Crypto Market to See $638M in Token Unlocks as Altcoin Market Continues Bleeding

Over $638 million in token supply is scheduled to enter the crypto market over the next seven days, according to data from Tokenomist.

The upcoming releases arrive as the altcoin market remains under pressure with thin liquidity and weak buyer interest.

Tokenomist data shows several large one time releases planned between Feb. 2 and Feb. 9, each valued above $5 million.

HYPE HYPE $30.75 24h volatility: 1.0% Market cap: $7.33 B Vol. 24h: $761.04 M leads by market value, with 9.92 million tokens worth over $300 million entering circulation.

XDC Network XDC $0.0365 24h volatility: 5.5% Market cap: $697.31 M Vol. 24h: $42.21 M , Berachain BERA $0.46 24h volatility: 5.8% Market cap: $67.90 M Vol. 24h: $25.24 M , and Ethena ENA $0.14 24h volatility: 1.7% Market cap: $1.10 B Vol. 24h: $214.03 M will also see token releases worth around $30 million each.

Several projects are seeing daily token additions through linear schedules, exceeding $1 million per day. RAIN leads, with 9.41 billion tokens worth over $90 million set to enter circulation this week.

Solana SOL $102.5 24h volatility: 2.7% Market cap: $58.08 B Vol. 24h: $9.02 B is also set to release around 479,120 SOL tokens valued at $48.24 million, representing just 0.08% of circulating supply.

Other notable daily releases include Canton (CC), Official Trump TRUMP $4.16 24h volatility: 1.6% Market cap: $966.84 M Vol. 24h: $335.55 M , and River (RIVER).

Large supply releases bring newly tradable tokens into circulation. If these events come during a weak market phase, early holders often sell and add pressure on spot prices.

Altcoin Market in Stress

The scheduled token releases come as the broader altcoin market continues to weaken. On Feb. 2, total altcoin market capitalization fell by 4.4%, adding to past week’s losses.

Ethereum ETH $2 288 24h volatility: 5.6% Market cap: $276.07 B Vol. 24h: $56.43 B dropped 9.5% over the past day, while major altcoins like BNB BNB $761.8 24h volatility: 2.3% Market cap: $104.14 B Vol. 24h: $2.75 B and XRP XRP $1.60 24h volatility: 3.7% Market cap: $97.38 B Vol. 24h: $5.35 B also recorded sharp drops.

According to data by TradingView, the altcoin market cap recently fell below its 100 day simple moving average. This level previously failed in May 2022 during the last bear phase.

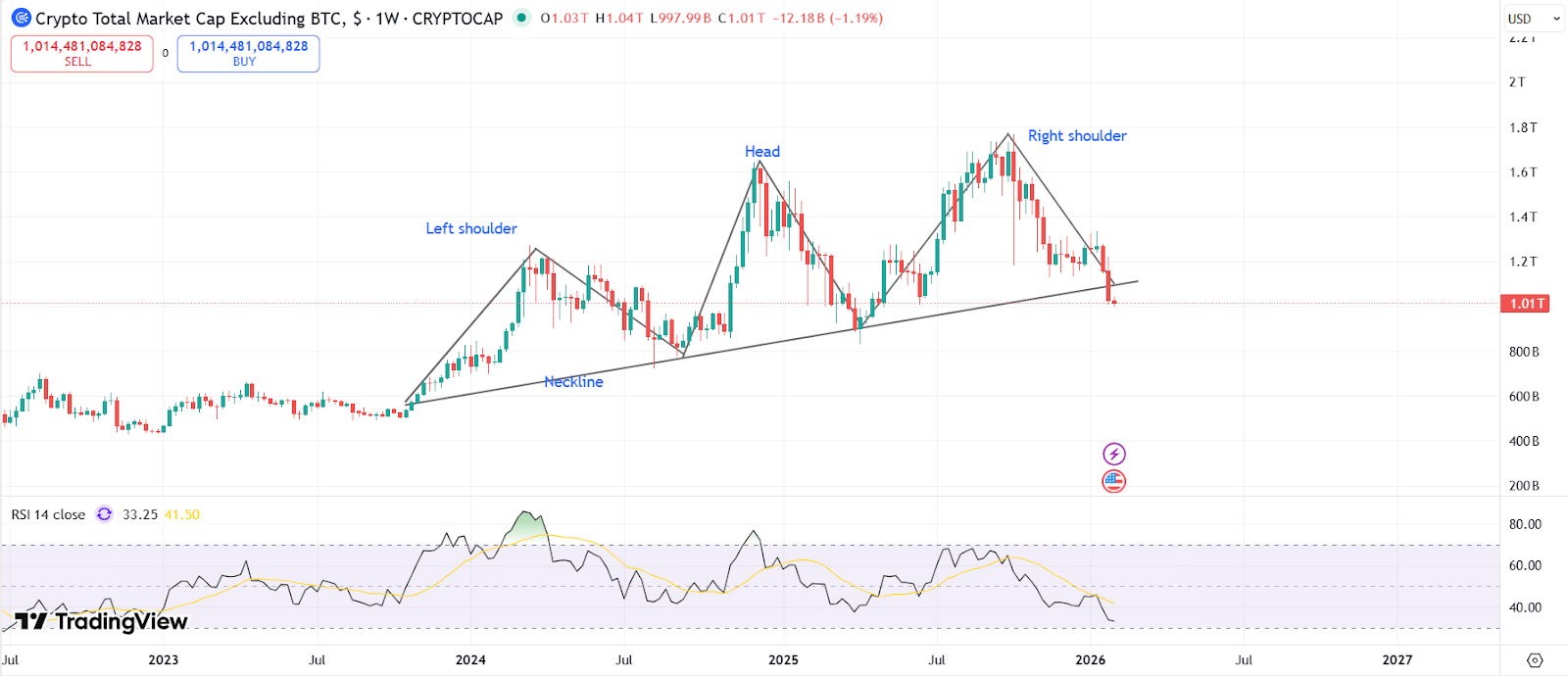

The altcoin market has also broken down below the neckline of a classic head and shoulders pattern on the weekly chart.

This suggests that altcoins are in distribution, not accumulation. Historically, this leads to deep underperformance across the market.

Head and shoulders pattern on the crypto market cap chart (excluding BTC). | Source: TradingView

Analysts warn that any near term altcoin rebound may result in short-term relief rallies rather than a sustained recovery.

nextThe post Crypto Market to See $638M in Token Unlocks as Altcoin Market Continues Bleeding appeared first on Coinspeaker.

You May Also Like

Whale LoraCle increased its long position in HYPE to $53 million, with unrealized profits exceeding $27.5 million.

Strategic $5.8M Transfer Signals Major Institutional Move