Bitcoin hits a new all-time high. Will four major factors continue to drive the rise?

Matt Hougan, Chief Investment Officer, Bitwise

Compiled by Saoirse, Foresight News

There are indeed many exciting developments in the current cryptocurrency space: regulation and legislation continue to improve, stablecoins are gaining momentum, corporate coin purchases are surging, institutions are steadily incorporating cryptocurrencies into their portfolios through ETFs, and Ethereum has regained its vitality, injecting much-needed altcoin momentum into the entire cryptocurrency market.

However, these developments have long been an open secret. I've always felt that the market underestimates the magnitude of each development, but that doesn't mean they're happening without anyone noticing. Media coverage of the cryptocurrency bull run has been overwhelming.

Despite this, I believe the market is poised for a series of significant upside surprises by the end of the year, strong enough to drive prices significantly higher. Here are four key developments that, in my opinion, are not yet priced into current market prices.

More governments will buy Bitcoin this year

At the beginning of 2025, the market generally believed that the three major sources of demand for Bitcoin this year were ETFs, enterprises, and governments, which we call the "three horses of Bitcoin demand."

So far, two of these forces have been instrumental: ETFs have bought 183,126 bitcoins, while publicly traded companies have snapped up 354,744. Given that the Bitcoin network has only ever produced 100,697 bitcoins, this has already boosted its price by 27.1%.

But the third pillar has yet to truly take off. True, the United States has established a "Strategic Bitcoin Reserve," but it only contains Bitcoin acquired through criminal forfeiture. Pakistan has announced the creation of a domestic Bitcoin reserve, and Abu Dhabi has invested in a Bitcoin ETF. However, compared to the large-scale purchases of ETFs and corporations, these are merely sporadic moves.

The consensus view is that the adoption of Bitcoin as a reserve asset has stalled, but I doubt it. Governments and central banks are moving slowly, but based on our discussions at Bitwise, they are definitely making progress.

To be clear: I don’t expect a massive national announcement before the end of the year, but I can certainly see more countries joining in, enough to make this a potentially significant driver by 2026. That alone could significantly drive prices higher.

A weaker dollar + lower interest rates = a rise in Bitcoin

One unique aspect of the current situation is that Bitcoin prices are approaching all-time highs, while interest rates are hovering near their highest levels since Bitcoin's creation in 2009. This shouldn't be the case. High interest rates are a challenge for non-yielding assets like Bitcoin (and gold), significantly raising the opportunity cost of holding them.

The market has already priced in multiple interest rate cuts before the end of the year, which should have supported Bitcoin. However, I believe the market has overlooked a key development with even greater implications.

The Trump administration strongly favors a weaker dollar and a more accommodative Federal Reserve policy. From direct criticism of Fed Chairman Jerome Powell to the appointment of Stephen Milan, a devaluation advocate, to the Fed Board of Governors, these actions strongly signal the administration's desire for a significant reduction in interest rates and a devaluation of the dollar.

It won’t be three rate cuts, it could be six or even eight.

The appointment of Milan is particularly noteworthy. Milan has gained widespread attention for his research paper arguing that the dollar's status as the global reserve currency places a heavy burden on the United States. He called for a new "Mar-a-Lago Accord" to lower the dollar's value relative to other major international currencies, suggesting that the Federal Reserve could achieve this goal by printing massive amounts of money.

If interest rates drop sharply and the dollar depreciates sharply due to money printing, the price of Bitcoin may rise significantly.

Lower volatility means higher allocations

One of the most underrated trends in the cryptocurrency space is the significant decline in Bitcoin volatility. Since the launch of the spot Bitcoin ETF in January 2024, not only has Bitcoin’s volatility itself declined significantly, but the rate of change in its volatility has also slowed significantly.

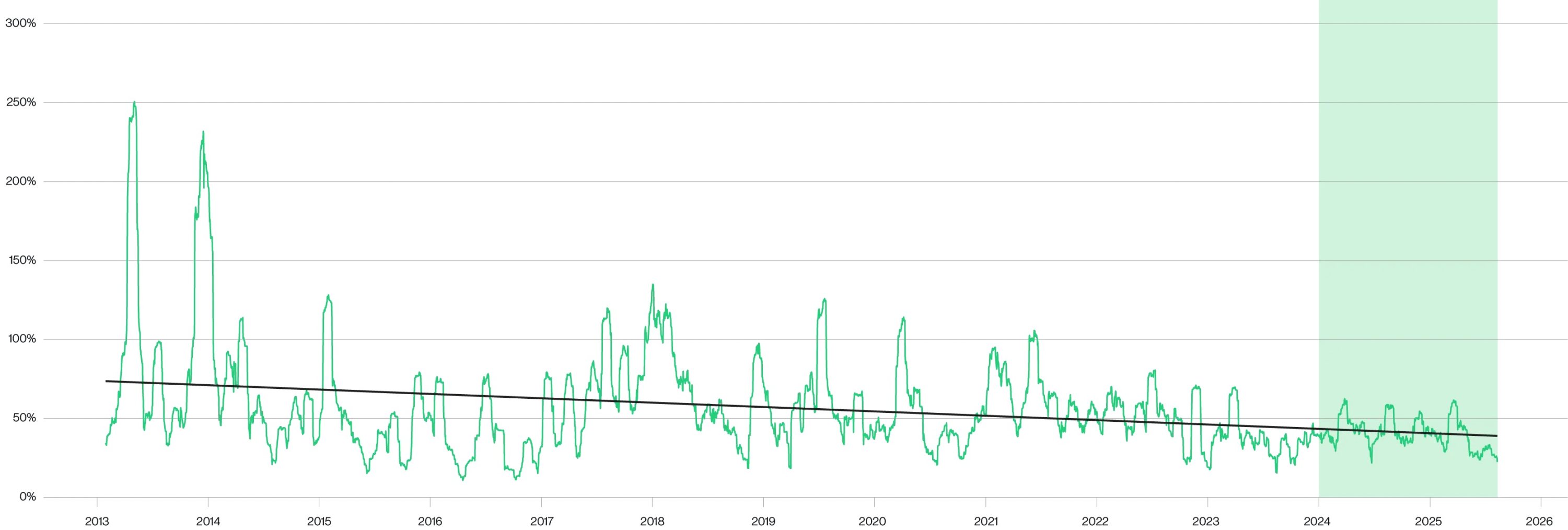

Bitcoin 30-day rolling volatility

Note: The green shaded area represents the period after the launch of the spot Bitcoin ETF

The reasons for the decline in volatility are easy to understand: the development of ETFs and corporate purchases have introduced new buyers to the cryptocurrency market, while regulatory and legislative progress has significantly reduced market risk. I believe this is Bitcoin's "new normal," with its volatility now roughly comparable to high-volatility tech stocks like Nvidia.

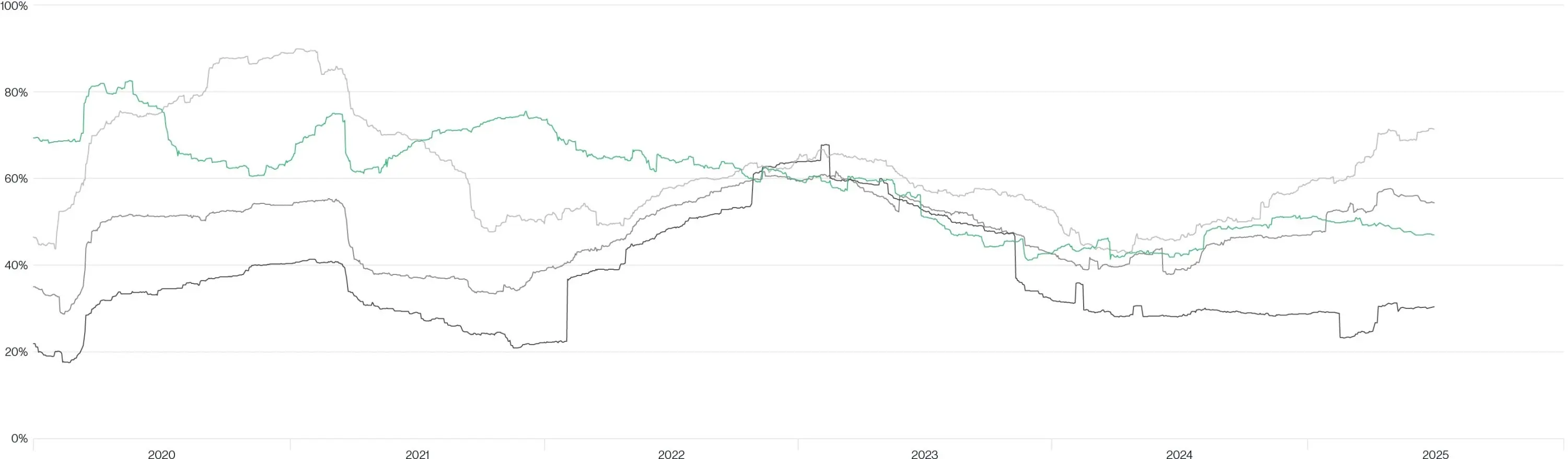

Comparison of Bitcoin's Volatility with Tesla, Nvidia, and Meta

In conversations with institutional investors, this decline in volatility is prompting them to consider significantly higher allocations to cryptocurrencies within their portfolios than before. Before the launch of spot Bitcoin ETFs, these discussions typically started with a 1% allocation, but now I frequently hear discussions starting with 5% or even higher.

This is one of the key reasons for the accelerated inflows into Bitcoin ETFs. Since July 1st, net inflows have reached $5.6 billion, bringing the total for the year to nearly $50 billion. It's worth noting that summer is traditionally a low season for ETF inflows, a fact that leads me to believe this trend is likely to accelerate further in the fall.

ICO 2.0: The Rebirth of Crypto Fundraising

Initial coin offerings (ICOs) have earned a bad reputation. In 2018, a wave of fraudulent ICOs emerged. These shell companies raised billions of dollars from investors, then absconded with the funds without delivering the promised products. This played a significant role in the abrupt end of the 2017 cryptocurrency bull run. The US SEC subsequently launched a crackdown, and investors grew weary of these fraudulent practices.

I think most investors and observers have dismissed ICOs as “defective,” but SEC Chairman Paul Atkins, in his recent “Cryptocurrency Initiative” speech, outlined a blueprint for the ICO’s rebirth:

If this concept is implemented, it could become a significant catalyst for the market's upward trajectory. Historically, cryptocurrency investors have shown unwavering enthusiasm for projects, both during the ICO boom and after its ebb. Once the new ICO Market 2.0 launches, it is expected to attract significant new capital to the cryptocurrency market.

in conclusion

The market does not rise on known good news, but only on good news that has not yet been reflected in the price.

I believe that the market, overall, is underestimating the scale of the current bull run in the cryptocurrency space and is also overlooking some specific drivers that will gradually become apparent in the coming months and years.

Be wary of subsequent sharp price increases.

You May Also Like

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be