Top 3 Crypto Picks for 2026 as Investors Reposition for the Next Crypto Cycle

The post Top 3 Crypto Picks for 2026 as Investors Reposition for the Next Crypto Cycle appeared first on Coinpedia Fintech News

The crypto market is entering a new crypto phase as early 2026 begins. Investor behaviour is changing, and the focus is moving away from short-term momentum toward utility-driven crypto projects with long-term potential. Instead of chasing quick price moves, many participants are now prioritizing real use cases, sustainable growth, and strong fundamentals.

This shift is driving a quiet capital rotation away from saturated assets and into newer crypto ecosystems that are still in early development stages. Analysts note that these transition periods often set the foundation for the next crypto market cycle. For long-term investors, this moment is increasingly viewed as a key entry window that could shape portfolio performance in the years ahead.

Bitcoin (BTC)

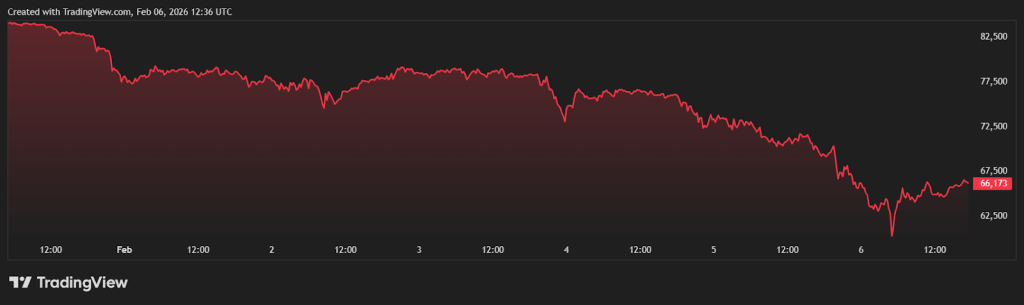

Bitcoin remains the undisputed leader of the market, but it is currently facing a period of heavy pressure. The price is trading around $66,500, with a market capitalization of approximately $1.4 trillion. While Bitcoin is the most secure network in the world, it is feeling the weight of a broader market sell off. The early rallies of the past year have cooled, leaving the asset in a zone of high volatility where it must prove its resilience once again.

The technical outlook for Bitcoin shows strong resistance at the $67,200 and $70,500 levels. Until it can reclaim these zones with high volume, the path upward is blocked. Analysts have issued some cautious price predictions, suggesting that if the $58,000 support fails, Bitcoin could drop back toward $40,000.

Ethereum (ETH): The Global Computer

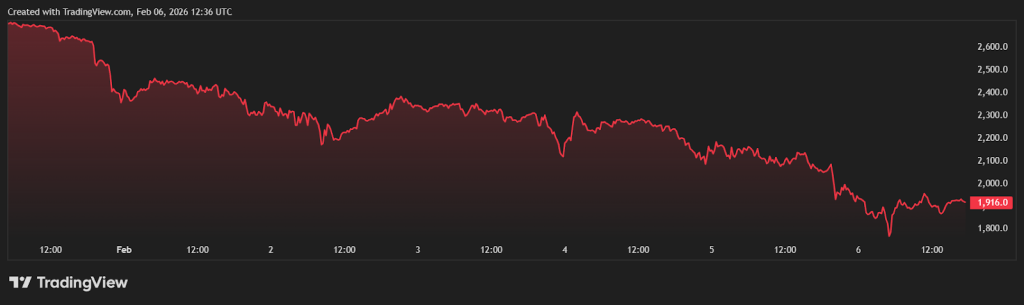

Ethereum continues to be the foundation for most decentralized applications, but its price action has been sluggish. It is currently trading at approximately $1,950, with a market capitalization of around $250 billion. Despite its dominance in smart contracts and NFTs, Ethereum has struggled to keep pace with some of its faster competitors. The network is undergoing constant upgrades to improve speed and lower costs, but the market has yet to fully price in these technical improvements.

From a technical perspective, Ethereum faces major resistance at $2,200 and $2,350. These levels have repeatedly rejected recovery attempts, showing that sellers are still in control of the short term trend. Some bad price predictions suggest that Ethereum could slip further toward $1,360 if the current support zones are broken.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is gaining attention as a project to watch heading into 2026, largely because it focuses on practical needs within crypto finance. The protocol is being developed as a lending and borrowing hub designed to let users access liquidity without selling their digital assets.

Instead of exiting long-term positions, users are intended to be able to use their crypto as collateral while retaining ownership. The system is built to be non-custodial, meaning users keep control of their private keys as they interact with the platform. This approach aims to support capital efficiency while allowing assets to continue working within a decentralized framework.

The protocol reached an important milestone with the V1 protocol launch on the Sepolia testnet, moving from roadmap to real execution. Users can now test core features such as supplying assets to liquidity pools, minting mtTokens, tracking debt positions, and observing basic risk controls like health factors in a safe, test environment.

The project is currently in Phase 7 of its distribution, with the token priced at $0.04. It has already raised over $20.4 million and attracted more than 19,000 holders. With a confirmed launch price of $0.06, the project is offering a structured entry point that is attracting massive attention from both retail and institutional participants.

mtTokens and Demand

The growth of the MUTM ecosystem is built around core mechanics such as mtTokens and a planned buy-and-distribute model. When users supply assets to the protocol, they receive mtTokens that represent their position. These tokens are designed to increase in value over time as interest from borrowing activity is generated. mtTokens can already be tested through the current V1 protocol on the testnet.

According to the project’s official whitepaper, Mutuum Finance also plans to introduce a buy-and-distribute mechanism in later stages. Under this model, a portion of protocol fees is intended to be used to acquire MUTM tokens and distribute them to stakers.

To ensure the system is accurate and secure, Mutuum Finance uses decentralized oracles to track market prices in real time. This professional setup is why analysts are projecting a target price of $0.18 to $0.25 shortly after the mainnet release. This prediction is based on the actual usage of the protocol rather than just market hype.

Further Roadmap Plans

The future of Mutuum Finance includes the launch of a native over-collateralized stablecoin and expansion to Layer-2 networks. These plans are crucial because they make the protocol accessible to everyone. By using Layer-2 technology, the platform can offer faster transactions and much lower gas fees. This allows retail users to take out small loans without losing their profits to network costs.

The native stablecoin would also provide a safe haven for users who want to borrow without worrying about market volatility. This combination of speed, safety, and low cost is what top crypto investors are looking for in 2026. As the supply in Phase 7 disappears, the urgency to participate is reaching a peak. With verified security from Halborn and a working testnet, Mutuum Finance is ready to lead the next crypto cycle.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected