Decent January US Jobs Data Still Has Holes

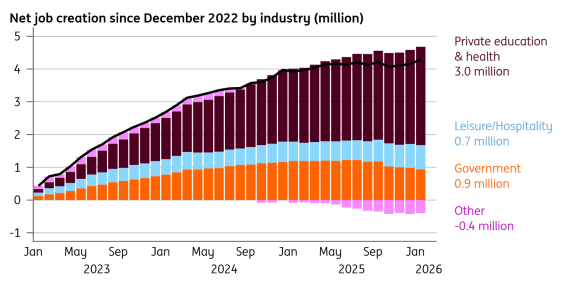

Although January's employment gain was more than expected, the US economy has been losing jobs overall, with the exception of the leisure and hospitality, private healthcare, and government sectors, according to major negative revisions.

Therefore, it's becoming more likely that the Fed will cut rates more than the two earmarked by the central bank itself.

Cryptos have stalled in a decline after the jobs figures, but the much-needed elevated boost remains elusive.

Bitcoin gained to above $67,250 after a bleed lower, with $65,000 in sight. But a further dissection of the data shows a far deeper concern for the Fed.

That should likely keep crypto bets in play.

US Jobs: Awful 2025

The January employment report had strong numbers, with payrolls increasing by 130,000 vs. 65,000 expected, and just 17,000 due to downward revisions in the prior two months.

Wages have seen a faster increase than expected at 0.4% month-over-month, topping the consensus of 0.3%, while the jobless rate has dropped once more to 4.3% from 4.4%.

Source: Macrobond

Source: Macrobond

But that is just a small portion of the story. The revisions to the benchmarks leave much to be desired.

Fed Chair Jerome Powell anticipated a final report figure of 60,000, translating to 720,000, yet the provisional estimate revealed a decline of -911,000, equating to a drop of 76,000 each month.

In truth, they experienced a decline of 862,000.

It is important to recognize that this effectively negates any job growth achieved in the past three years within the education and healthcare sectors outside of government, hospitality, and private industries.

The retail, construction, manufacturing, technology, financial, and business services sectors are currently lacking in job creation opportunities.

Consequently, the demand for the Fed to lower interest rates will likely intensify, which has in the past been a clear boost for cryptos.

In addition, while Wednesday's data did have some good points, the private healthcare and education sectors continue to lead the pack, with 137,000 new employment added, while the government sector lost 42,000.

With a 33,000-person increase, the construction industry saw encouraging development.

On its own, this data is not likely to convince the market that the Fed will soon reduce interest rates.

By January, the same set of voters will have probably kept their optimistic view of the job market's prospects.

The Fed thinks the Bureau of Labor Statistics has greatly exaggerated employment growth, as Chair Powell said in December.

Recent adjustments may raise concerns, but a rate decrease before March seems unlikely, especially if core and headline inflation are in line with market estimates of 0.3% this week.

Weak JOLTS job listings and the Challenger report on hiring intentions both point to a sharp drop in available positions.

Given this, it seems improbable that we will see a widespread improvement in hiring very soon.

The quick shift from a scenario of strong demand to one of oversupply, with fewer than 0.9 jobs available for every unemployed person today, suggests that wage growth is decelerating swiftly.

In 2022, there were two job opportunities for every unemployed person.

Wages in the private sector are slowing to 3.3% by the end of 2025, according to Tuesday's employment cost index.

It is hardly surprising that salaries would average less than 3% in 2026, given the sharp decline in the quits rate, which shows market turnover.

Consumer confidence will remain low as a result, and this will have no positive effect on household budgets.

This will assist in alleviating inflationary pressures in the long term, though, because the US economy is mostly service-based and labor expenses are usually the largest cost input.

This supports BRN's view that the Fed is likely to be more aggressive in its moves, casting doubt on our forecast of two 25 bps reductions this year and expanding the opportunity for further rate decreases.

Kevin Warsh’s Challenges

After the latest data, the nomination of Kevin Warsh to lead the Fed by President Trump could encounter considerable obstacles ahead.

Warsh's peers at the Fed might be reluctant to lower interest rates, aligning with Trump's favored approach.

This could result in a challenging initial year in the role, starting in May.

While Powell has faced similar challenges as the outgoing chair, markets are likely to perceive Warsh as a less seasoned and more unpredictable entrant to the powerful central bank.

Crypto Moves Yet to Reflect True Fed Bets?

On Wednesday, Bitcoin fell to $65,800, below short-term trend lines and keeping the $60,000 retest potential alive as liquidity declines below present levels.

It has recovered to almost $67,250 as of this writing.

Given the continuous problems around the $70,000-$72,000 region, market players are indicating that momentum has lessened.

To stabilize the outlook, it might be crucial for there to be a rapid rebound above $68,000. Otherwise, risks could mount to lower support levels.

There is still no consensus on the asset's future course beyond short-term graphs.

Following the observation that stablecoins are "taking over the crypto payments sector from Bitcoin," Cathie Wood of Ark Invest has adjusted her 2030 price prediction from $1.5 million to $1.2 million.

On the other hand, Bernstein analysts called the current downturn the "weakest bear case in history" and stuck to their $150,000 year-end goal, saying that "nothing has actually blown up."

The asset, according to Michael Burry, has shown itself to be a speculative instrument rather than a hedge against devaluation; he warned that it may go into a downward cycle and hurt related businesses.

Those who are concerned with risk management have not changed their tone of warning.

Important holders, meanwhile, are unwavering.

Michael Saylor called the asset a "swarm of cyber hornets" and stated that he would continue to purchase it even if its price dropped to $1.

The long-term goal was $266,000, established by JP Morgan analysts using gold as an example.

However, they deemed that goal impossible for this year and pointed out that it trades below the projected manufacturing cost of $87,000.

Blockcast – Licensed to Shill: What's in Store for 2026 – Stablecoins, the Future of DeFi.. and a Return of NFTs?

Licensed to Shill opens 2026 with a forward-looking conversation on the forces shaping the next phase of digital assets. Real-world assets, prediction markets, NFTs beyond the hype cycle, and the role of SMEs in pushing practical adoption all feature as the panel weighs what’s likely to matter – and what’s likely to fade – in 2026.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Be at the heart of TradFi–DeFi collaboration at Money20/20 Asia 2026.

Are you looking to forge partnerships with banks and fintechs? To expand into new markets across Asia, or to secure funding from top-tier investors? This April, the world of digital assets, blockchain, and Web3 converges with the biggest players in APAC’s financial ecosystem at Money20/20 Asia 2026 and its brand new ‘Intersection’ zone, complete with a dedicated content stage, TradFi-Defi innovator showcase, and curated networking spaces. From traditional banking giants to decentralised innovators, private equity leaders, and cutting-edge fintech disruptors, this is where they meet to forge partnerships, spark dialogue, and shape the future of finance.

You May Also Like

Avalanche and Hyperliquid Lead Crypto Rally Post-Fed Rate Cut

Pi Network Accelerates Real World Adoption as Picoin Transitions from Digital Asset to Everyday Payment

The Pi Network ecosystem is once again demonstrating significant progress. While the community initially focused on mining ac