Best Memecoins to Invest in Today, February 11- DOGE, PEPE, POPCAT

Highlights:

- Dogecoin might be building toward its third breakout after a long sideways price movement.

- PEPE is testing a make-or-break support zone near $0.0000030.

- POPCAT shows a relief bounce could be forming from the $0.04050 level.

The crypto market remains under pressure as Bitcoin once again slipped below the key $70,000 level. This setback has kept the broad market in a rangebound over a potential partial U.S. government shutdown slated to commence on February 13. The total market capitalization and 24-hour trading volume have declined to $2.33 trillion and $98 billion. Meanwhile, the fear and greed index is holding in the extreme fear zone at 9 levels.

The memecoin sector has painted the same picture, with the market capitalization and trading volume dropping to $30 million and $3.18 million, respectively. With market corrections always seen as good opportunities for market entry, let’s discuss the best memecoins to invest in today.

Best Memecoins to Invest in Today

1. Dogecoin (DOGE)

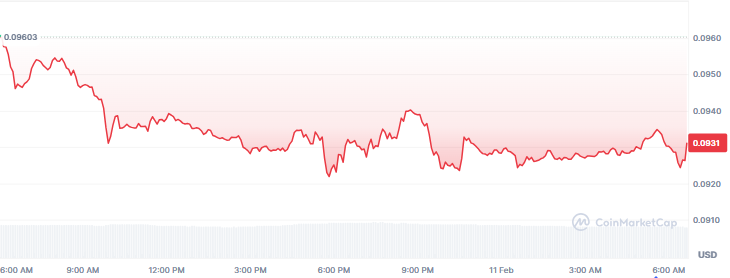

Dogecoin has been under intense pressure recently as the price dropped below the $0.10 level. As of this writing, the price is hovering around $0.0931, down by 1.50% over the last 24 hours. Moreover, its market cap and trading volume have dropped to $15 billion and $840 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

According to a recent analysis from Bitcoinsensus, Dogecoin may be entering its third major bull phase. The chart has pointed out two previous cycles that have been followed by a sharp price expansion after a prolonged consolidation. The initial cycle started in 2017, and it resulted in a 95x rally. Another explosive run was made in 2021, climbing more than 300x above its base.

Similar conditions have been observed forming again. The price behavior seems to be re-emerging, and a new breakout is starting to form after long sideways movements. If history holds, Dogecoin may be setting up for a significant move toward the $5 range, making it one of the best memecoins to invest in today.

2. PEPE

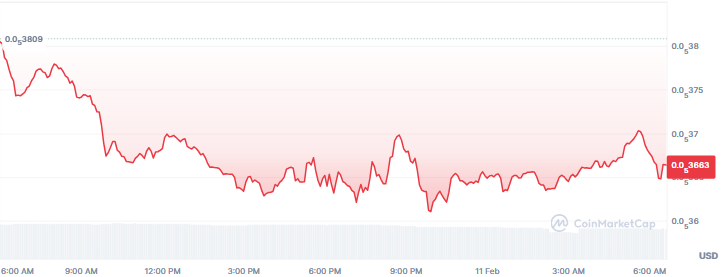

PEPE continues to struggle amid broader market weakness. The frog-themed memecoin has declined by 12% and 37% on the weekly and monthly charts, respectively. Currently, PEPE is exchanging hands at $0.000003663 with a market cap of $1.50 billion.

Source: CoinMarketCap

Source: CoinMarketCap

PEPE remains on its long-term downward trend, pressing against a crucial support level of $0.0000030. This decline has several triangle structures, as demonstrated by crypto analyst Pepe Whale. However, the most recent session is developing tight compression, indicating a possible reversal.

The analyst also noted that sellers have slowed down as the price nears this support shelf. Previous interaction with this level has resulted in significant rebounds. In case the price holds, the first level to monitor is around the $0.0000050 resistance. However, a breakdown below support could flip sentiment and invalidate the recovery outlook.

3. POPCAT

POPCAT is down by 1.50% over the last 24 hours to trade at $0.0502. The market cap stands at $50 million, while the trading volume declined by 20% to $10 million.

Source: CoinMarketCap

Source: CoinMarketCap

Despite the bearish pressure noted in POPCAT’s market recently, there is a catch. The memecoin has formed support at the $0.04050 region. This suggests that a relief bounce toward the $0.100 level is possible. Should the reversal retest the immediate resistance at $0.1141, the memecoin could challenge the next resistance at $0.1574.

Source: TradingView

Source: TradingView

In addition, indicators such as the Moving Average Convergence Divergence and Relative Strength Index support this imminent rally. The MACD line is making a crossover above the signal line, indicating increased buying pressure. Meanwhile, the RSI is surging from the oversold region, suggesting a shift from the current market trend.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Aave V4 roadmap signals end of multichain sprawl

Wormhole Token Surges After Tokenomics Reset and W Reserve Launch