Spot Solana ETFs Log $12M Outflows, Analysts Eye Price Bottom

Key Insights:

- Spot Solana ETFs have seen more than $150 million in net outflows over the past month.

- SOL price has corrected accordingly, with Solana losing 62% of its market cap since October 2025.

- Solana’s DEX activity has collapsed from $117.7 billion in total January volume.

Solana plunged 40% in the past month as the broader crypto market correction intensified. Investors sold off risk assets, putting heavy pressure on SOL’s liquidity. The network’s momentum slowed as traders shifted capital to safer holdings.

On Feb. 9, the spot Solana ETF saw the second-largest outflows or nearly $12 million. Last week, the SOL price dropped to $75 before recovering partially as of now.

Spot Solana ETF Sees Second-Largest Outflows

Blockchain analytics firm Santiment reported that Solana ETFs recorded $11.9 million in net outflows. This marks the second-largest single outflow event on record.

The withdrawals comes as Solana’s SOL token has lost 62% of its market capitalization over the past four months. This reflects sustained selling pressure and weakening investor confidence.

Solana ETF outflows | Source: Santiment

Solana ETF outflows | Source: Santiment

Santiment noted that such large ETF outflows have historically coincided with late-stage capitulation. In the previous crypto market cycles, such stages came just ahead of the bottom formation.

Spot Solana ETFs had a good start after launching on Wall Street in November 2025. By early Jan. 2026, the net inflows into these ETFs had surged to more than $1 billion.

However, the numbers have dropped since then and currently stand at $860 million. This shows that the outflows have been picking up pace. It’s similar to what we have been seeing with Bitcoin and Ethereum ETFs.

The sharp daily withdrawal was part of a broader trend rather than a one-off move. On a weekly basis, Solana exchange-traded funds recorded net outflows of $8.92 million.

As a result, total assets under management across Solana ETFs declined to $727.97 million. It marks a significant drop from the $1.1 billion levels seen last month.

Solana ETF Outflows Hint SOL Price Bottom

SOL price performance has also followed the weakening trend in Solana ETF flows. After rebounding toward the $140–$150 zone in January, the recovery failed to break through key resistance and quickly reversed.

Since then, SOL price has been moving downward market by lower highs and lower lows. On the other hand, the selling pressure has accelerated moving into early February.

Analyst Crypto Patel stated that he has begun accumulating Solana after previously warning of downside risk near the $190 level.

SOL price decline | Source: Crypto Patel, X

SOL price decline | Source: Crypto Patel, X

Patel highlighted that Solana has entered a key accumulation zone between $50 and $75. He revealed his first buys were executed at around $70. He added that additional buy orders have been placed in the $50 to $40 range.

Patel reaffirmed his long-term bullish stance on Solana. He set multi-year price targets in the $500 to $1,000 range. He also noted that his prior short positions have been closed with reported gains of around 64%.

Solana DEX Volumes Decline

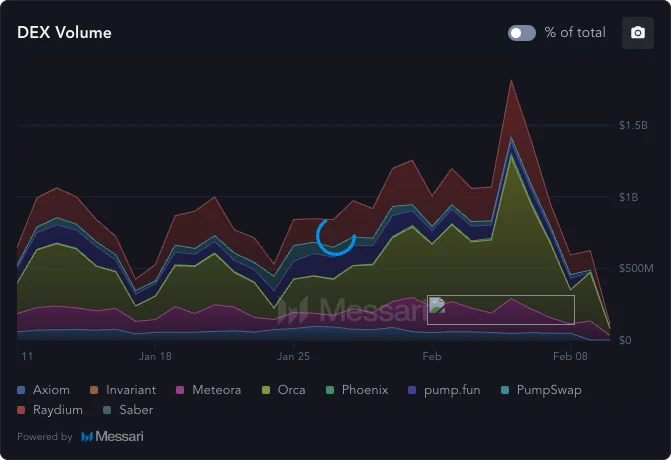

In addition to this development, Solana’s on-chain activity has dropped significantly. In January 2026, Solana recorded a total decentralized exchange (DEX) volume of about $117.7 billion. That’s an average of nearly $3.8 billion per day.

Solana DEX Volumes | Source: Messari

Solana DEX Volumes | Source: Messari

On the other hand, the daily DEX volume on Feb. 9 fell to roughly $112 million. It’s a level not seen since the early stages of the 2024 bull market.

The steep decline points to a near-complete withdrawal of speculative liquidity. Analysts note that DEX activity has historically played a key role in supporting Solana’s price by providing depth and momentum.

The post Spot Solana ETFs Log $12M Outflows, Analysts Eye Price Bottom appeared first on The Market Periodical.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

RWA Crypto Projects Gain Momentum with Chainlink, VeChain, and Avalanche Surging in Engagement