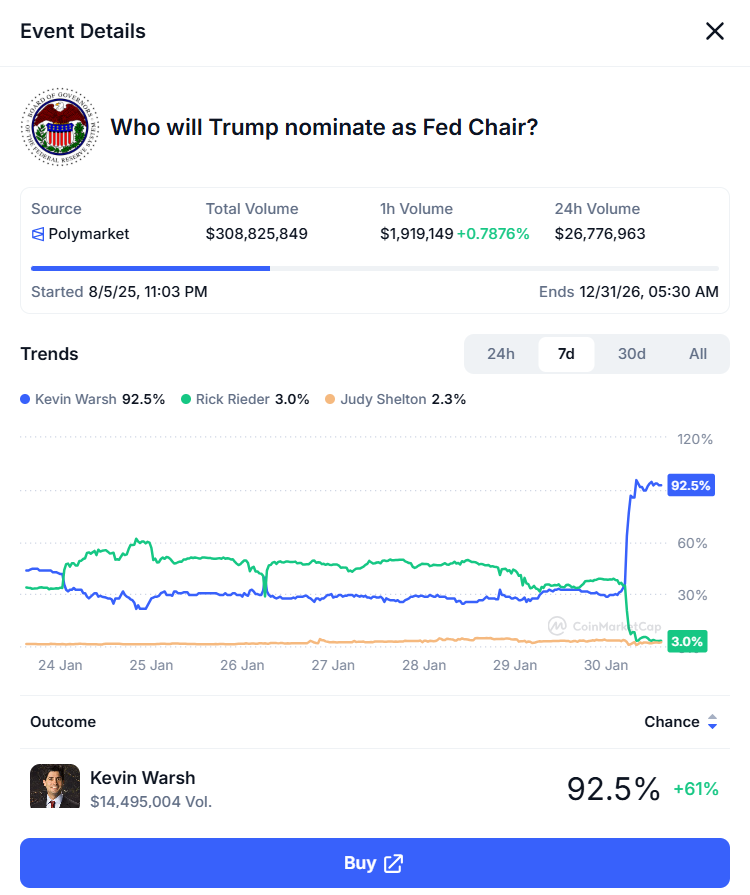

Prediction market Polymarket also reflects this view. It shows a strong belief that Trump will choose Warsh, with his odds near 92.5%, far ahead of Rick Rieder at 3.4% and Judy Shelton at 2.2%.

- Also Read :

- U.S. Federal Government On Track to Another Shutdown as Top Analyst Signals Further Bitcoin Drop

- ,

Why Kevin Warsh Seen as Bearish for Bitcoin Today

Kevin Warsh, one of the youngest former Federal Reserve governors, is now seen as a strong contender to replace Fed Chair Jerome Powell.

Warsh is known for favoring strict monetary discipline, tighter liquidity, and higher interest rates. He is known for supporting tight monetary policy, higher interest rates, and less liquidity, which usually hurts risk assets like Bitcoin.

In the past, Warsh was skeptical about Bitcoin and called it too volatile to work as real money. Because of this, traders view his policy approach as less friendly toward crypto.

Meanwhile, crypto markets have reacted to the odds of Warsh becoming the next Fed Chair by pushing Bitcoin prices lower. This suggests traders see his potential leadership as a negative signal for crypto risk appetite.

Despite earlier negative comments, he has acknowledged Bitcoin’s role as a possible store of value similar to gold. At a time when the U.S. dollar was weak, he said Bitcoin “makes sense” as part of an investment portfolio.

Conflict With Trump’s Rate Cut Push

Warsh’s history appears to clash with Trump’s public stance. Trump has repeatedly called for fast and deep rate cuts, even suggesting rates near 1%. Several analysts believe Warsh may not follow such an aggressive easing path if appointed.

However, many believe that a future Fed chair would still need to align with President Donald Trump’s pro-crypto stance, making Warsh’s chances less certain.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Kevin Warsh is a former Fed governor whose policy views influence interest rates, liquidity, and investor risk appetite across crypto markets.

The Fed Chair shapes rate policy and liquidity, which strongly affects Bitcoin demand, market sentiment, and capital flows.

While skeptical of Bitcoin as money, Warsh has acknowledged it can act as a store of value, similar to gold, in certain conditions.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless