Metaplanet Unveils Bitcoin-Backed Yield Curve In Bid To Take On Japan’s Bond Market

Metaplanet is rolling out a Bitcoin-backed yield curve and a preferred share program aimed at making BTC a credible form of collateral in Japan’s capital markets, a move aimed at challenging the dominance of traditional fixed income products.

The Bitcoin-backed yield curve would create a pricing framework for Bitcoin-collateralized credit, opening the door for institutional investors to tap into BTC while locking in predictable yields.

The “Metaplanet Prefs” program will further weaponize the firm’s growing Bitcoin treasury by issuing BTC-backed instruments across multiple credit profiles and maturities.

Head of Bitcoin strategy Dylan LeClair said in an X post today that the initiatives mark the next step in Metaplanet’s mission to “digitally transform Japan’s capital markets” and prepare for “hyperbitcoinization.”

By embedding Bitcoin into the country’s fixed income structure, the company is betting it can legitimize BTC as institutional-grade collateral.

The announcements land on the heels of Metaplanet’s best quarter yet, with revenue up 41% quarter-on-quarter 1.239 billion yen ($8.4 million) and net income swinging to a 11.1 billion yen ($75.1 million) profit from a 5 billion yen loss.

Metaplanet Posts Strong Quarterly Results

Metaplanet’s new initiatives came as it announced a strong-second quarter performance.

The company’s revenue climbed 41% quarter-over-quarter (QoQ) to 1.239 billion yen, which is around $8.4 million. Net income also rebounded to a 11.1 billion yen ($75.1 million) profit from a 5 billion yen loss last year.

The company’s year-to-date (YTD) performance dwarfed the 7.2% average gain posted by the Tokyo Stock Price Index (TOPIX) Core 30, which is a benchmark that tracks giants including Toyota, Sony and Mitsubishi Heavy Industries.

Metaplanet also outperformed Nintendo and SoftBank Group, which both posted double-digit gains during the same period but lagged behind the Bitcoin treasury firm by a wide margin.

CEO Simon Gerovich said in an X post earlier today that this latest quarter performance marks the company’s strongest ever.

With the stellar quarter results and the launch of two new initiatives, Metaplanet is perfectly placed to continue its Bitcoin accumulation strategy.

Just a day before the earnings release, the company announced that it bought another 518 BTC for approximately $61.4 million. Gerovich disclosed that the average purchase price for this most recent acquisition was around $118,519 per BTC, with the holdings generating a yield of 468.1% for the firm YTD.

Following the latest Bitcoin buy, the Japanese firm now holds 18,113 BTC, which was acquired for about $1.85 billion at $101,911 per BTC.

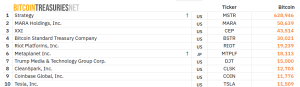

Metaplanet is now just over 1,000 BTC away from overtaking Riot Platforms as the fifth biggest corporate Bitcoin holder globally. Riot currently holds 19,239 BTC, data from Bitcoin Treasuries shows

Investors are also increasingly placing bets that Metaplanet’s BTC strategy will pay off. According to the earnings report, the number of Metaplanet shareholders has soared 350% since the firm started buying BTC in Q4 2024.

Strategy, the company that pioneered debt-funded Bitcoin buys, still maintains a comfortable lead in the BTC treasury race. The Michael Saylor-led software giant holds 628,946 BTC.

Largest corporate Bitcoin holders (Source: Bitcoin Treasuries)

Metaplanet does, however, have plans to acquire 210,000 Bitcoin by the end of 2027. Assuming the top 5 corporate BTC holders, excluding Strategy, don’t buy more of the crypto, Metaplanet could become the second largest Bitcoin holder as early as next year.

At the start of the month, the company already announced that it aims to raise $3.73 billion through a stock offering to support its Bitcoin accumulation.

US Leads In Number Of Corporate Bitcoin Treasuries Under Pro-Crypto Trump

Over the past 30 days, another 15 companies have added Bitcoin to their balance sheets, pushing the total amount of these firms worldwide to 292.

Bitcoin treasury statistics (Source: Bitcoin Treasuries)

The US has the most Bitcoin treasury companies, with 99 such firms. In second place is Canada with 43 companies that hold BTC.

A possible reason for the higher number of Bitcoin treasuries in the US could be linked to the pro-crypto administration under US President Donald Trump, which is pushing to make the US the crypto capital of the world.

Trump has already started delivering on his pro-crypto campaign promises since entering the White House for a second term, and has signed the GENIUS stablecoin Act into law, among other crypto policy changes.

Under the new administration, the US Securities and Exchange Commission (SEC) has also dropped several high profile cases against US crypto firms, while its Chair, Paul Atkins, looks to ease crypto licensing requirements with his recently-unveiled “Project Crypto” initiative.

Following the SEC’s lead, the US Commodity Futures Trading Commission (CFTC) also kicked off its “Crypto Sprint” initiative earlier this month, announcing that it has started exploring spot crypto trading on futures exchanges.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise