JPMorgan: Bitcoin is Now a More Attractive Investment Than Gold Long Term

Bitcoin Magazine

JPMorgan: Bitcoin is Now a More Attractive Investment Than Gold Long Term

Bitcoin’s long-term investment case relative to gold has strengthened, according to JPMorgan, even as the cryptocurrency suffers one of the sharpest market pullbacks in its history.

In a new note, JPMorgan analysts reportedly said Bitcoin’s risk-adjusted profile versus gold has improved after gold’s strong outperformance over the past year and a notable rise in volatility for the traditional safe-haven asset.

The divergence between the two assets has been stark. Since October 2025, gold has climbed roughly a third, while BTC has fallen nearly 50% from its peak above $126,000.

The downturn marks four consecutive months of declines — a stretch not seen since before the pandemic. Gold rose more than 60% in 2025, driven by central bank buying and renewed safe-haven demand, while BTC struggled to maintain momentum and underperformed many risk assets.

Still, JPMorgan global markets strategist Nikolaos Panigirtzoglou argued that gold’s rally has come with a key shift: rising volatility.

That has narrowed the perceived risk gap between the metal and BTC.

The bank highlighted that Bitcoin’s volatility relative to gold has fallen to a record low, with the bitcoin-to-gold volatility ratio drifting toward 1.5.

Panigirtzoglou suggested that, on a volatility-adjusted basis, Bitcoin’s market capitalization would need to rise dramatically — theoretically implying a price near $266,000 — to match private sector investment levels in gold.

While he acknowledged such targets are unrealistic in the near term, the comparison underscores what JPMorgan views as significant upside potential over the long run once negative sentiment fades.

Bitcoin is currently crashing

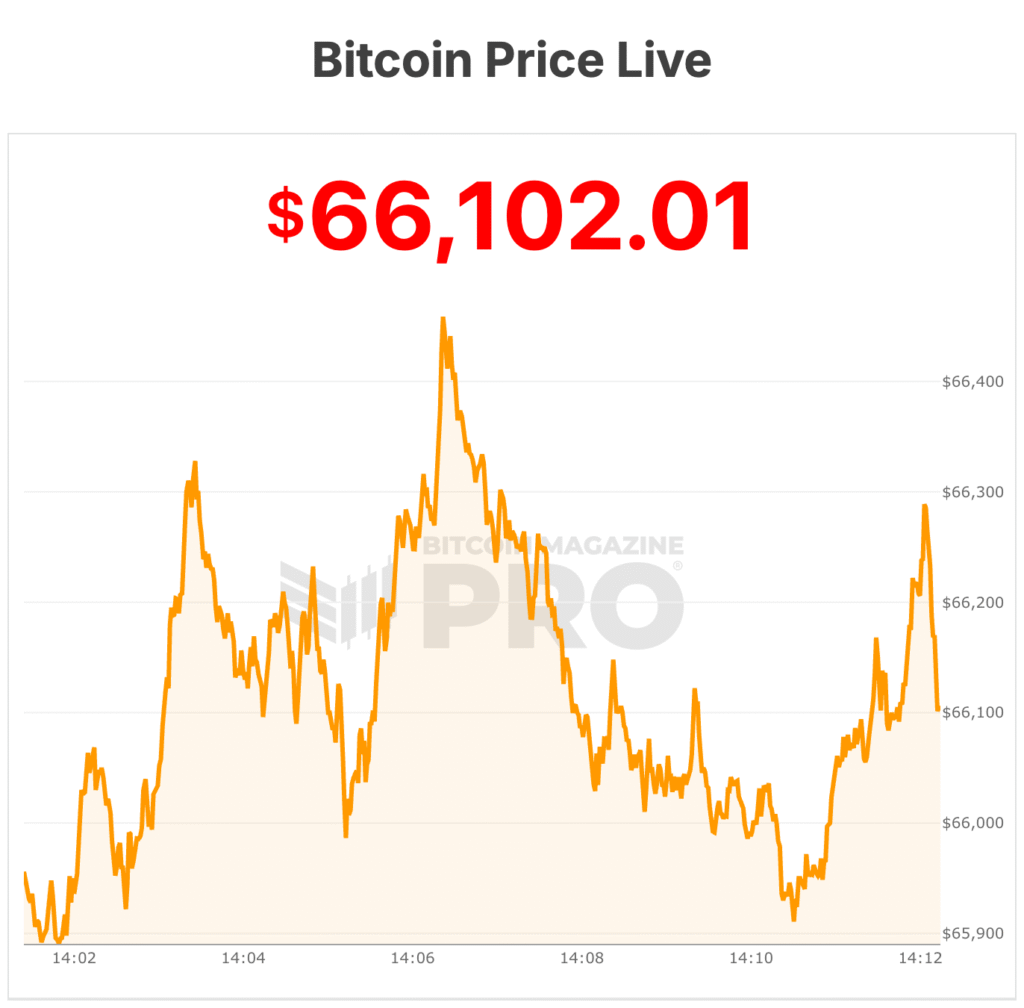

The note comes as Bitcoin’s price crashed sharply Thursday, dipping to $65,000 in volatile trading — marking what appears to be the largest absolute dollar drawdown on record.

From its October highs, BTC has retraced roughly $62,000, eclipsing prior nominal declines seen in 2018 and 2022, according to Bitcoin Magazine Pro data.

JPMorgan also pointed out that BTC is now trading well below its estimated production cost of $87,000 — historically seen as a soft floor.

Analysts noted that sustained prices under production cost could force inefficient miners out, eventually lowering the network’s marginal cost base.

Despite the downturn, JPMorgan said liquidation activity has remained modest compared with past crashes, though U.S.-listed spot Bitcoin ETFs continue to see persistent outflows.

U.S. spot BTC ETFs saw more than $3 billion exit last month, following around $2 billion in December and $7 billion in November, the report added.

At the time of writing, BTC is trading near $66,000.

This post JPMorgan: Bitcoin is Now a More Attractive Investment Than Gold Long Term first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility