Banks, crypto fail to reach agreement in White House stablecoin meeting

A White House meeting on stablecoin yield and rewards ended without a deal, but participants described the discussions as more productive than previous talks, according to details shared by journalist Eleanor Terrett.

- White House stablecoin yield talks ended without a deal, but both banks and crypto firms described the meeting as more productive than earlier discussions.

- Banks introduced written “prohibition principles” and signaled limited flexibility by acknowledging potential exemptions for transaction-based stablecoin rewards.

- The White House urged both sides to reach an agreement on stablecoin rewards regulation by March 1, with further talks expected soon.

The gathering brought together senior banking executives, crypto industry leaders, and policy staff to debate whether and how stablecoin issuers should be allowed to offer yield or rewards.

While no compromise was reached, negotiations moved into more detailed territory.

White House stablecoin talks show progress but no final deal

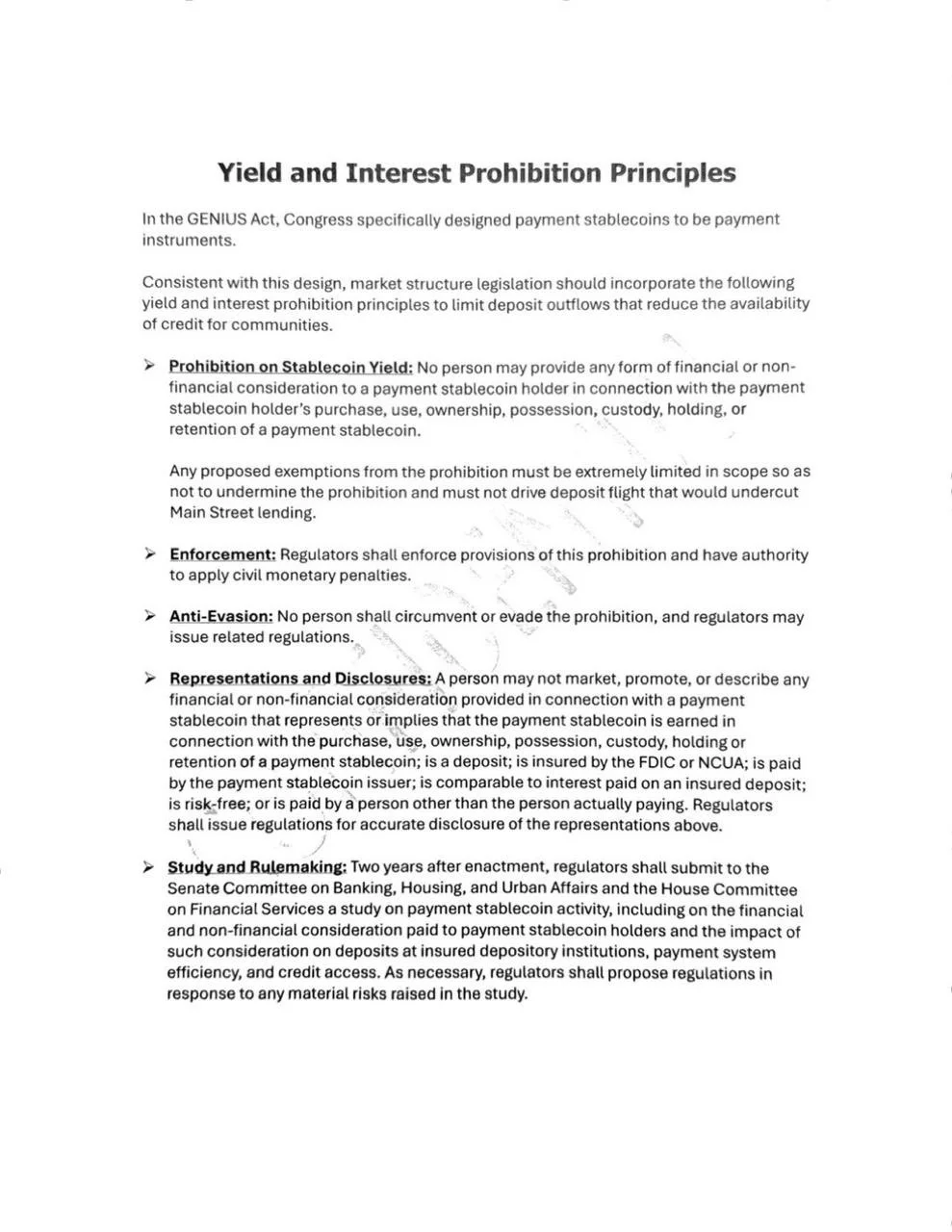

Banking representatives arrived with a written set of “prohibition principles” outlining firm red lines around stablecoin rewards. These principles detailed what banks are willing to accept and where they refuse to budge.

One notable shift emerged. Banks included language allowing for “any proposed exemption” related to transaction-based rewards.

Sources described this as a meaningful concession, as banks had previously declined to discuss exemptions altogether.

Much of the debate centered on “permissible activities.” This refers to what types of account behavior would allow crypto firms to offer rewards. Crypto companies pushed for broad definitions. Banks argued for narrower limits to reduce risk and regulatory exposure.

Ripple’s Chief Legal Officer Stuart Alderoty said that “compromise is in the air,” signaling cautious optimism despite unresolved issues.

March 1 deadline looms as talks continue

The meeting was smaller than the first White House session on stablecoins. It was led by Patrick Witt, Executive Director of the President’s Crypto Council. Staff from the Senate Banking Committee were also present.

Crypto attendees included representatives from Coinbase, a16z, Ripple, Paxos, and the Blockchain Association. Major banks in attendance included Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC, and U.S. Bank, alongside leading banking trade groups.

The White House has urged both sides to reach an agreement by March 1. Further discussions are expected in the coming days. However, it remains unclear whether another full-scale meeting will be held before the deadline.

You May Also Like

Where Is Marcela Borges Now? The Horrific True Story Behind ‘Terror Comes Knocking’

‘Compromise is in the air’: Ripple CLO signals progress on crypto bill