How to achieve a stable daily income through WPA Hash mining in 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

WPA Hash cloud mining gains attention in 2026 as investors seek stable crypto income beyond price swings.

- In 2026, crypto investors are shifting from trading to WPA Hash cloud mining for stable, contract-based daily income.

- WPA Hash lets users earn daily crypto returns via computing power, avoiding hardware hassle and frequent trading.

- Cloud mining gains traction as investors seek structured, low-risk crypto income beyond market price fluctuations.

In 2026, after several rounds of volatility, the cryptocurrency market is gradually becoming more structured and rational. For many investors, simply relying on price fluctuations is no longer the only option; how to obtain a relatively stable cash flow while controlling risk has become a new focus.

It is against this backdrop that someone would begin to explore and try participating in the operation of cryptocurrency networks through WPA Hash cloud mining, hoping to explore a long-term income model that does not rely on frequent trading and is based on a computing power mechanism.

From active trading to passive computing power participation

The first thing that anyone who gets in contact with cryptocurrencies focuses on is to earn profits by buying and selling cryptocurrencies. However, as market volatility increased, they gradually realize that rather than frequently judging price direction, it is better to let assets operate continuously through computing power, forming a more stable cash flow structure.

The cloud mining model provided by WPA Hash is based on this logic: users do not need to purchase mining machines or maintain hardware; they only need to allocate computing power through the platform to participate in the mining process of mainstream cryptocurrency networks, and the income is settled daily according to the contract rules. How is the “daily fixed income” achieved?

In actual use, the overall process of WPA Hash is relatively clear:

Step 1: Register an Account

Users register an account through the official platform and receive a $15 new user reward upon completing the basic process.

Step 2: Select a BTC Cloud Mining Contract

The platform offers Bitcoin cloud mining contracts with different hashrate levels and periods, covering various options from small-scale trials to high-hashrate participation.

Step 3: Automatic Hashrate Management

After contract activation, the platform centrally allocates hashrate resources to participate in the Bitcoin network operation; users do not need to intervene in the technical aspects.

Step 4: Daily Earnings Settlement

Earnings are settled daily in BTC or equivalent assets; relevant data can be viewed in the user’s backend.

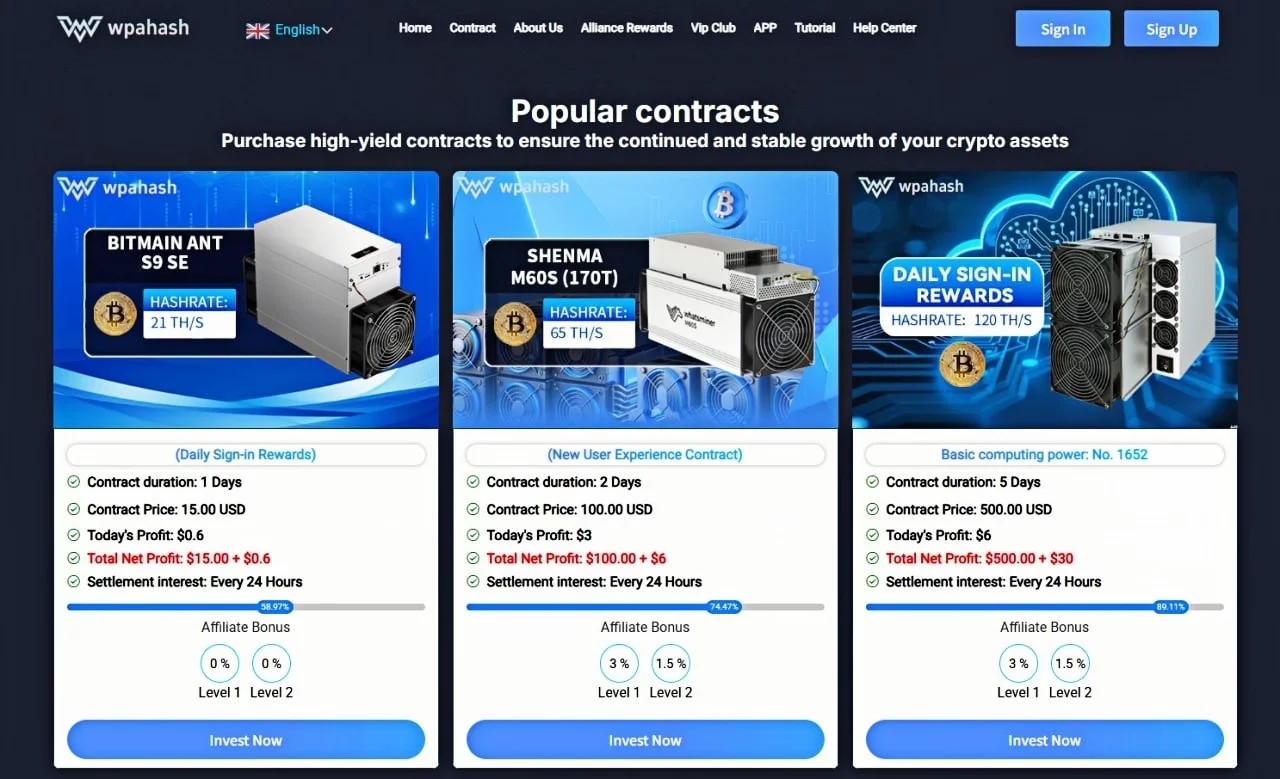

Cloud mining contract examples (platform showcase)

New User Experience Contract

Investment: $100 | Term: 2 days | Daily Yield: $3

Maturity Yield: $100 + $6

Basic Computing Power: 1659 | Investment: $500 | Term: 5 days | Daily Yield: $6

Maturity Yield: $500 + $30

Medium Computing Power: Project 2747

Investment: $3,000 | Term: 18 days

Daily Yield: $42

Maturity Yield: $3,000 + $756

Medium Computing Power: Project 2938

Investment: $5,000 | Term: 22 days

Daily Yield: $75

Maturity Yield: $5,000 + $1,650

Classic Computing Power: Project 4834

Investment: $58,000 | Term: 38 days

Daily Yield: $1,131

Maturity Yield: $58,000 + $42,978

Yields are settled automatically daily. Principal is returned upon contract maturity. Specific yields depend on real-time platform data. Click here for more contract details.

Why WPA Hash?

After comparing multiple platforms, many investors ultimately chose WPA Hash for long-term use, primarily based on the following considerations:

- No hardware or maintenance costs: Avoids mining machine depreciation, electricity, and operational issues.

- Multi-currency hashrate support: Allows for flexible adjustments to participation based on market conditions and personal preferences.

- High degree of automation: Yield settlement and data display are highly automated.

- Relatively clear transparency: Contract rules, cycles, and settlement logic are clear.

In conclusion

WPA Hash mining isn’t about “changing a financial situation overnight,” but rather using it as part of a crypto asset system to balance risk and return. Achieving a relatively stable daily income without constant monitoring or frequent trading is precisely the initial motivation for choosing cloud mining.

For users seeking to reduce operational burden and pursue long-term stable returns, participation in computing power may be a worthwhile area of research.

For more information, please visit the official platform.

Email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Woman shot 5 times by DHS to stare down Trump at State of the Union address

What is Play-to-Earn Gaming? Unlocking New Possibilities