In this article:

1. What Is Obmify?

2. What Is Premium Support?

3. Why Premium Support Stands Out

4. What Ensures the Security of Transactions?

5. Conclusion

The cryptocurrency industry empowers users to manage their funds and investments directly, without relying on intermediaries. However, growing attention from regulatory bodies — such as the National Bank of Ukraine (NBU) — is making it increasingly difficult to operate with digital assets.

In spring 2025, for example, Ukraine’s central bank began scrutinizing crypto cards, while in Australia, authorities imposed new restrictions on crypto ATMs. Despite this, P2P platforms and crypto exchanges remain the go-to solutions for small-scale conversions and withdrawals.

Things get more complicated when handling large transactions. In such cases, choosing a reliable counterparty becomes absolutely critical.

To explore a safer alternative, the Incrypted editorial team tested Premium Support from Obmify — a service specifically designed to handle high-value crypto operations with enhanced reliability and care.

Obmify is an aggregator of cryptocurrency exchange services that helps users quickly find the best options for converting specific digital assets. The platform is seamlessly integrated with popular crypto wallets and online banking services.

In addition to its online functionality, Obmify also supports offline crypto exchange services across numerous cities in Ukraine, as well as in several EU countries and other global jurisdictions.

Premium Support by Obmify is a dedicated service tailored for clients dealing with large volumes of crypto assets — starting from $5,000 and up.

Users gain access to a private chat with a personal account manager who guides them through every step of the transaction. This hands-on approach ensures a smooth, secure, and transparent experience.

Key features of the Premium Support service include:

- Secure transportation of cash within Ukraine and abroad

- Business payouts to bank cards across different financial institutions

- Transactions via payment systems

- Real estate purchases

- Buying and selling cryptocurrencies

One of the core advantages of Obmify’s Premium Support is the personalized assistance provided at every stage — from placing an order to successfully completing the transaction.

With a dedicated account manager by their side, users benefit from up-to-date, reliable information and can easily clarify any questions they may have along the way.

The team takes a tailored approach to every client, offering flexible solutions that adapt to a variety of needs and scenarios.

Obmify’s service coverage goes far beyond Ukraine. Premium Support is available to clients in the United States, Canada, the United Kingdom, and most EU countries.

Countries with Obmify Crypto Exchange. Source: Obmify.

Countries with Obmify Crypto Exchange. Source: Obmify.

The service guarantees full anonymity and confidentiality for its clients.

Crypto operations inherently carry certain risks for users. The most common threats include technical errors and fraud by unscrupulous counterparties.

Obmify’s Premium Support service helps users conduct transactions securely by minimizing these risks. The platform works exclusively with vetted partners and allows clients to fully delegate the exchange process to a dedicated personal manager.

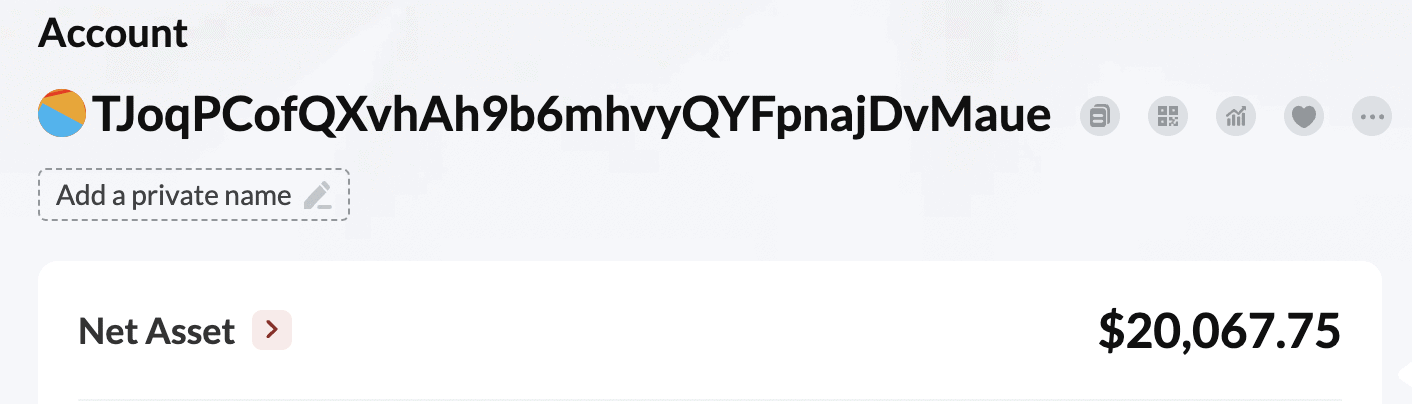

Additionally, Obmify maintains its own insurance fund exceeding $20,000. This reserve is held to cover client expenses in case of unforeseen circumstances.

Obmify Premium Support Insurance Fund. Source: Obmify.

Obmify Premium Support Insurance Fund. Source: Obmify.

Obmify has long been a trusted player in the market, offering clients reliable and convenient tools for converting and withdrawing digital assets. Their new Premium Supporservice is specifically designed for users handling large volumes of cryptocurrency.

Thanks to this service, clients receive full personalized assistance, with guaranteed anonymity and a high level of security throughout every transaction.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact

[email protected] for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Countries with Obmify Crypto Exchange. Source: Obmify.

Countries with Obmify Crypto Exchange. Source: Obmify.

Obmify Premium Support Insurance Fund. Source: Obmify.

Obmify Premium Support Insurance Fund. Source: Obmify.