Why Bitcoin’s Latest Decline Looks Like a Market Reset, Not a Pullback

Bitcoin has continued its decline following the recent bearish outlook, falling from the $90,000 area to below $75,000.

While price action alone suggests weakness, derivatives, demand, and network data together point to a broader structural reset rather than an isolated pullback.

According to a report shared by CryptoQuant, multiple market components are simultaneously unwinding, indicating that the forces which supported the 2025 rally have largely dissipated.

Short-Term Price and Derivatives Structure

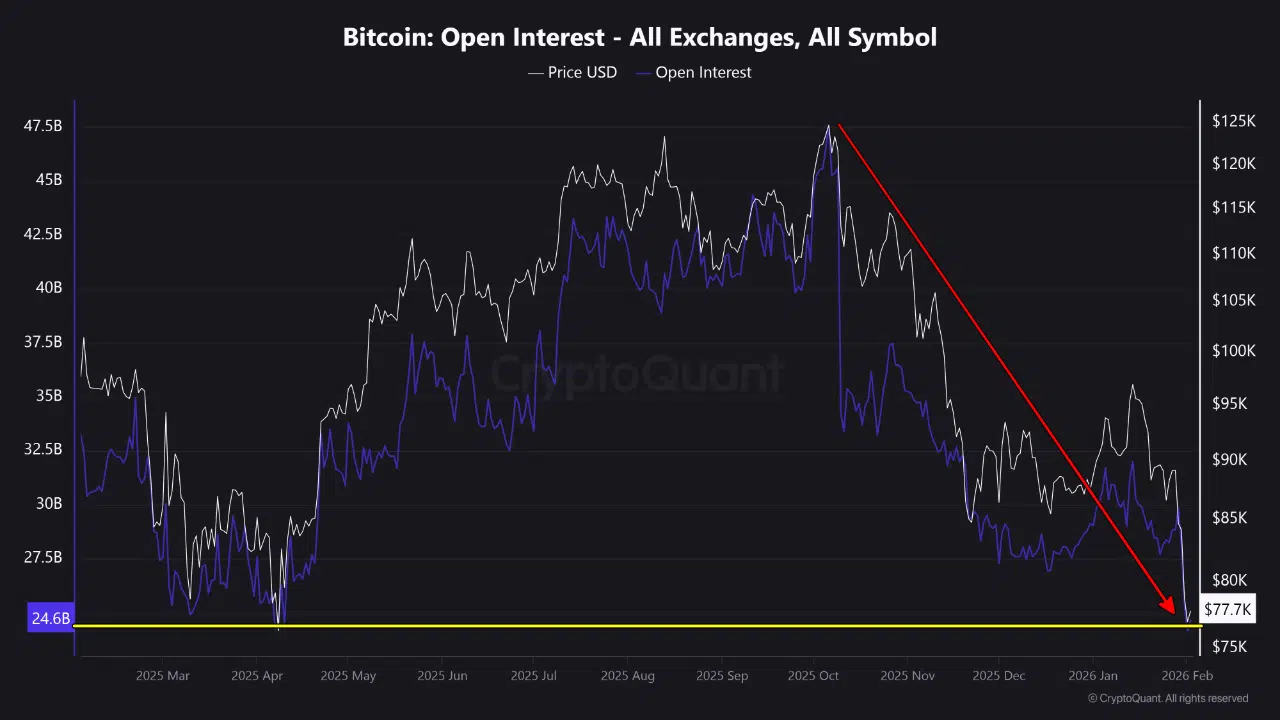

The most immediate signal comes from the collapse in Bitcoin open interest. Open interest has fallen sharply from late-2025 peaks near $47.5 billion to approximately $24.6 billion, representing a 50% reduction in leveraged exposure.

This magnitude of deleveraging reflects a forced exit from speculative positioning. The futures market, which previously amplified upside momentum, has been materially reset, leaving price action without its prior leveraged support.

This magnitude of deleveraging reflects a forced exit from speculative positioning. The futures market, which previously amplified upside momentum, has been materially reset, leaving price action without its prior leveraged support.

At the same time, funding rates have pivoted aggressively into negative territory, reaching approximately -0.008, the deepest negative reading since September 2024. This shift reflects a rapid change in positioning dynamics, where over-leveraged long positions were flushed and aggressive short activity increased.

Together, collapsing open interest and deeply negative funding point to a leverage unwind rather than organic trend continuation.

Institutional Demand Signals Remain Weak

Demand conditions remain strained, particularly among U.S.-based participants. The Coinbase Premium Index has dropped into deeply negative territory, reaching some of the lowest levels observed over the past year.

This indicates that selling pressure is being led by U.S. institutions and professional traders, rather than offshore or retail-driven activity. With domestic demand failing to absorb supply, price recovery attempts remain structurally constrained.

Network Stress and Miner Capitulation

Pressure is also visible at the network level. Bitcoin has lost approximately 30% of its hashrate, signaling growing operational stress among miners.

This has been accompanied by a spike in miner outflows, suggesting a transition from holding behavior to active liquidation. Such behavior typically emerges when profitability deteriorates and operators are forced to sell reserves to cover costs.

Miner distribution adds an additional layer of supply pressure at a time when institutional demand is already subdued.

Scenarios and Risk Framework

Short-Term Relief Scenario:

The scale of futures liquidations and leverage removal could allow for a brief, reactive rebound, driven by positioning normalization rather than renewed demand.

Structural Risk Scenario:

With speculative leverage wiped out, U.S. institutional demand stalled, and miners actively distributing coins, downside risk remains unresolved. Without a clear recovery in demand or stabilization in network conditions, price action may continue to reflect a broader market reset.

Takeaway

The current environment reflects a full-spectrum reset rather than a routine correction. Leverage has been forcibly removed, institutional participation has weakened, and miners are adding supply through liquidation.

While short-term rebounds remain possible following large liquidations, the broader structure points to a market undergoing recalibration. Confirmation of stability will require evidence of renewed demand, leverage rebuilding, or miner pressure easing. Until then, Bitcoin remains in a fragile equilibrium rather than a recovery phase.

The post Why Bitcoin’s Latest Decline Looks Like a Market Reset, Not a Pullback appeared first on ETHNews.

You May Also Like

The Future of Metalworking: Advancements and Innovations

Fed rate decision September 2025