US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

A severe sell-off over the weekend that wiped about $250 billion off the cryptocurrency market has rekindled speculation that the digital assets are in a structural failure or merely responding to macro stressors.

Though all prices in the industry have tumbled ferociously, market analysts claim that it is a contraction of the U.S. liquidity situation and not a collapse of crypto markets.

Raoul Pal, founder and CEO of Global Macro Investor, said that a temporary lack of U.S. dollar liquidity is triggered by a series of macro events, such as repeated government shutdowns, Treasury cash management dynamics, and a vacuum of risk capital.

Bitcoin’s Drop Mirrors Tech Stocks as Liquidity Tightens, Pal Says

In a post published on X over the weekend, Pal pushed back against claims that Bitcoin and crypto had “broken” or detached from traditional markets, arguing instead that similar pressure has appeared across other long-duration assets.

Pal cited analogies between Bitcoin and the U.S. software-as-a-service equities, saying that the two asset classes have been almost identical in their price movements throughout the downturn.

He said this suggests a shared macro driver rather than sector-specific weakness.

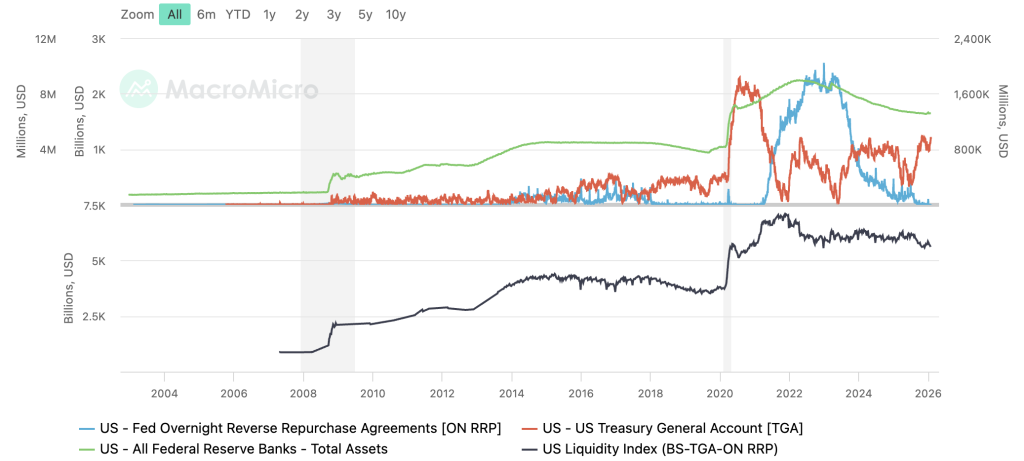

In his analysis, he pointed out that U.S. total liquidity has become the dominant factor in this phase of the cycle, outweighing broader global liquidity measures that typically correlate more closely with crypto prices.

The liquidity squeeze, Pal argued, stems from a combination of factors that reduced the amount of capital circulating through the financial system.

Source: MacroMicro

Source: MacroMicro

These are the finish of the Federal Reserve reverse repo facility drawdown in 2024, a reconstruction of the Treasury General Account in mid-year 2025, and the effects of the recent partial U.S. government shutdown.

He also included that a robust rise in gold also averted marginal liquidity that could have otherwise been pumped into less risky assets like crypto and high-growth equities.

Market data is also indicative of the magnitude of the damage, as Bitcoin plunged over 10% from a weekend high near $84,000 to lows of approximately $76,000 to establish one of the biggest CME futures gaps in history.

Bitcoin and Ethereum Sink as Derivatives Interest Hits 9-Month Low

At the time of writing, Bitcoin was trading at $76,839, which is a 12.6% decline during the last week and 39% below its all-time value. Ethereum was subject to even greater losses, falling by almost 7% in 24 hours to about 2243 and still more than 54% below its high.

The crypto market in general has been experiencing the same trend, with a total market capitalization going down to approximately $2.66 trillion, which was previously around $3 trillion just a week earlier.

Liquidations were fast, and over $2.5 billion was wiped out in a single day, with over $5.4 billion liquidated since Thursday, according to CoinGlass data.

The overall interest in all derivatives markets has dropped to about $24.2 billion, its lowest point in nine months, with leveraged positions flushed out.

The selloff was coupled with dystrophic liquidity on weekends and a succession of macro news, such as trade tensions, increasing yields in long-dated Japanese government bonds, and increasing geopolitical risks in the Middle East and Asia.

On-chain indicators suggest confidence remains fragile. Exchange outflows dropped sharply after the sell-off, showing limited dip buying, while large Bitcoin holders reduced exposure by an estimated 10,000 BTC since early February.

Short-term holders are deep in unrealized losses, with NUPL metrics sitting in capitulation territory, though not yet at levels historically associated with final market bottoms.

Analysts note that without stronger accumulation from long-term investors, such rallies tend to fade.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?