Financing Weekly Report | 8 public financing events; Usual completed a $10 million Series A financing, led by Binance Labs and Kraken Ventures

Highlights of this issue

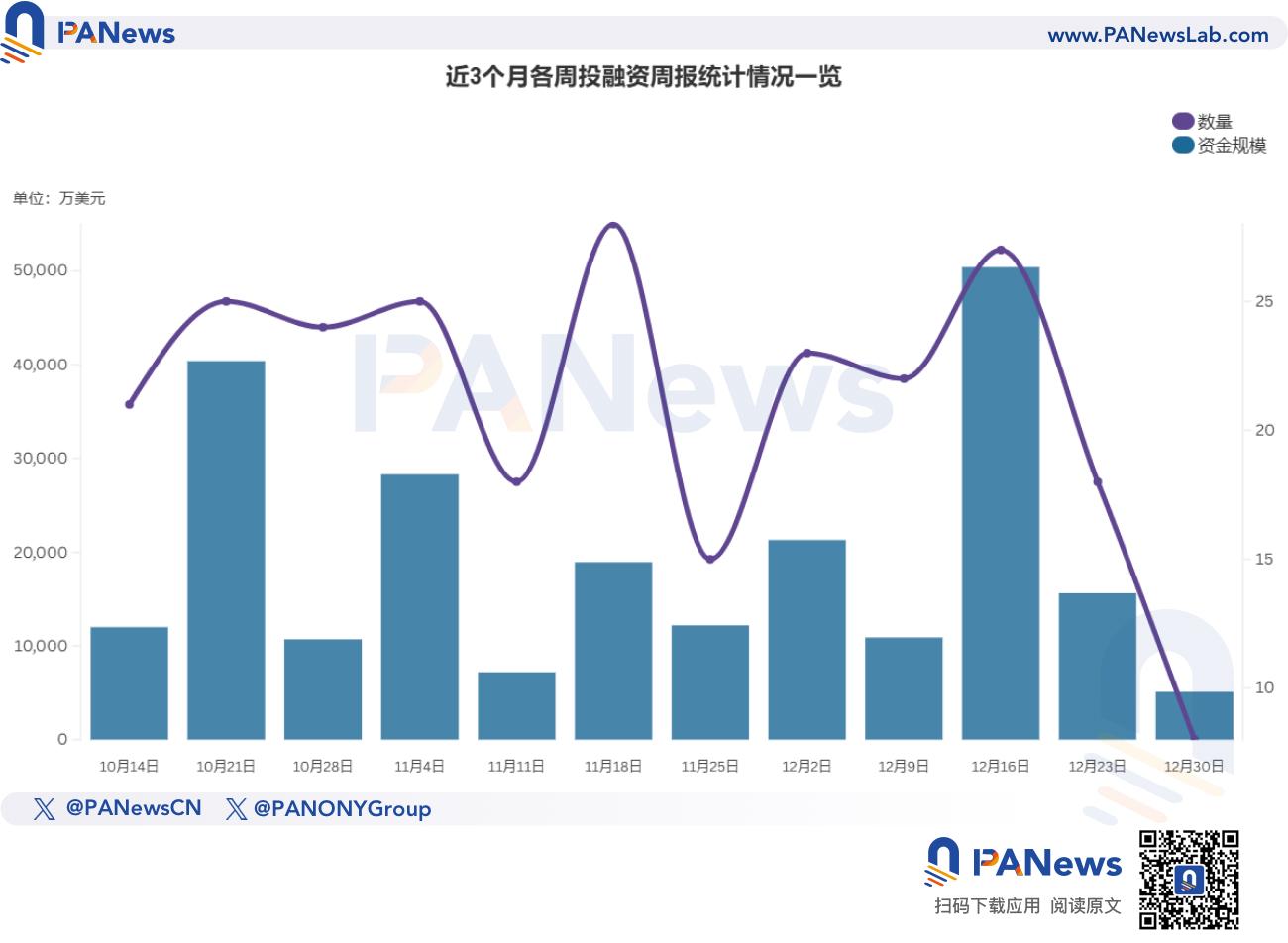

According to incomplete statistics from PANews, there were 8 investment and financing events in the global blockchain last week (12.23-12.29), with a total funding amount of over US$51 million, which was a significant decrease compared to the previous week. The overview is as follows:

- DeFi announced four investment and financing events, among which the stablecoin issuer Avalon Labs completed a $10 million Series A financing, led by Framework Ventures;

- The AI track announced three investment and financing events. ChainOpera AI completed a $17 million seed round of financing, led by IDG Capital and others;

- The consumer application sector announced one investment and financing event. Kettle, an on-chain luxury watch trading market, completed a $4 million financing led by ParaFi Capital.

DeFi

Stablecoin issuer Avalon Labs completes $10 million Series A financing, led by Framework Ventures

Avalon Labs, the issuer of the Bitcoin-backed stablecoin USDa, has completed a $10 million Series A financing round to expand its Bitcoin decentralized finance (DeFi) ecosystem. The round was led by Framework Ventures, with participation from UXTO Management, Presto Labs, and Kenetic Capital. Avalon Labs is committed to transforming Bitcoin from a digital store of value to a more active financial tool, providing users with services including stablecoin USDa, Bitcoin-backed lending, yield-generating savings accounts, and credit cards. Users can obtain USDa tokens by pledging BTC at a fixed 8% lending rate. Currently, the total locked volume (TVL) of USDa has reached $700 million.

Usual Completes $10 Million Series A Funding, Led by Binance Labs and Kraken Ventures

RWA stablecoin protocol Usual announced the completion of a $10 million Series A financing round, led by Binance Labs and Kraken Ventures, with support from many well-known institutions including Galaxy Digital, OKX Ventures, Wintermute, Amber Group, GSR, Fasanara Digital, etc. Usual is committed to promoting new developments in the stablecoin field through innovative stablecoin solutions and decentralized finance (DeFi) models. This round of financing will lay a solid foundation for its construction of a decentralized ecosystem and promotion of the "stablecoin revival" plan.

Cross-chain DeFi protocol EYWA completes new round of financing, with Kenetic Capital participating

Cross-chain DeFi protocol EYWA has completed a new round of financing, led by Kenetic Capital and Curve Finance founder Michael Egorov, and supported by 1inch co-founder. The specific amount of financing has not been disclosed. As of now, EYWA has accumulated a total of US$8.5 million in financing. Kenetic has previously invested in well-known blockchain projects such as Ethereum, Solana, Algorand, and Polkadot.

DEX platform Valhalla completes $1.5 million Pre-Seed round of financing

DEX platform Valhalla announced the completion of a $1.5 million Pre-Seed round of financing, led by Robot Ventures, with participation from Miton C, Kronos, Sumcap, Hash3, Big Brain Holdings, GSR, Wincent, and multiple angel investors. Valhalla is a decentralized exchange (DEX) platform where users can trade cryptocurrencies directly from their wallets without relying on intermediaries. Valhalla's goal is to create a fully on-chain perpetual contract exchange.

AI

ChainOpera AI Completes $17 Million Seed Round Financing, Led by IDG Capital and Others

ChainOpera AI has completed a $17 million seed round of financing and plans to develop blockchain L1 and AI operating systems for building decentralized AI agents and applications. The financing was led by Finality Capital, Road Capital and IDG Capital, and participated by many well-known investment institutions and angel investors, including David Tse, co-founder of BabylonChain, and Sreeram Kannan, founder of EigenLayer. ChainOpera will use this funding to build a decentralized ecosystem that supports AI co-creation and co-ownership, and promote AI innovation and data privacy protection. Its platform plans to launch flagship products and mobile applications in the coming weeks to further promote the integration and development of blockchain and AI.

Decentralized AI platform Nodepay completes second round of financing, totaling $7 million

Decentralized AI platform Nodepay announced that it has completed its second round of financing, totaling US$7 million. Investors in the latest round of financing include IDG Capital, Mythos, Elevate Ventures, IBC, Optic Capital, Funders.VC, Etherscan founder Matthew Tan and CoinHako co-founder and CEO Yusho Liu. Nodepay's previous investors include Animoca Brands, Mirana, OKX Ventures, JUMP Crypto and Tokenbay Capital. According to reports, Nodepay is a decentralized AI platform dedicated to democratizing AI training through real-time data retrieval. By converting idle Internet bandwidth into resources, Nodepay powers the next generation of AI models.

Swan Chain announces completion of $2 million financing

Decentralized AI infrastructure project Swan Chain (formerly known as FilSwan) has completed a $2 million financing round led by DWF Labs, Optimism Foundation and Promontory Tech.

Consumption

Kettle, an on-chain luxury watch trading market, raises $4 million in funding led by ParaFi Capital

Kettle, an on-chain luxury watch trading market, announced the completion of a $4 million financing led by ParaFi Capital, with strategic investors including Zee Prime Capital, Kronos, Signum Capital, IOSG Ventures, and Puzzle Ventures. The funds will be used to build the RWA platform. According to reports, Kettle is a peer-to-peer market where users can trade based on the full financial value of luxury watches. Kettle claims that the watches on its platform are certified for insurance and stored in the Kettle Vault in New York.

Investment institutions

Hashgraph Group Obtains Fund Management License in Abu Dhabi and Will Launch $100 Million Web3 Fund

Switzerland-based Hashgraph Group has obtained a fund management license from the Abu Dhabi Global Market (ADGM) in the United Arab Emirates. The license obtained by Hashgraph Ventures Manager, a subsidiary of Hashgraph Group, allows it to launch a $100 million Web3 venture capital fund from the Abu Dhabi Global Market (ADGM).

Hashgraph Group will contribute $20 million, or 20% of the fund, as seed capital. The fund will focus on investing in startups and established companies within the Hedera ecosystem. Stefan Deiss, co-founder and CEO of Hashgraph Group, said the fund has received widespread support and attention from co-investors, including government agencies, sovereign wealth funds, venture capital funds, family offices and other qualified investors; the group will focus on investing in companies that utilize the Hedera network and promote cooperation between Web3 companies.

The fund will prioritize strategic investments in companies in the Web3 and deep tech sectors (developing artificial intelligence (AI), blockchain, robotics, and quantum computing solutions). Qualified projects will have the opportunity to participate in the Hashgraph Association's Startup Studio Program.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most