Bitcoin Support Break Under $85K Weighs on Strategy Shares

This article was first published on The Bit Journal.

Bitcoin plunges below $85K, and Strategy Inc. feels the shockwave. The crypto market’s latest tumble didn’t just rattle traders; it slammed the Bitcoin-focused treasury giant’s stock, sending shares tumbling nearly 11% in a single session.

With Strategy holding hundreds of thousands of BTC, every dip in Bitcoin turns into amplified market drama. As the dust settles, investors are left staring at plummeting charts, wondering just how far this Bitcoin price drop will ripple across both crypto and traditional markets.

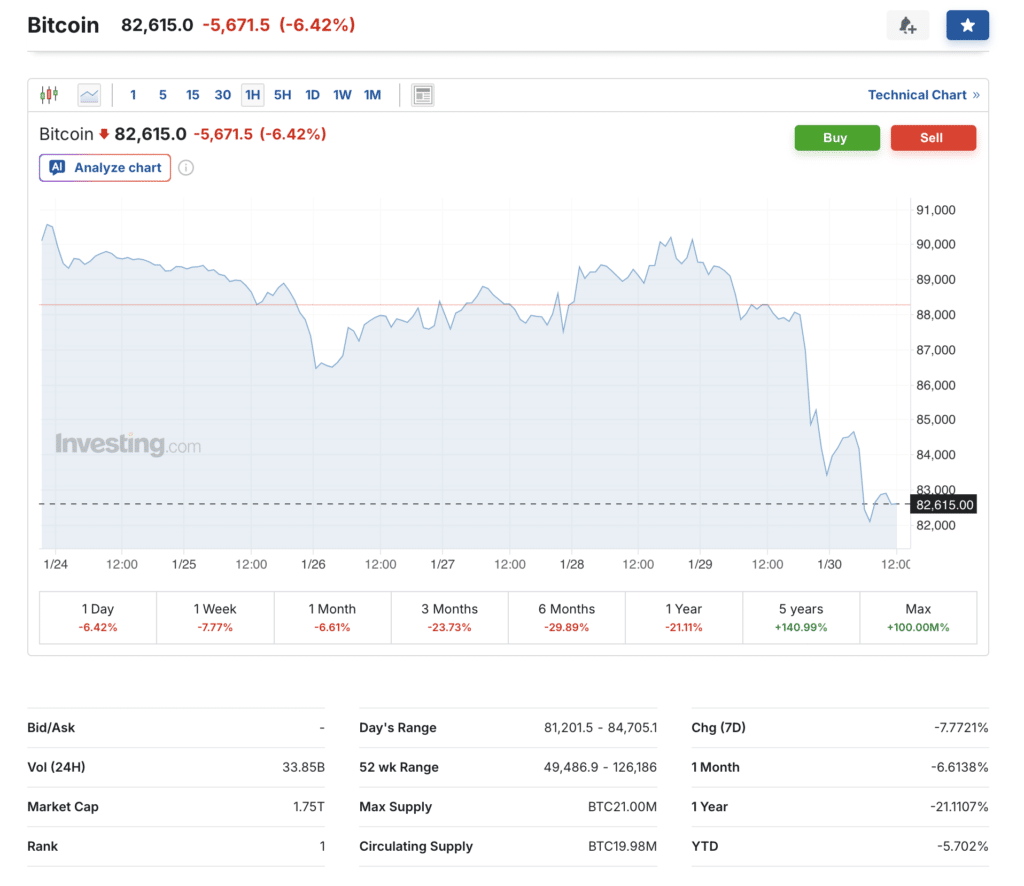

- Live Bitcoin Price Today: Around $82,251.60 USD

- 24-Hour Volume: $78,438,632,877 USD

- BTC Market Cap: $1,643,567,181,046 USD

- Circulating Supply: 19,982,190 BTC

- Max Supply: 21,000,000 BTC

Bitcoin is down sharply in recent trading, reflecting a significant Bitcoin price drop and heightened market instability. The major cryptocurrency dipped below the $85,000 mark, trading around $82K, with volumes spiking amid a broad crypto market sell-off. This movement has not only shaken Bitcoin traders but also had a pronounced impact on correlated equities, including Strategy’s shares.

Market Overview: Bitcoin Falls Below $85K Amid Broad Sell-Off

Bitcoin’s latest slide represents one of the most pronounced BTC price crash today episodes this month, as price action broke below key support levels, pushing BTC near $82,000. The drop comes during a period of elevated volatility, with liquidations across crypto futures markets and a shift in investor sentiment toward safer assets.

This movement underscores how quickly the Bitcoin price drop below $85K can affect both digital asset markets and broader risk-linked equities.

What’s Driving the Bitcoin Price Drop?

The current Bitcoin price drop January 2026 round is being driven by a mix of macro and crypto-specific factors. Broader sell-offs in tech and risk assets, coupled with heightened geopolitical tensions and waning institutional liquidity, have helped push Bitcoin into negative territory.

Traders cite large forced liquidations and ETF outflows as catalysts behind the sharp price slide, which has intensified the ongoing BTC market decline and spilled over into traditional financial markets.

Technical Breakdown: Why Bitcoin Dipped Under $85K

Technically, Bitcoin’s breakdown has been marked by the erosion of multiple support zones, transforming previous key levels into resistance. When support breaks, price momentum often accelerates lower, leading to rapid declines. The breach under $85K triggered widespread stop-losses and compounding selling pressure, reinforcing the Bitcoin price drop narrative. This event highlights how delicate price floors can contribute to deeper corrections in the crypto landscape.

Bitcoin Support Break Under $85K Weighs on Strategy Shares 3

Bitcoin Support Break Under $85K Weighs on Strategy Shares 3

Strategy Stock Plunge: Impact of Bitcoin’s Slide on Equities

The Strategy stock drops 11% headline isn’t an isolated anomaly. It reflects how equities with significant Bitcoin exposure can suffer steep losses when BTC undergoes a correction. Shares of Strategy and similar crypto-linked firms often mirror BTC’s price action, resulting in amplified moves on both upside and downside cycles.

The recent equity sell-off shows how intertwined digital and traditional markets have become when faced with systemic Bitcoin volatility January 2026 pressures.

Bitcoin Drops to $82K: Sentiment and Market Psychology

Investor psychology plays a central role in periods of sharp Bitcoin price drop episodes. When crypto markets weaken, fear gains ground, triggering exits even among longer-term holders. This creates a feedback loop where price declines fuel sentiment shifts, accelerating selling.

The current move into the lower $80K range highlights how quickly market confidence can erode, with traders now watching support levels closely to gauge if the slide persists.

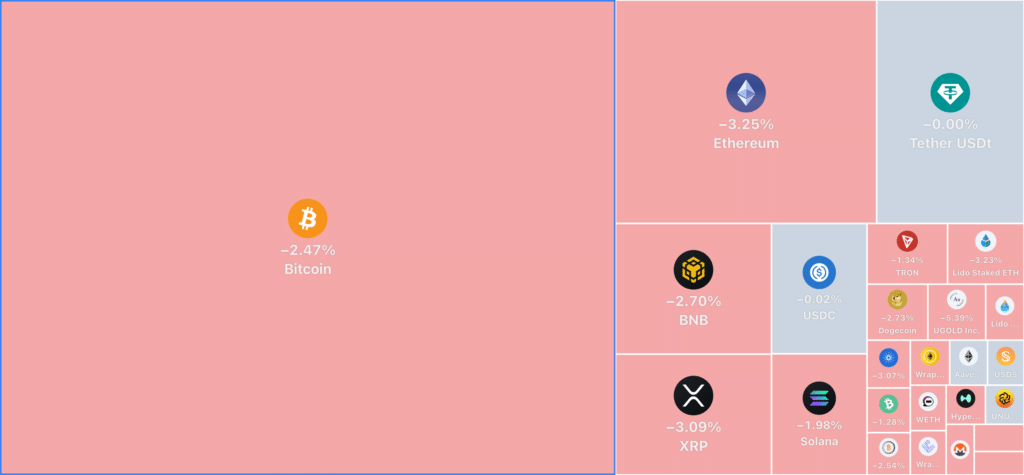

Broader Crypto Market Sell-Off: Altcoins Follow Bitcoin

The pain hasn’t been limited to Bitcoin. Other major cryptocurrencies have mirrored BTC’s performance, with many dropping well below recent support levels. This synchronicity underscores a broader crypto market sell-off where correlated assets fall in tandem during panic phases.

The decline across altcoins further signals that the Bitcoin price drop below $85K isn’t an isolated event but part of a wider market retracement.

Bitcoin Support Break Under $85K Weighs on Strategy Shares 4

Bitcoin Support Break Under $85K Weighs on Strategy Shares 4

Macro Forces at Play: Global Market Risk Off

Macro-level dynamics have also fed into the Bitcoin price drop narrative. Sell-offs in equities, weaknesses in other risk instruments, and tightening monetary signals have increased correlations between crypto and traditional assets. Global risk-off sentiment has driven flows into safer havens while reducing appetite for speculative assets like Bitcoin, reinforcing the ongoing downward momentum.

Institutional Flows: ETF Outflows and Market Pressure

Institutional flows have become an influential driver in Bitcoin price action. Recent outflows from major Bitcoin ETFs and weaker inflows have caused liquidity stress, contributing to the BTC market decline. When institutional support wanes, price structures can suffer, leading to steeper sell-offs as market makers and participants reassess risk positions.

Risk Management: Strategies for Traders Amid the Drop

Traders navigating the current Bitcoin price drop phase need robust risk management. Tight stop-loss protocols, position sizing adjustments, and diversified portfolios are essential tools to mitigate exposure. With BTC’s price action slipping below $85K, these risk discipline measures become more critical to survive heightened volatility and preserve capital during turbulent market conditions.

Outlook: Can Bitcoin Stabilise After the Drop?

Despite the recent sell-off, markets may find a footing if sentiment improves and macro pressures ease. Historical cycles suggest that periods of steep correction can be followed by consolidation or rebound phases. However, achieving this will require renewed buying interest and stronger support levels to absorb selling pressure and reverse the narrative around the Bitcoin price drop today.

Regulatory and Global Influences on Bitcoin’s Price

Regulatory ambiguity and global economic policies also feed into Bitcoin’s performance. Uncertainty around future actions by key central banks and policy shifts in major economies can accelerate volatility. Investors often view these external signals as risk factors that could amplify Bitcoin price drop and stock impact scenarios when confidence falters.

Market Sentiment: Fear and Greed Metrics

Market-wide sentiment indicators have shown elevated fear during the recent downturn, a hallmark of steep Bitcoin price drop phases. Extreme fear often precedes market bottoms, but it can also perpetuate selling before a reversal takes shape. These psychological metrics offer traders and analysts an added layer of insight into broader market behaviours during sell-offs.

Strategic Implications for Investors

The recent Bitcoin price drop and its knock-on effect into stocks like Strategy underscores the importance of strategic portfolio diversification. Exposure to a single asset class during turbulent markets can magnify losses. Investors should consider broader investment principles, including asset allocation and risk tolerance, especially during periods of elevated market stress.

Bitcoin’s Role in a Diversified Portfolio

While Bitcoin remains a dominant crypto asset, its penchant for volatility means it should be treated as a strategic component of diversified portfolios. The current BTC price crash today highlights how dramatic swings can impact risk assets, reinforcing the need for balanced exposure across asset classes to mitigate downside risks.

Conclusion

The Bitcoin price drop below $85K and the concurrent Strategy stock drops 11% illustrate how deeply market sentiment and macro forces can influence both digital and traditional financial landscapes. Traders and investors must remain vigilant, employing disciplined risk frameworks and staying attuned to evolving market signals. Price action in the months ahead will be critical to determining whether BTC resumes its bullish trajectory or enters a prolonged consolidation phase.

To navigate ongoing volatility effectively, market participants should focus on data-driven decision-making and robust risk management methodologies.

Appendix: Glossary of Key Terms

Bitcoin Price Drop: A rapid decrease in Bitcoin’s market price over a short period.

BTC Market Decline: General decrease in the value of Bitcoin and broader related assets.

Crypto Market Sell-Off: Widespread selling activity across cryptocurrency markets.

Liquidations: Forced closure of leveraged positions due to price thresholds.

Support Level: Price point where demand is expected to prevent further decline.

ETF Flows: Capital entering or exiting exchange-traded funds tied to crypto.

Frequently Asked Questions About Bitcoin Price Drop

Why is Bitcoin price dropping today?

Multiple factors including market liquidations, macro risk sentiment, and institutional outflows are pushing prices lower.

Can Bitcoin recover after falling below $85K?

Reversal depends on renewed buying interest and stabilization of market sentiment.

How does BTC volatility affect stocks like Strategy?

Equities with Bitcoin exposure can move in tandem with BTC’s price, amplifying swings.

Is this the start of a long-term downtrend?

It’s too early to confirm; continued price action near key supports will reveal more.

Should traders change strategy during high volatility?

Yes, risk management adjustments are crucial during steep price drops.

Reference

Bitcoin price

crypto market

Read More: Bitcoin Support Break Under $85K Weighs on Strategy Shares">Bitcoin Support Break Under $85K Weighs on Strategy Shares

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%