Solana Price Analysis: February Sets Up a Breakout or a Structural Failure

The post Solana Price Analysis: February Sets Up a Breakout or a Structural Failure appeared first on Coinpedia Fintech News

After weeks of grinding volatility, Solana price analysis shows that it has entered a decisive phase as February 2026 begins. With SOL stabilizing after a turbulent January, holders are now intrigued and facing a binary question: does this consolidation mark the foundation in SOL/USD for expansion, or is it a pause before another leg lower?

At the current juncture, the pain point is clear. Price action has cooled after months of network optimism, while broader markets oscillate between risk-on and caution. Yet beneath the surface, on-chain and ecosystem data suggest that Solana crypto may be transitioning into a structurally stronger phase rather than a speculative lull.

Institutional Maturation Is Becoming Visible On-Chain

Meanwhile, Solana crypto’s narrative has shifted meaningfully since the full Firedancer validator client went live on mainnet in December 2025.

While adoption remains ongoing, early 2026 marks the phase where the client is no longer theoretical. Validators are actively migrating stake, increasing client diversity, and reducing single points of failure.

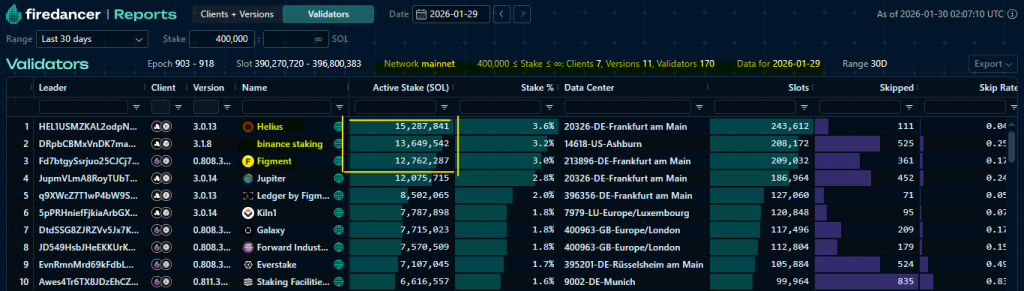

This transition is critical, as true network resilience will only emerge when a supermajority participates. This update is still in progress, but it’s steadily advancing and showing adoption. Per “reports.firedancer.io”, so far the validators have reached 170, with the top active stakers being “Helius, Binance staking, and Figment” that collectively staked around 31.5 million SOL tokens on this mainnet.

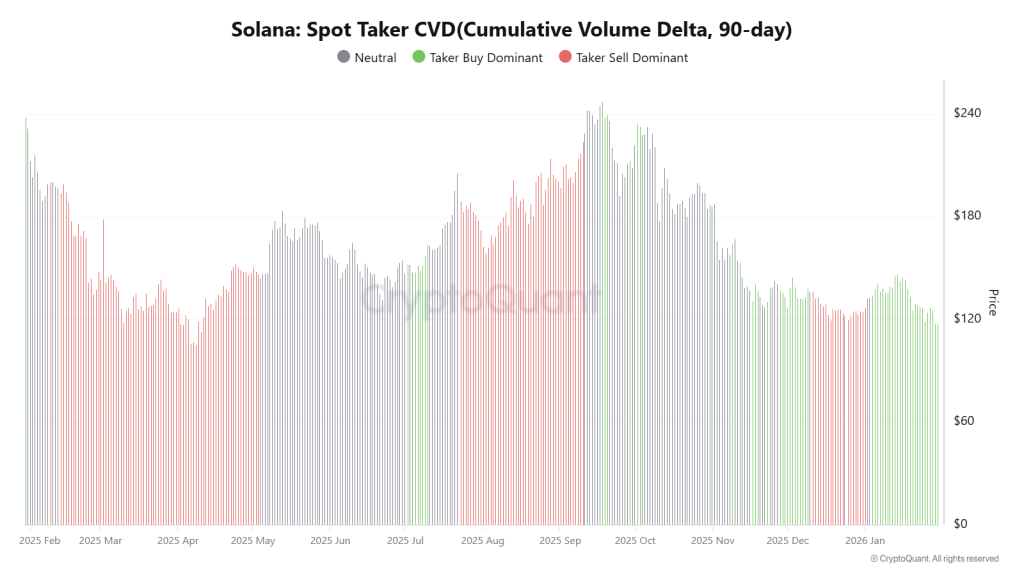

At the same time, on-chain demand metrics are strengthening. The 90-day spot Taker CVD has remained aggressively taker buy-dominant since early January, even as price temporarily crashed. Historically, this alignment suggests conviction-led accumulation rather than reactive short covering. In this context, the current red market conditions resemble a shakeout rather than distribution.

Ecosystem Expansion Is No Longer Abstract

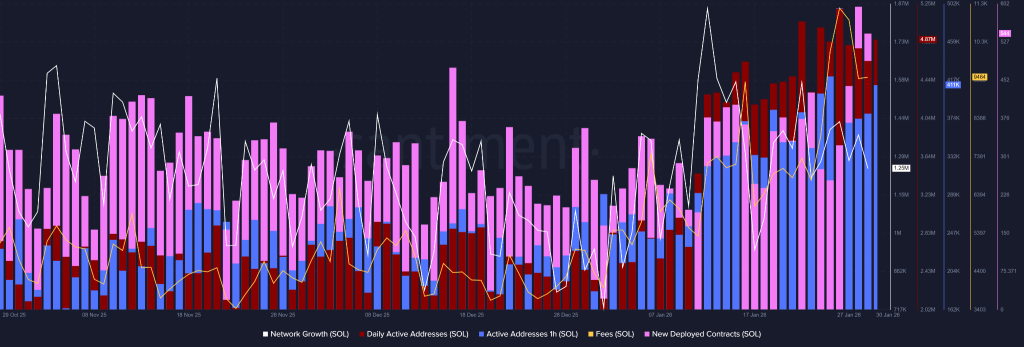

Still, the chart tells only part of the story. Network growth data reveals that new Solana addresses climbed from 1.25 million to a peak of 1.86 million on January 12, indicating sustained onboarding. More notably, daily active addresses executing SOL transactions surged to 4.87 million, nearly doubling from early January levels.

From a revenue perspective, fees exceeded 11,000 SOL on January 26th and by month end at above 9400 SOL, more than doubling since the start of January. This rise coincided with a sharp increase in developer participation, as newly deployed Solana programs rose from 226 to 544 within weeks. Such growth points to builders deploying real applications, not just experimental contracts.

Stablecoins, RWAs, and the Privacy Narrative

That said, stablecoin activity has become one of the clearest demand drivers. According to DefiLlama, USD1’s market capitalization surpassed $5 billion, with over $610 million circulating on Solana alone. Monthly growth near 300% makes Solana the fastest-expanding USD1 chain, reinforcing its position as a preferred settlement layer.

Additionally, RWA tokenization by major funds and the launch of GhostSwap by GhostwareOS have introduced new capital flows and privacy-focused use cases. Together, these developments suggest ecosystem depth rather than cyclical hype.

Support and Resistance That Matter Now

Now, judging from a structural perspective, Solana price analysis shows that it faces well-defined levels, and it may bleed more or possibly a liquidation grab with a long wicked hammer candle could trap bears.

But one thing is clear: the token’s current price is not aligned with the ecosystem’s optimism, and it’s a clear divergence. So, the market tends to auto-correct, and after the noise dies down, it will enter a recovery rally to readjust from an undervalued state to an improved state, and that’s when the divergence will decrease.

Support at $115–$120 remains the primary defense zone for now, and it’s already at the edge of it. If it fails, it has a secondary downside level near $105 if macro pressure resumes. On the upside, a sustained reclaim of $150 would open the possibility of a broader recovery phase in SOL/USD, while $260 remains a longer-term extension zone if accumulation persists.

In sum, this Solana price analysis reflects a network in transition. February’s direction will likely depend less on sentiment and more on whether infrastructure adoption and on-chain demand continue to validate price resilience.

You May Also Like

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus